Aon Inpoint brings Aon’s unparalleled capabilities through our 50,000 colleagues in 120 countries giving clients access to the very best minds, proprietary benchmarking data, leading innovations, tools, and research across the entire range of the risk and people implications of a transaction

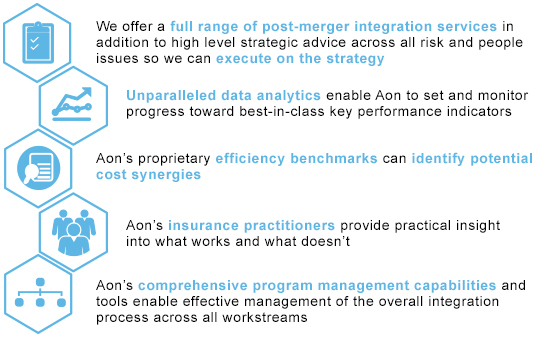

Aon Inpoint services can be engaged holistically or in an “a la carte” manner, but what truly differentiates us is our unique combination of analytical and advisory capabilities and a deep understanding of and ability to support implementation

Our services include:

- Strategic Advice

- Tactical Business Reviews

- Competitor Reviews & Target Screening

- Market Entry Strategies

- Program Management

- Transaction Execution Management

- Due Diligence

- Post-Merger Integration

- Synergy Realization & Tracking

- Benchmarking & Performance Measurement

- Selective Capital Raising

- Selective Actuarial & Risk Management

- Product Innovation & Roll-Out

- Business Process Optimization