Accounting Strategy Team

As the largest corporate pensions consulting firm in the UK with over 100 dedicated corporate consultants, we are unique in the depth of our expertise and the breadth of our experience of accounting issues faced by UK corporates.

Aon’s Accounting Strategy Team is uniquely placed to leverage our experience with over 350 pension accounting clients to ensure you receive the best and most efficient service.

We have strong links with all the main audit firms and speak to their central audit and pensions teams at least quarterly, ensuring a 'no surprises' approach to your audit process.

Using this unrivalled market presence, we work under all applicable accounting standards to deliver:

- Advice on setting assumptions, ensuring that you are aware of the implications on auditor discussions and your accounts; and

- Ongoing benchmarking of your peers and the wider market to give you a real-time picture of market practice;

- Strategic benchmarking advice to take back control of your accounting position by taking positive action to improve the position and remove future volatility;

Assumption setting

We review your assumptions each year to ensure that your accounting position is a genuine best estimate and there is no unrewarded prudence on your balance sheet.

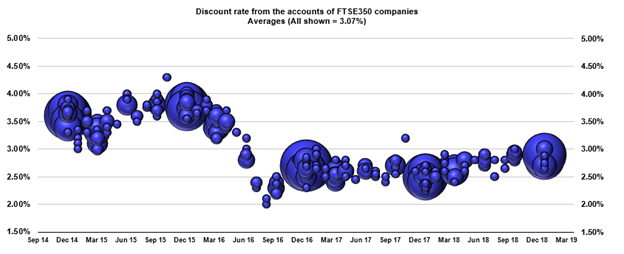

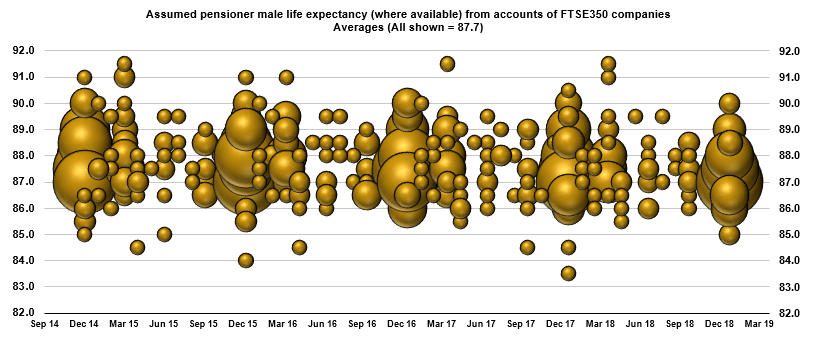

We monitor the assumptions of our clients and of the FTSE 350 to give you deep insight into the market's approach to setting assumptions, allowing you to position yourselves appropriately in the market.

Strategic benchmarking service

Your accounting position doesn't just depend on assumptions, and individual pension plan performance is heavily dependent on investment strategy, company contributions, and the impact of member option exercises.

We are passionate about helping you to understand and improve your accounting position – we will show you how your scheme is performing compared to your competitors, explain the key reasons for any differences, and allow you to take back control of your accounting position.

Speak to Aon’s Accounting Strategy Team to get your FREE personalised benchmarking report.

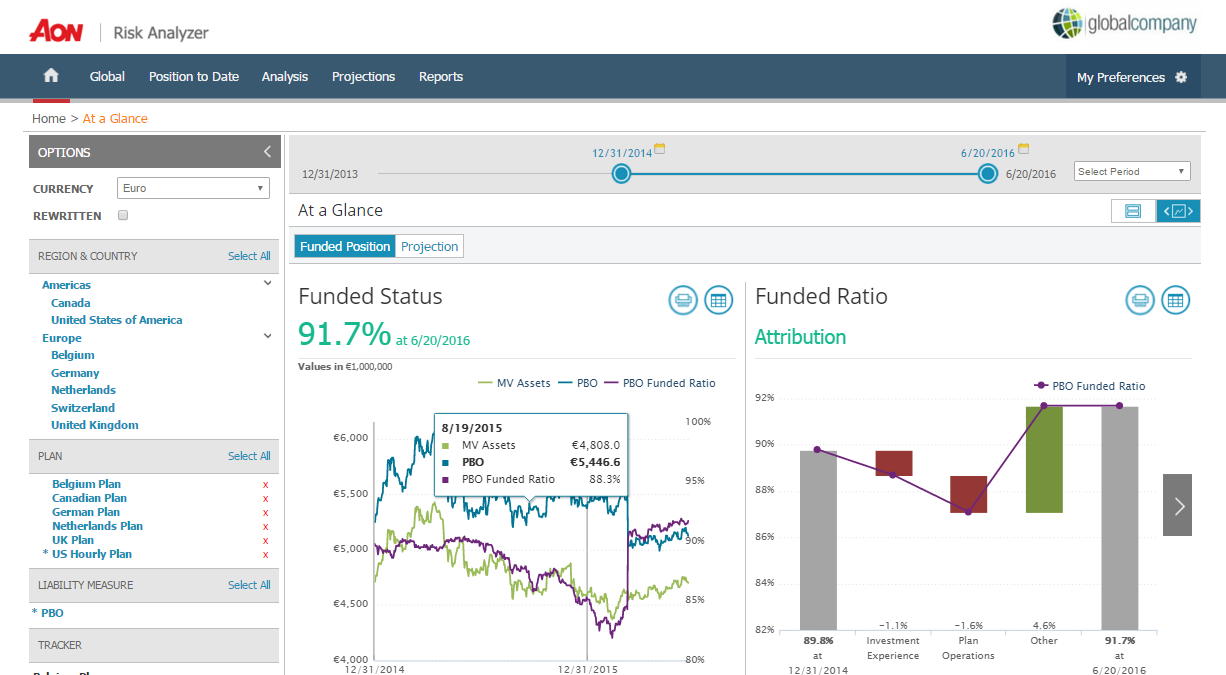

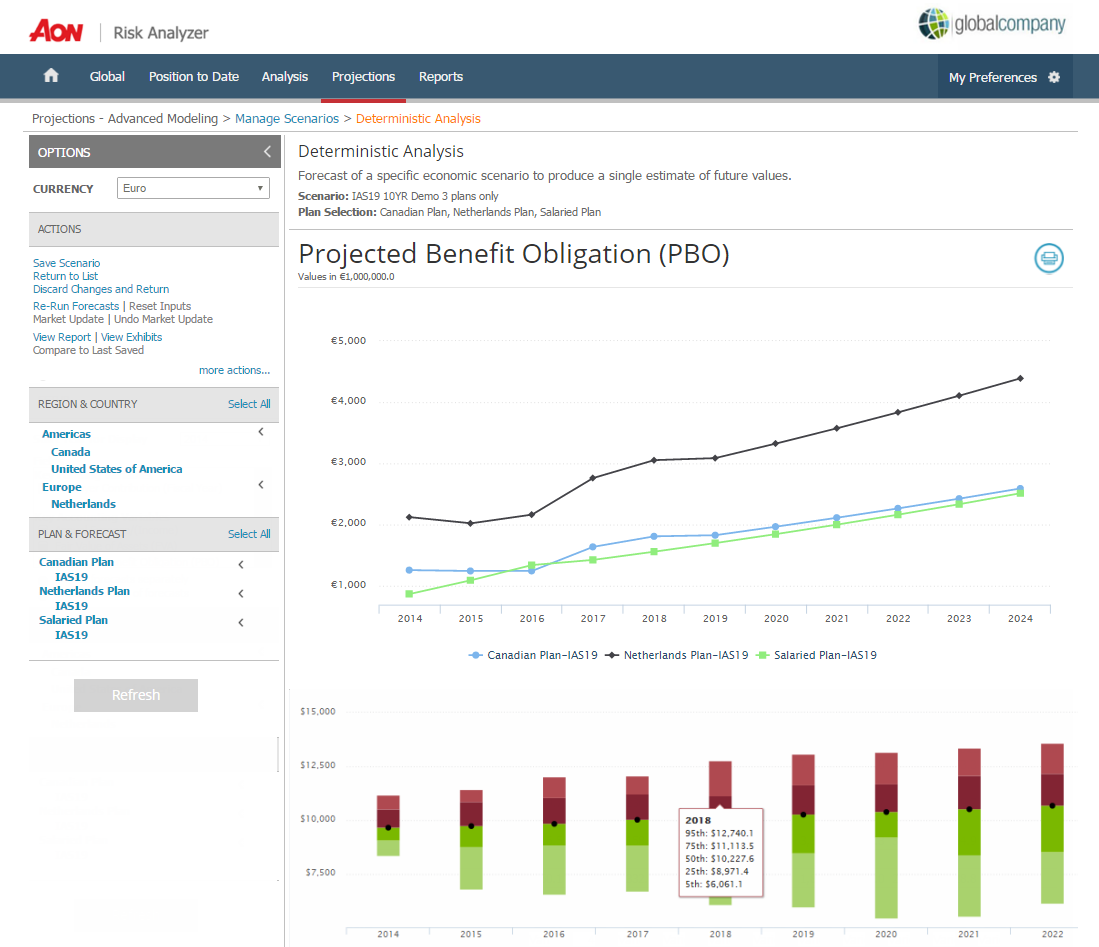

Global Risk Analyzer

Using our market leading Risk Analyzer software, you can project the accounting position of your pension schemes around the world, and interactively change assumptions to see the expected impact on your balance sheet and P&L and how things are expected progress in future years.

For more information on how our scheme funding and accounting services can support your scheme, email [email protected].

Aon Solutions UK Limited - a company registered in England and Wales under registration number 4396810 with its registered office at The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN.