Asset & Liability Management

We have been carrying out ALM studies for pen¬sion funds, collective pension foundations and other institutional investors since 1997 and have thus accumulated considerable expertise in this field. Our team of pension fund experts and investment specialists combines a broad range of skills and expertise, which guarantees a balanced presentation of both the assets and liabilities sides of the balance sheet.

Our ALM studies are based on iGALM (interactive Global ALM), our proprietary ALM model. This model presents the expected development of assets and liabilities over a longer time frame, as a rule 10 years. iGALM contains a sound financial and theoretical capital-market model which can be customised for the stochastic simulation of realistic scenarios (Monte Carlo method).

Based on this expected development of assets and liabilities, we can determine a fund’s capacity for taking risks as well as its projected funded status, membership structure and cash flows, in order to optimise its investment strategy and funding or benefits schemes.

The following table shows an example of the simulated development of funded status (based on 10,000 stochastic simulations):

The 95% value at risk (VaR) for funded status in 2015 is 77.7%. With a 95% probability, funded status will not drop below 77.7% until 2015. The conditional value at risk (CVaR) for funded status in 2015 is 70.8%. If funded status falls below the VaR in 2015, then its expected value will be 70.8%.

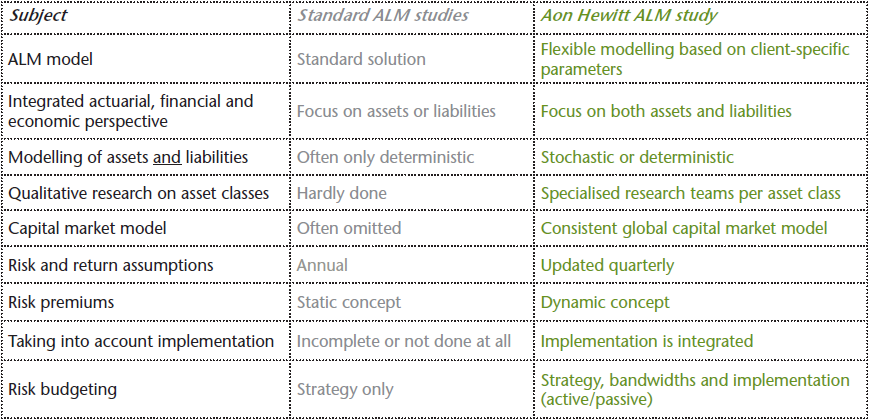

Our ALM studies are independent from banks and insurance companies and are guided exclusively by the client’s interests. Other important differences between our ALM studies and Standard ALM studies are:

Please do not hesitate to contact us for a personal meeting.