Selecting Fund Managers and Consultants - What Do Trustees Look For?

Aon's latest research, in partnership with Leeds University Business School, puts the relationships between trustees and their fund managers and investment consultants under the spotlight and gives insights into the interactions which are fundamental to the investment processes of pension schemes.

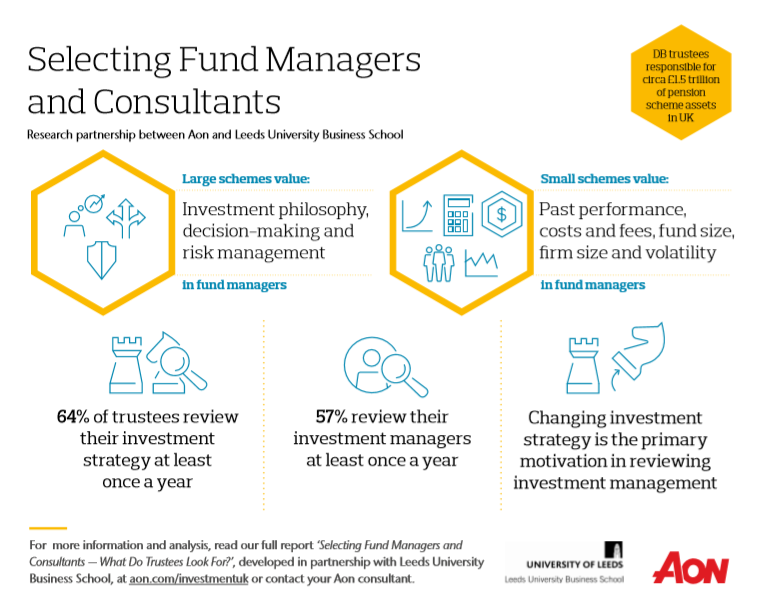

A few key highlights from the research are that:

- Trustees focus on risk-adjusted performance and most retain a longer-term view

- Large scheme trustees place greater emphasis on investment philosophy, decision making and risk management

- Small scheme trustees focus more on past performance, costs and fees, fund size, firm size and volatility

- 64% of trustees review investment strategy annually and 57% review their investment managers annually.

- What trustees value in investment consultants varies - especially by size of scheme

- Irrespective of scheme size, trustees look to consultants for clear advice, understanding of the scheme and its goals, and risk management advice

- Trustee/consultant interactions are complex and often scheme specific

Selecting Fund Managers and Consultants - What Do Trustees Look For?

Aon's latest research, in partnership with Leeds University Business School, puts the relationships between trustees and their fund managers and investment consultants under the spotlight and gives insights into the interactions which are fundamental to the investment processes of pension schemes.

Selecting Fund Managers and Consultants - What Do Trustees Look For? - Overview Infographic

Let's talk about your investment decision-making today.

Email us at [email protected].

© Copyright 2023 Aon Investments Limited. All rights reserved.

Aon Investments Limited is authorised and regulated by the Financial Conduct Authority.