Future pandemic: How can APAC companies stay prepared?

Addressing the underserved, Risk & Innovation

The COVID-19 pandemic exposed a number of vulnerabilities in organisations’ business models and risk approaches. According to Aon’s global survey ‘Reprioritizing Risk and Resilience For a Post-COVID-19 Future’, prior to COVID-19, a pandemic or other major health crisis was not a top 10 risk on organisations’ risk register for more than 80% of respondents.

When it occurred though, a global health and economic crisis ensued, and organisations’ risk infrastructures were tested. Still, some regions were more prepared than others.

One year on, existing and emerging long-tail risks continue to challenge organisations across all industries and geographies, and the pandemic, its economic devastation and a hardening insurance market are pushing organisations to build a new enterprise risk management (ERM) strategy.

To move forward, organisations must reprioritise risk and resilience, broaden their perspective and elevate risk management as a critical business priority.

APAC companies survive and thrive

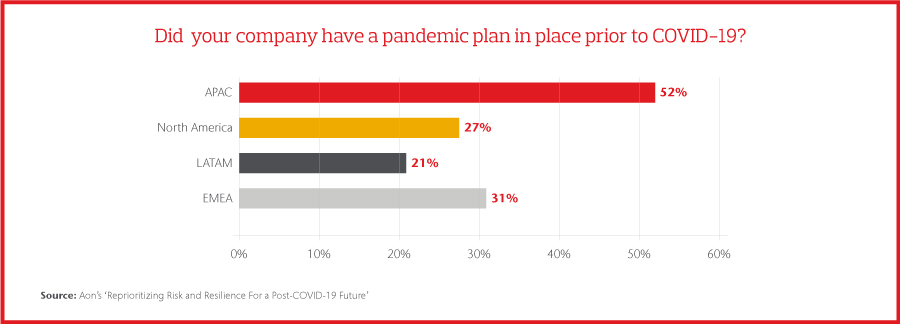

APAC companies have been more prepared in their pandemic response compared to their global counterparts. According to Aon’s

‘Reprioritizing Risk and Resilience For a Post-COVID-19 Future’ survey, more than half of APAC respondents had a pandemic plan in place prior to the event, which is significantly higher than the benchmark (30%).

Also, significantly higher numbers of businesses in APAC reported that they thrived during the pandemic, suggesting they were more resilient and better able to pursue opportunities (11% compared to 7% overall).

“Many of these organisations learned from earlier threats (SARS, avian flu and swine flu), so they introduced robust plans and had state-run track-and-trace technology already in place,” says Alastair Nicoll, Regional Director, Captive & Insurance Management, Global Risk Consulting, APAC.

Even so, 35% reported that they have accelerated the review of enterprise risk management (ERM) (benchmark 29%), with 78% intending to review business continuity strategies (benchmark 57%). “This appears to demonstrate a much higher level of risk maturity in these organisations, which has improved their preparedness and their ability not only to be resilient but to thrive,” says Nicoll.

Fluctuating pandemic infection rates within regions influenced the stage businesses found themselves in (‘react and respond’, ‘recovery’ and ‘reshape’). APAC organisations reported being in the ‘reshape’ phase in higher numbers on average (36% compared to the benchmark of 29%).

“This may be related to the fact that the region was earliest to be impacted by first and second waves,” Nicoll explains. “It provides some indication that applying the lessons learned from the event and the resilience of organisations has enabled them to move forwards with strategic plans.”

The path to reprioritising risk and resilience

The COVID-19 pandemic has devastated health systems and economies, alerting many leaders to gaps in their risk readiness and the need for a different approach. It will likely serve as a catalyst for change in many organisations as there was overwhelming evidence that taking an enterprise-wide approach to the crisis response was the most valuable lesson.

To learn from the events of the past year, organisations should strengthen their decision making in each of the three time frames – react and respond, recover and reshape – and reprioritise enterprise risk management and resilience, including:

- Expanding risk to encompass long tail and emerging risks

- Building a more resilient workforce

- Rethinking access to capital

“Government response has been a necessary stopgap for a global event of this size, but our survey reveals that there is also a clear need for risk transfer solutions to support corporate mitigation efforts,” says Nicoll. “Part of that journey will require companies to rethink access to capital alongside risk, in addition to ongoing collaboration between the public and private sector.”

“Equally important is that the insurance industry innovates in response to companies’ changing needs, increasing global volatility, and emerging risks,” he adds. “Successful insurance solutions in the wake of the pandemic will be more agile, strategic, targeted and scalable.”