The Gender Pay Gap and Your Employment Practices Liability

It is impossible to open a newspaper or turn on the television at present without seeing references to the gender pay gap. It is the workplace issue of the moment with many organisations struggling to contain the fallout from the publication of their gender pay gap figures. What does this mean for you and your organisation and will your Employment Practices Liability (“EPL”) contract meet the challenges ahead?

What is the Gender Pay Gap?

The gender pay gap measures the difference between the average pay of men and women, irrespective of job title or work carried out. This is not the same as equal pay, which compares the pay of men and women carrying out the same, similar or equivalent jobs. So an organisation that complies with the law and pays men and women equal pay for equal work can still have a gender pay gap, if for example, there are a disproportionate number of men in senior positions.

In 2015 David Cameron announced his intention that the then Conservative Government would end the gender pay gap within a generation. That pronouncement foreshadowed the Equality Act 2010 (Gender Pay Gap Information) Regulations 2017 (“the Gender Pay Gap Regulations”), which came into force on 6 April 2017 and ushered in mandatory gender pay gap reporting for large companies.

Gender Pay Gap Reporting- the requirements

The Gender Pay Regulations impose a duty on large private companies and voluntary sector employers (those with 250 or more employees) to analyse the gender pay in their organisation and to publish a Gender Pay Gap report. The first report was to be published by 4 April 2018 (hence the current rush) with subsequent reports to be published on an annual basis thereafter.

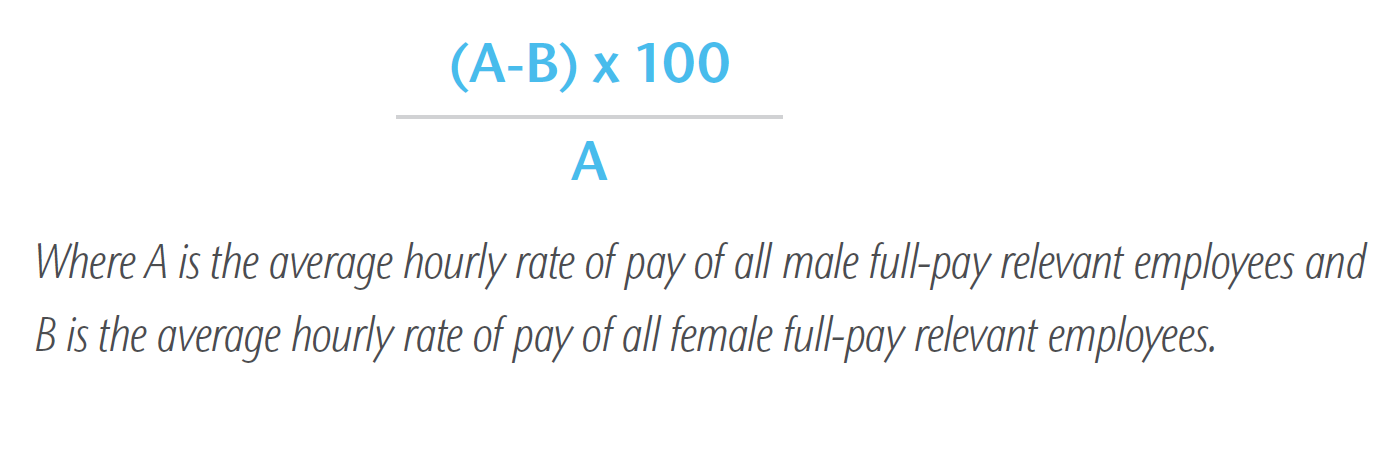

So what should be in the report? It is worth recapping the basics. The gender pay gap is always expressed as a percentage and is calculated using the following formula:

Where A is the average hourly rate of pay of all male full-pay relevant employees and B is the average hourly rate of pay of all female full-pay relevant employees.

Gender pay gap figures must be published using both mean and median figures. The mean is the mathematical average (the sum of all values divided by the total number of those values). The median figure, on the other hand, is the mid-point value in the data. The median is seen as being a more accurate figure as it is less likely to be distorted by a small number of disproportionately high or low values in the way that the mean figure would be.

Broadly speaking the information to be provided falls into two main groups, data on pay and on bonuses. Employers must follow the rules in the regulations to calculate and then publish the following information in respect of relevant employees:

- • Mean and median gender pay gap figures.

- • Mean and median bonus gender pay gap.

- • The proportion of men and women receiving a bonus.

- • The proportion of men and women in each of four pay bands (quartiles), based on the employer's overall pay range.

The report must be published on the employer’s own website as well as a government website. This is an important point as it means (as has been very evident in recent months) that the information is publicly available and can be easily shared. A number of news organisations have links directly to the relevant Government website, together with significant analysis of the published data and a large number of organisations have generated negative publicity following publication. It is also evident that there are wide pay variations across sectors and it has highlighted those organisations which are heavily male dominated in their senior echelons.

The Risks

The obvious concern with the increased transparency around gender based pay is that it may cause employees to focus on pay disparity issues leading to an increase in Equal Pay claims and sex discrimination claims. Both types of claim can be difficult and incredibly costly to defend. This is particularly so when faced with Equal Pay class actions.

It is also important to try and anticipate what could be next. It is not inconceivable that the issue of pay gaps for minorities, what is termed the black and minority ethnic (BAME) pay gap could be on the agenda in the not too distant future raising similar issues, particularly around discrimination.

So how does one manage these risks? It would seem self-evident that those organisations which take robust measures to address inequality, including any gender or race based pay disparity, will be less likely to suffer claims. Such organisations will also be seen as presenting a better risk profile for their insurers. As well as taking action to mitigate potential risks it is also pragmatic to examine how your insurance contract can help.

Your EPL Contract

As with all insurance contracts it is important to be familiar with the extent of cover so that you are satisfied it will meet the risks faced by your organisation and staff. Most EPL contracts will cover Insureds for loss in respect of claims arising out of employment practice wrongful acts. It is still very common for these contracts to contain long lists of wrongful acts into which the defendant’s claim must fall. An alternative approach, and one which we increasingly favour, is to have an extremely wide, usually one paragraph, definition of the employment practice wrongful act intended to encompass all potential claim scenarios.

It is important that your wording does cover the potential risks. It is not uncommon for contracts to seek to exclude Equal Pay Claims and this exclusion should be removed if possible. It is also worth checking whether there is coverage for entity public relations costs which might provide coverage for the costs of dealing with any adverse publicity arising from the information disclosed. This would be unusual but perhaps something that one could try to include on renewal.

For many the key driver for EPL contracts remains defence costs cover. Employment claims can be incredibly costly to defend and recourse to such cover can be critical in dealing with claims.

Finally for further information on the issues covered by this article, do not hesitate to speak to your usual Aon contact.

FP: CB002