By Ian Leslie, Business Development Director, Aon’s Credit Solutions

A common response to a business insolvency is that it “was a one-off” and that there is little point in “shutting the stable door after the horse has bolted”. While both of these statements can be correct at times, in the world of credit management they are just as likely to be myths. In the context of the recent swathe of insolvencies, it is difficult to argue that they were simply “one-offs” while there are measures that businesses can and should take to “shut the stable door” even after the event, to stem further possible losses.

A one off, or all connected?

Let’s tackle the “one off” theory first. In the last twelve months we’ve seen a whole raft of high profile names go out of business including Toys R Us, Maplin, Palmer & Harvey, parts of Conviviality Group, as well as Carillion. Can all these really be one-offs? Yes, they’re across multiple sectors and yes, they each had different economic structures, but they all have one thing in common; all of these businesses failed to keep up with their respective markets and paid the ultimate price. While it’s the lack of cash that ultimately kills a business, it’s usually the end result of a long journey and the culmination of a combination of bad management decisions and unforeseen events.

Markets are evolving quickly and businesses such as Toys R Us struggled to catch up once they began to lag behind. Back in the 1980’s, economist Michael Porter wrote that there are three generic strategies a business can follow: be the best in market; be the price leader in market; or be niche. Anything else leaves a business ‘stuck in the middle’ which is where many businesses currently find themselves. It’s where companies like Toys R Us, Maplin and others ended up and, while they’re all unique in their own way, they are all far from being one-offs.

The year of the CVA

There will be more insolvencies to follow in 2018. Government statistics showed an increase in company insolvencies of 12% for the second quarter in comparison to 20171 and the prevailing economic winds are leading experts to believe that this trend is set to continue with a particular growth in the number of Company Voluntary Arrangements (CVA). This year a large number of high profile retailers and fine dining chains have gone into a CVA and not all have managed to successfully trade out of their difficulties. From a trade credit insurance perspective, the vote on whether or not going into CVA works as a rescue plan is still out. Whilst the fashion retailer New Look seems to have made it work, others undoubtedly will be far less fortunate, and for that reason trade credit cover for these companies is difficult, if not impossible, to come by.

The domino effect

So what about that stable door? The knock-on effects of insolvency (or the domino effect) for a company’s own distinct supply chain and customer base is, in turn, hitting one in four businesses in the UK according to research from R3, the insolvency and restructuring trade body. Andrew Tate, spokesperson for R3, said:

“No business exists in isolation, and every headline-grabbing corporate insolvency will have consequences for numerous other enterprises. In the worst-case scenario, the loss of a vital business relationship can lead to a company’s own insolvency in turn – the ‘domino effect’ in action. Recently, we have seen a string of insolvencies of high-profile companies, from Carillion to Toys R Us, which will have caused upheaval at other companies.”

An insolvent company will impact its supply chain through loss of sales (and therefore cash), and other stakeholders such as its employees, competitors and service providers will also face the consequences. Arguably the size of the companies that have gone insolvent this year has created a domino effect which can be felt throughout the entire UK economy. And how will other factors like Brexit exacerbate the difficulties for business? The BBC reported on the 3 August that the lack of information businesses are receiving is making it impossible to plan for the future with the Institute of Directors adding that businesses “can only adjust once there is clarity about the direction of travel”.

So what can you do to shut the door?

The domino effect from a company insolvency is far reaching and can affect many stakeholders, across a multitude of sectors. Given challenging markets and changing consumer behaviour, coupled with the uncertainty around the future of the UK economy, a perfect storm is raging which will see ‘one off’ insolvencies consigned to history as multiple businesses go into a CVA or ultimately, out of business. The good news is, there are solutions available to help so that, even if the horse has bolted, it is not too late to shut the stable door to prevent future damage from a client’s insolvency.

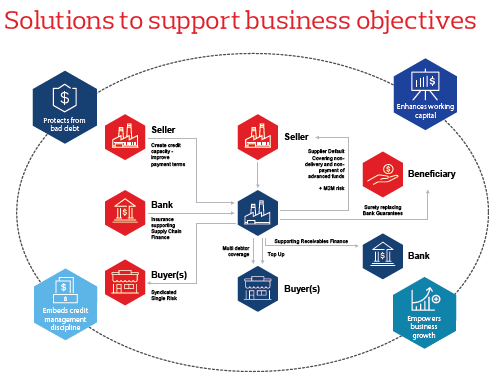

Aon, a market leading broker in credit solutions, can support a business's working capital in the following areas:

- Trade credit solutions to help protect against losses from non-payment of a commercial trade debt arising from both insolvency and delayed default / slow payment by a buyer

- Trade receivables and payables solutions to improve payment terms and cashflow, and enhance access to finance

- Surety and guarantees to replace letters of credit and cash collateral, to help improve cashflow

For further information on how Aon could help your organisation contact: Ian Leslie

1 https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/729810/Insolvency_Statistics_Commentary_-_Q2_2018.pdf

Aon is authorised and regulated by the Financial Conduct Authority. FPNAT.404