|

|

|

|

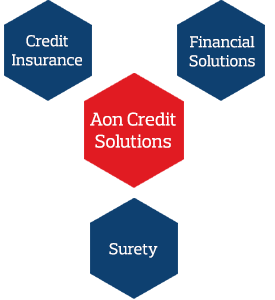

Aon Credit Solutions

The Aon Credit Solutions practice is a global leader in formulating tailored risk transfer solutions that address domestic and international trade risk.

Our comprehensive approach encompasses a combination of insurance and surety solutions that:

- Mitigate non-payment, political, and contract performance risks

- Optimize working capital utilization

- Bridge trade finance constraints to maximize access to financing

- Enhance credit management function to accelerate revenue growth

Our experts of over 500 specialists around the globe place more than 30 percent of global trade credit premiums worldwide and operate in over 57 countries. Supporting over $770 billion in ongoing trade transactions our designated professionals have the expertise to respond rapidly to risk in highly volatile trade environments. Our objective is to be regarded by our clients as their trusted trade risk advisor by fulfilling the Aon Client Promise.

Trade Credit Insure

Trade credit insurance or accounts receivable insurance is a solution that indemnifies a seller against losses from non-payment of a commercial trade debt arising from either the bankruptcy or slow payment of a buyer. Learn More.

Why Aon Credit Solutions?

- Local presence

Aon’s global Credit Solutions network connects you with the best insurance knowledge and markets in the world. As a result of placing more premium with insurance carriers, we can combine our global strength to get you better insurance coverage, stronger advocacy and faster resolution of claims. We also harness our worldwide presence to help companies expand into emerging markets.

- Globally connected

Industry specialists teams provide key updates on sector specific risks, political risk and market capacity trends in both the domestic and international markets you are expanding. As one Aon, our global presence enables us to coordinate complex multinational programs with standardization of policy terms centralized in a country of your choice, or decentralized with assigned local representation around the globe.

Case studies

|

|

|

|

|

|

|

|

Request Info