Alastair McIntosh, partner at Aon, explores DB schemes’ end goals, and how they can keep flightplans on course to achieve them.

Regulatory demands, pressure from sponsors, improved funding positions and greater emphasis on scheme governance have all sharpened trustees’ focus on long-term targets in recent years. Whether schemes are aiming for buyout, self-sufficiency or another option as their end goal, having a clear target and a robust flightpath to achieve it is now more important than ever.

Aon’s 2023/24 Global Pension Risk Survey asked 204 UK defined benefit (DB) pension schemes, ranging from less than £100m to over £10bn and across a mix of industry sectors, about their current risk priorities and how these relate to their long-term targets.

Buyout dominates schemes’ long-term goals

Aon has published its Global Pension Risk Survey for more than a decade. Over that time, we have seen a gradual increase in the number of schemes targeting buyout as their long-term goal. However, in this year’s findings and for the first time, more than half of the schemes we surveyed (55 percent) said that they expect to buyout in the future. A further 30 percent are targeting self-sufficiency, and 15 percent either have yet to decide, or have another end goal.

The Pensions Regulator’s DB Funding Code, likely to be introduced in 2024, will require all DB schemes to have an agreed long-term target and a journey plan to achieve it.

Timescales to targets are falling

As well as having clearer long-term targets, most schemes are also confident that they are getting close to achieving their goals. We have seen a significant increase in the number of schemes that have already reached their long-term target, from just 3 percent in 2021 to 16 percent in this year’s report.

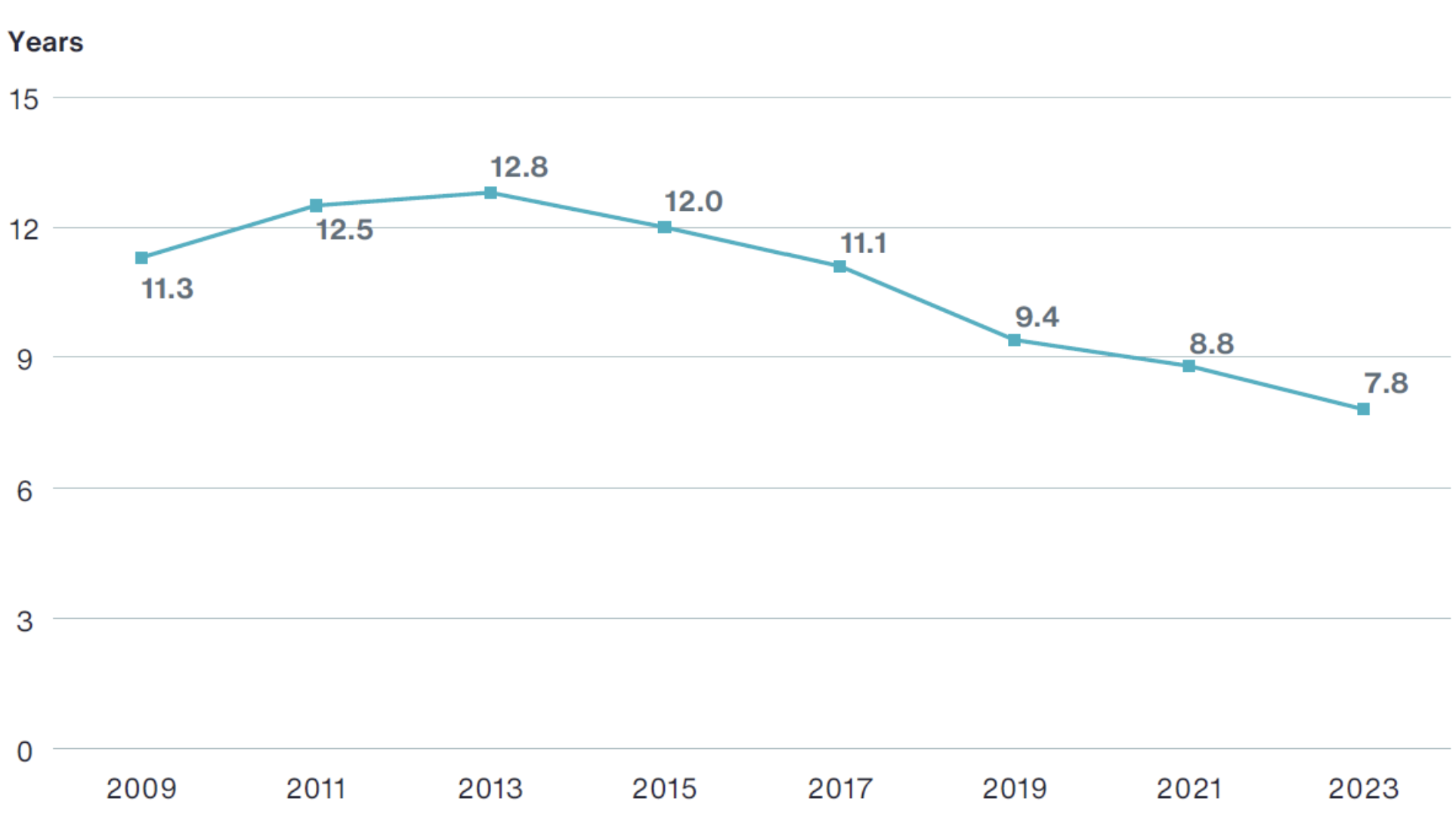

The average anticipated timescale for the remaining schemes to reach their long-term targets is now just 7.8 years, a whole five years less than we reported a decade ago (see graph) even though the average target is stronger. Much of this is down to good risk management by trustees and sponsors, so this is a very positive trend. It was also encouraging to see that 64 percent of respondents expect to achieve their long-term target by sticking to their agreed funding plan, suggesting that trustees and sponsors are confident that they have robust risk management strategies in place.

Timescale to Reach Long-Term Target As Reported in Previous Global Pension Risk Surveys

Source: 2023/24 Global Pension Risk Survey – UK Findings

However, although the average time to achieve long-term goals is 7.8 years, there are still significant differences between schemes. While 46 percent of schemes expect to reach their target within the next five years, a quarter of schemes still anticipate that it will take them more than 11 years to do so.