Rupert Kotowski explores investment insights from Aon’s Global Pension Risk Survey 2023/24

UK defined benefit (DB) pension schemes’ investment strategies have faced many challenges over the last 18 months, from global political instability to macroeconomic shocks. While those factors have inevitably shaped schemes’ investment decision-making, Aon’s Global Pension Risk Survey 2023/24 shows that trustees remain focused on scheme-specific needs and long-term goals.

The survey findings include responses from trustees, pension managers and scheme sponsors representing 204 UK DB pension schemes, from under £100m to over £10bn in assets under management and reflected their expectations before the Mansion House reforms announcement.

Higher gilt yields impact investment strategies

Aon carried out our research in the second quarter of 2023, so the findings capture the impact of significantly rising gilt yields across 2022 on schemes’ investment strategies. The majority (84 percent) of respondents said they are either better off or the same from a funding perspective than 18 months previously and also have significantly lower deficits.

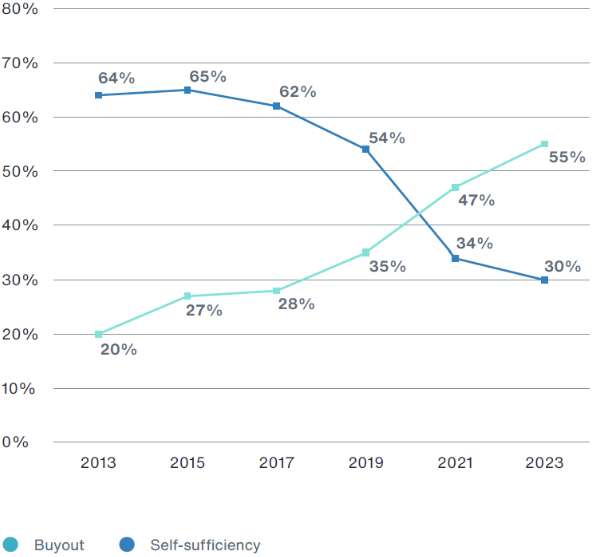

These improvements focused schemes’ attention on their long-term targets and the investment strategies they need to achieve those goals. More than half of respondents (55 percent) are now aiming for buyout as their long-term target. This is the highest percentage that we have seen since the Global Pension Risk Survey launched (see graph).

Development of Buyout and Self-Sufficiency Targets

Source: Aon’s Global Pension Risk Survey 2023/24

With significantly lower deficits there is an increased focus on de-risking. Respondents’ longer term investment plans are shifting away from equities and growth assets and towards bulk annuities, liability-driven investment (LDI) and credit.

Over the next two years, 39 percent of respondents expect to reduce their exposure to equities, and 35 percent also anticipate lower allocations to illiquid assets with the most significant switch being to Credit (with30 percent of respondents). This could reflect both changing attitudes to risk for schemes targeting buyout and use of strategies such as Cashflow-Driven Investment (CDI).

Risk and return remain in focus

The market instabilities of Autumn 2022 have affected trustees’ approach to risk and return, particularly in relation to hedging programmes. Among respondents, 45 percent said that they expect to either reduce their return targets to maintain their hedge ratio or reduce hedge ratios to maintain return targets. Just over a third (34 percent) of schemes expect to maintain both target returns and target hedge levels, but accept that this brings other risks such as higher leverage in LDI portfolios.

The events of Autumn 2022 also raised the profile of fiduciary management, with 26 percent of respondents saying they are more likely to consider fiduciary management as a way of managing operational risk than previously. Ways of implementing fiduciary management will vary depending on schemes’ needs, ranging from a fully outsourced chief investment officer (CIO) model to specific areas of strategy such as cashflow management.

Schemes are acting on ESG concerns

All DB schemes are now required to report on ESG and stewardship factors as part of their investment governance, so it is positive to see that 87 percent of schemes say they are engaged with ESG. Respondents are focused on finding an approach that is appropriate for their individual scheme, with 65 percent adopting a compliance-based approach and 22 percent aiming to develop their own set of policies.

Over half (51 percent) of schemes say that they have aligned their approach with their sponsor’s environmental. social and governance (ESG) and net zero goals, reducing reputational risk.

Equity portfolios are the most advanced in terms of ESG focus, with a total of 68 percent of schemes either having already implemented an ESG approach or intending to do so in the next two years. Trustees’ focus is now also turning to credit portfolios, with 41 percent intending to increase ESG-related investment within the next 12-24 months.

ESG Focus in the Next 12-24 Months

Source: Aon’s Global Pension Risk Survey 2023/24

Our Global Pension Risk Survey shows that schemes are continuing to switch their long-term target to buyout and make progress towards achieving this. Trustees are focused on building investment approaches that are suited to their individual schemes, driven by available time, skills, budget, and wider scheme priorities. Views on strategies such as fiduciary management and approaches to ESG beliefs will also shape investment approaches over the next 12-24 months, while trustees will need to ensure they have the right frameworks in place to continue to manage risk and return in a market environment that remains uncertain.

We look forward to seeing how Mansion House reforms and the new funding code will impact respondents’ expectations in our next survey in 2025.

You can download a copy of the survey at www.aon.com/GPRS2023.