Solutions

Aon’s Captive & Insurance Management team manages 1,232 (re)insurance entities worldwide including captives, protected and incorporated cell facilities, special purpose vehicles and specialist insurance and reinsurance companies. The diverse client base of (re)insurance entities globally, across five distinct practice groups: Captive Management, Risk Finance & Captives Consulting, Commercial (Re)Insurance, Insurance-Linked Securities (ILS), and Protected/Incorporated Cell Companies through Aon’s White Rock Group. As a risk retention mechanism, an insurance vehicle is often at the heart of a comprehensive risk program.

We deliver value to clients by focusing on the management control and reduction of clients’ total cost of risk. As an integral part of Aon’s Global Risk Consulting practice, we do this by helping our clients identify and quantify the risks they face; by assisting them with the selection and implementation of the appropriate risk transfer, risk retention, and risk mitigation solutions. As a risk retention mechanism, an insurance vehicle if often at the heart of a comprehensive risk program.

We leverage the diverse risk consulting expertise required for a successful risk management programme. Our consulting and management team work closely together to create and implement innovative solutions.

We manage captives for parents of all sizes, from privately held entities to multinational conglomerates. Covers written include all property and casualty lines, employee benefits, customer programs and bespoke policies to respond to emerging risk.

We provide a full range of management services to all types of Insurance-Linked Securities (ILS) and structured insurance vehicles.

ILS is a well-established, important and growing element of the global reinsurance market. This ‘convergence’ market now accounts for some 20% of reinsurance capacity worldwide. 2020 represents one of the most challenging economic periods in the world’s history but ILS continue to prove its non-correlation to broader market trends and its resiliency.

Aon has the largest team in the market possessing extensive experience of managing ILS entities globally. We provide full insurance management, consulting and ILS services to both cedant sponsors and investors, with access to risk modelling, actuarial and valuation, governance, risk management and compliance, and policy underwriting and administration capabilities and other services within the wider Aon group.

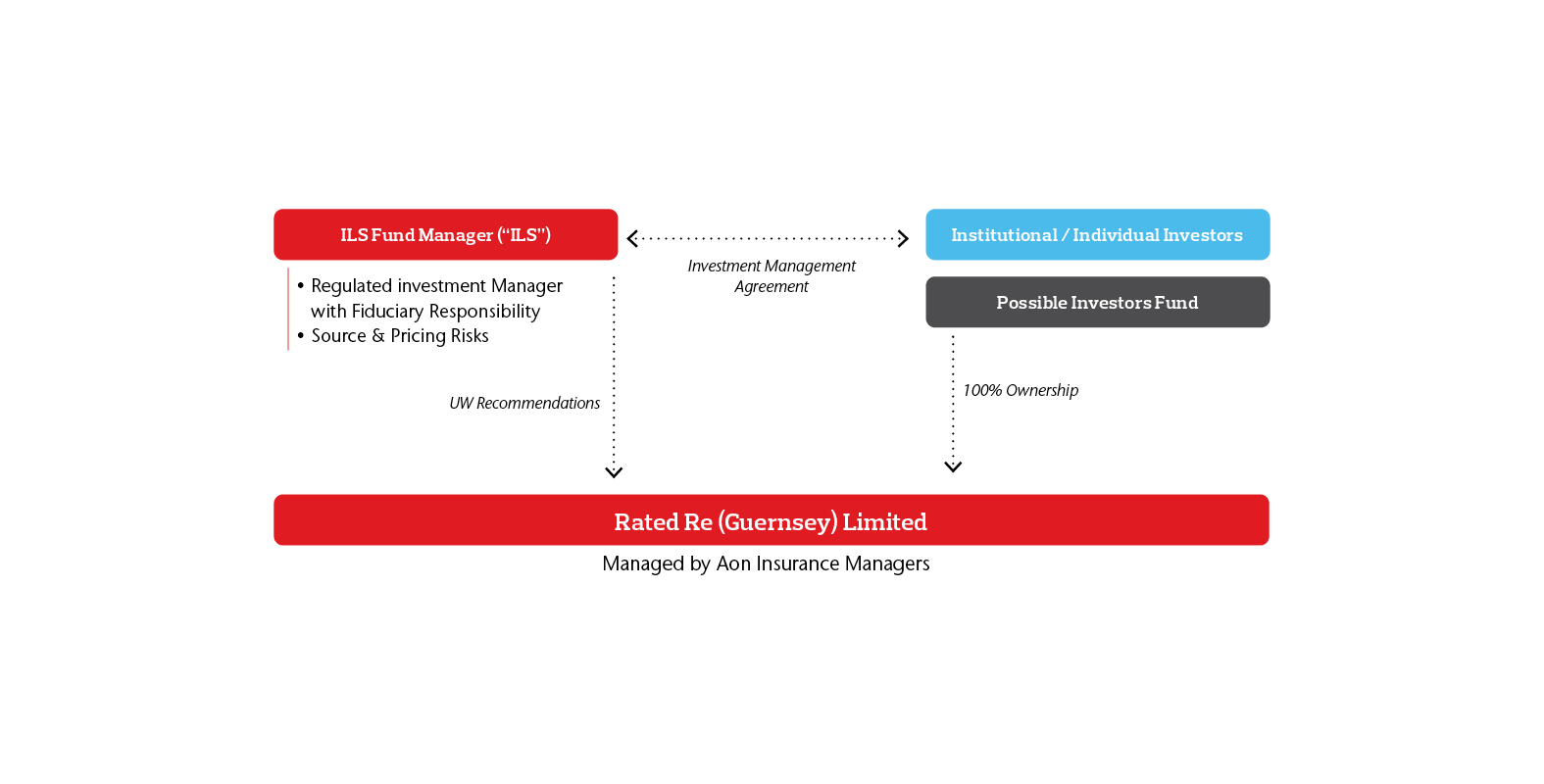

Rated Reinsurance

Rated Reinsurance suits large institutional investors in the ILS space with long term commitment or ILS fund managers with strong origination relationships that are looking to enhance distribution channels for their investors.

Aon have successfully navigated the formation of a number of market facing reinsurance companies in the last five years with 2 having been established in Guernsey for a leading ILS Manager. Our reinsurance management platform is unique and the first of its kind to be developed by an insurance management services firm. Aon utilises leading reinsurance systems and provides a framework focussed on Compliance and Corporate governance including an appointed risk officer, an ERM framework and an internal audit function.

We are experienced in the financial strength rating process along with the ongoing requirements for rated vehicles and maintain strong relationships with AM Best and can help client develop an understanding of the financial, operational and strategic issues that influence these ratings.

Aon regularly provide thought leadership in this area along with other ILS structures we see and are able to offer a bespoke solution in terms of structuring and management of your vehicle.

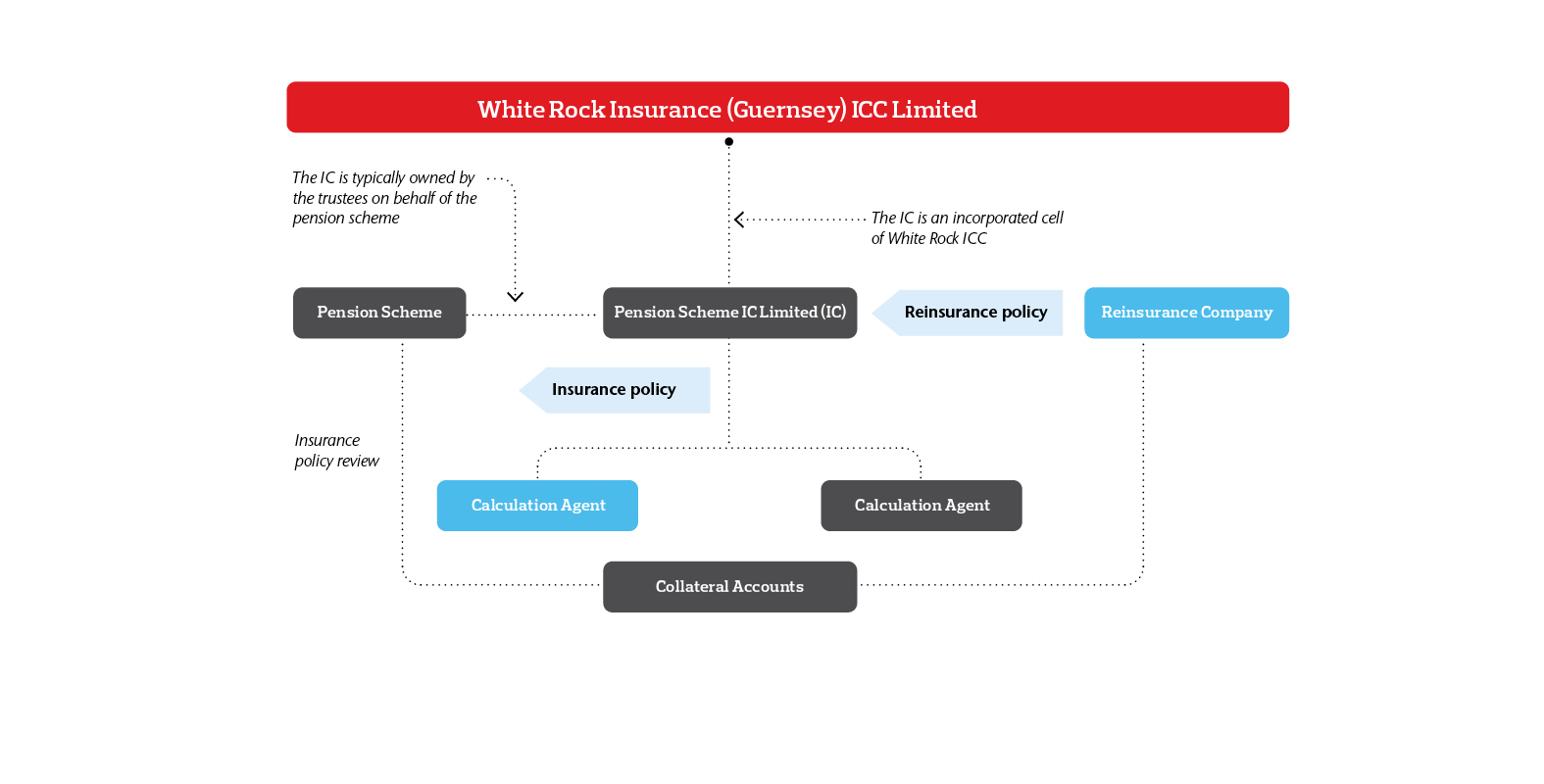

White Rock is a unique and leading group of (re)insurance vehicles with operations in a number of key domiciles including Bermuda, District of Columbia, Gibraltar, Guernsey, Isle of Man, Malta and Vermont.

White Rock Insurance Company PCC Limited was the first Protected Cell Company to be formed in Guernsey under the new legislation in 1997, making it the first of its kind anywhere in the world. White Rock Insurance (Guernsey) ICC Limited was the first insurance licensed ICC in the world.

Owned by Aon, the White Rock Group offers clients a diverse suite of insurance solutions through utilisation of Protected Cell Incorporated Cell and Segregated Account facilities.

Through White Rock Aon aim to provide clients with (re)insurance solutions without the cost, complexity and parent company management time and expense that a wholly owned captive subsidiary requires.

We provide tailored solutions to commercial reinsurance entities based on our clients’ specific needs. Aon Insurance Managers manages a portfolio of 64 entities across the Life & Non-Life insurance sectors. Our Life portfolio companies manage assets in excess of US$18.8 billion and our Non-Life portfolio generates gross written premiums of approximately US$513 million per annum.

We assist clients with their insurance buying decisions; optimising the balance of risk transfer and retention financing through comprehensive valuation and comparative analysis.

We prepare captive feasibility studies for companies considering a captive; utilisation and strategic reviews for existing captives and other risk consulting-related projects.