Escrow and Indemnification, a Thing of the Past?

Oct 18, 2014 | by ASATS team

For many years, escrow and/or indemnification has been the standard by which buyers will insure the veracity of the sellers’ representation and warranties and their ability to meet claims from breaches thereof. The negotiations around these escrows and indemnifications can be intense and delay deal closings.

Representation and warranty (R&W) insurance (also known as a warranty and indemnity insurance) is a financially superior alternative to typical escrow and indemnification under any circumstances, where an escrow’s duration exceeds 3 months. From a pure economic value perspective, substituting an R&W policy in lieu of typical escrow can add anywhere between 1-3% of value to any given deal.

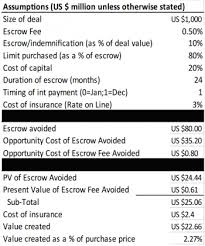

As an example, assume a buyer originally offers US $1 billion to a seller, expecting 10% be set aside in an escrow and the duration of that escrow is 2 years. Assume the opportunity cost of capital of the seller to be 20%. Further assume the buyer then decided to replace 80% of the escrow with an R&W policy. Under this scenario, approximately US $23 million in value (2.3% of deal value) is created.

For many years, escrow and/or indemnification has been the standard by which buyers will insure the veracity of the sellers’ representation and warranties and their ability to meet claims from breaches thereof. The negotiations around these escrows and indemnifications can be intense and delay deal closings.

Representation and warranty (R&W) insurance (also known as a warranty and indemnity insurance) is a financially superior alternative to typical escrow and indemnification under any circumstances, where an escrow’s duration exceeds 3 months. From a pure economic value perspective, substituting an R&W policy in lieu of typical escrow can add anywhere between 1-3% of value to any given deal.

As an example, assume a buyer originally offers US $1 billion to a seller, expecting 10% be set aside in an escrow and the duration of that escrow is 2 years. Assume the opportunity cost of capital of the seller to be 20%. Further assume the buyer then decided to replace 80% of the escrow with an R&W policy. Under this scenario, approximately US $23 million in value (2.3% of deal value) is created.

Case study:

As proof to this theoretical case, Aon had a private equity client (PE client 1) that did, in fact, enter into an agreement with a seller’s company (seller’s company A) for US $1 billion. While the agreement was signed, the deal had not yet closed. Once Aon realized what client 1 was doing, we suggested a structure identical to the one described above. In short, the seller, who had already agreed to a price of US $1 billion, was approached by the buyer with an option to reduce the escrow from US $100 million to US $20 million. The buyer made this offer but inquired about the price reduction that the decrease in escrow is worth to the seller. In return for avoiding 80% of the escrow, the seller ultimately reduced the price by US $25 million. The structure is as follows:

In short, for the cost of insurance (US $2.4 million), the buyer was able to save US $25 million in purchase price (over 10X return on the cost of the insurance). In this particular scenario, the buyer was able to reap the entire value created by the R&W policy. This begs the following question: How do users of this solution, whether they be buyers or sellers, strategically deploy R&W in such a way that they can capture the value creation? Aon views this in two ways:

- When viewed from a buyer’s perspective, deploying the solution during an auction can provide a strategic advantage

Buyer introduces first

When the buyer introduces the solution first, especially during an auction, the buyer can accelerate the negotiation, knowing that he can achieve the required deal protection through an R&W policy, making an offer with a relatively low escrow amount to make their offer incrementally more attractive. It should be noted that, as R&W becomes more common, this strategic advantage would shift from offensive to defensive. Many geographies have relatively low penetration rates of this solution (e.g. U.S. only has about 10% of the possible deals using this solution), but these penetration rates are moving up sharply. Currently, in many geographies, buyers using this solution would be the only one doing so in a given auction. In the future, buyers not using this solution will be at a disadvantage as, more than likely, at least one other buyer will be using R&W insurance.

-

When viewed from a seller’s perspective, introducing the concept of using R&W as opposed to escrow as part of the auction process is desirable. This would enable the seller to integrate the solution into the Common Information Model

Seller introduces first

We refer to this process as a “Seller Flip”. The seller pre-negotiates the R&W policy and then once a preferred buyer is selected, the seller flips the policy to be finalized by the buyer. When done in this fashion, all the buyers in an auction will be bidding on the seller under the same terms, thereby bidding away the value of the escrow avoidance to the benefit of the sellers.

From a seller’s perspective, there is another benefit that using R&W insurance for sellers of assets that are Private Equity (PE) firms. Internal rates of return, (IRR), is a key measure when limited partners are weighing investing money in various PE firms.

Continuing the real world example from above, let’s now assume that Client 1 decides to sell its acquisition for US $2 billion after three years with a two year escrow of 10%. He has made a respectable IRR of 24.46% by doing so. However, if he substitutes insurance for 80% of the escrow, thereby accelerating his ability to distribute money to his limited partners, he would improve his IRR by 77bps.

There have been many factors driving the accelerated adoption of R&W / W&I insurance, including lower pricing, better policy wording, and more streamlined processing. However, given the economic dominance of this solution versus standard escrow, we believe that the adoption rate will continue until escrows are the exception to the reps and warranty insurance rule.

Appendix 1: Detailed NPV Calculation