Insurance-Linked Securities/Collateralized reinsurance

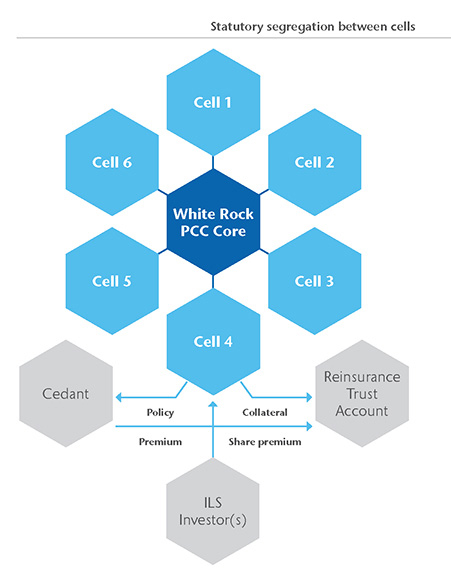

The White Rock Group provides capital market investors with flexible and innovative transformer facilities which can be used to directly access the reinsurance market.

Utilizing transformer vehicles, capital markets investors are provided the opportunity to participate in (re)insurance event risk, with a primary focus on natural catastrophe perils, via an asset class that is largely uncorrelated to the global capital markets and which is viewed to provide an attractive risk adjusted return. In the absence of a clearly defined trigger event, the initial collateral and any associated proceeds will be realised by the investor.

White Rock offers a turn-key solution to investors looking for ease of set up and flexible ownership options, with minimal operational costs. The White Rock team has extensive experience with establishing new protected cells and provides all management services and oversight to the vehicles.

Clients include dedicated Insurance Linked Securities funds, (re)insurers, hedge funds, private equity funds, pension funds, banks and other financial institutions.