DB pension schemes are engaging with ESG risks, but it is important to look beyond equities says Jennifer O’Neill, partner in Aon’s Responsible Investment group

Trustees’ investment decisions over the decades-long lifetime of their members have an impact far beyond the scheme’s funding position.

As the UK government’s Mansion House proposals showed last summer, those decisions have the potential to influence everything from business innovation to long-term plans to reduce emissions and contain climate change.

Defined benefit (DB) pension schemes have faced increasing regulatory demands around environmental social and governance (ESG) factors from The Pensions Regulator and Department for Work and Pensions. In many cases, trustees have gone far beyond those requirements to devise policies that put ESG at the heart of their portfolios.

But different interpretations of ESG by asset managers, consultants, governments, and global regulators have also made it difficult for some trustees to find their way through an increasingly complex jungle of ideas and rules.

That has left some trustees feeling frustrated by a lack of clarity and consistency. It has also made it more important than ever for schemes to clearly define their own policies and ESG beliefs, and to then use these as the basis for their investment approach.

Despite these challenges, Aon’s 2023/24 Global Pension Risk Survey paints a positive picture of DB pension schemes’ engagement with ESG. Aon collected responses from 204 UK DB schemes of different sizes and from a variety of industries, in the second quarter of 2023. Most respondents were trustees (62 percent), pensions managers (25 percent) or scheme sponsors (11 percent).

Engagement with ESG is increasing, but schemes must look beyond equities

The survey found that 87 percent of respondents are now engaged with ESG, making it a significant factor in trustees’ and other stakeholders’ investment decision-making.

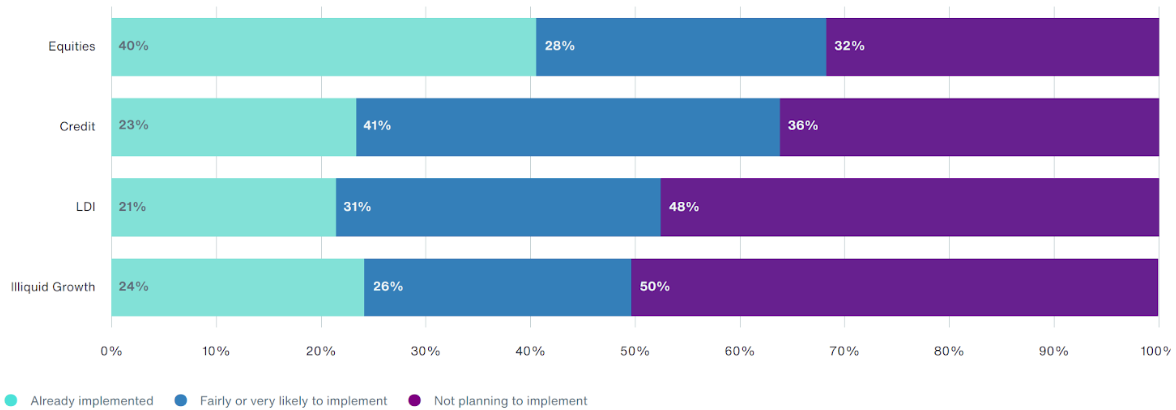

It was also encouraging to see that respondents intend to increase their ESG focus on asset classes beyond equities over the next 12 to 24 months. To date, equity investment and related practices such as stewardship of assets have been the main focus for ESG investment. But trustees also need to look more holistically across their portfolios, including fixed income, alternative assets, and other strategies such as liability-driven investment (LDI).

Our survey results showed that this is now beginning to happen, with 41 percent of respondents likely to implement an ESG focus in their credit portfolio over the next 12-24 months, and 31 percent saying they will address this for LDI strategies.

ESG Focus in the Next 12-24 Months

Trustees are having to balance ESG engagement with other scheme priorities

We were pleased to see that over a fifth of schemes (22 percent) are committed to developing their own set of policies for ESG investment. However, the majority (65 percent) are focused on taking a compliance-based approach. This suggests that trustees are under time pressure, as they grapple with a range of governance challenges across their schemes that could be compromising their capacity to focus on ESG.

But it is crucial that trustees remain focused on this area of risk and learn lessons from schemes that have been at the forefront of ESG engagement. Larger schemes have led the way in developing their own policies, and this again points to trustee bandwidth. Smaller schemes are likely to be under greater pressure to address projects and risks that are top priority for their specific circumstances.

Schemes are aligning with sponsors’ net-zero goals

Scheme sponsors have also been engaged in defining ESG and net zero goals for their businesses. These are often still works in-progress, but many trustees are aware of the significance of making their scheme’s investment principles consistent with those of their sponsor.

Just over half (51 percent) said they are aligned with the sponsor’s ESG and net zero goals and a further 15 percent said that they are not aligned with the sponsor, but that this needs further consideration.

The long-term impact on members

As temperatures continue to increase, and global action to curb climate change remains fragmented, pension schemes’ investment strategies will have an increasingly material impact on the lives of their members– and on the society and environment in which those members live.

Trustees face more regulatory pressure than ever to address ESG in their investment approaches, but for this to be truly effective, schemes need to evolve their policies to look beyond equities and take a more holistic approach to ESG. Trustees’ biggest challenge will be identifying how to achieve this, while still balancing the myriad of other governance commitments they face.

You can download a copy of the survey at www.aon.com/GPRS2023.