4 Ways to Achieve Success at Mid-Year Renewals

How can corporate buyers achieve optimal placement outcomes given the current reinsurance market dynamics?

Key Takeaways

-

Macroeconomic volatility has coincided with an increased frequency of extreme weather events, causing reinsurers to reassess their appetite.

-

Capital optimization is more important than ever.

-

Buyers must mitigate uncertainties with data-led portfolio differentiation.

Risk managers are faced with a new reality, one that includes lower risk appetites, reduced capacity, and increased rates. Meanwhile, insurers are facing their own challenges as reinsurers have been withdrawing capacity, but high demand has meant an increase in reinsurance costs.

While ongoing inflationary pressure, supply chain challenges, geopolitical instability, and climate-driven events weigh heavily in underwriting discussions, insurers remain focused on profitable growth during mid-year reinsurance renewals.

“Competition and appetite are healthy, but insurers are closely monitoring their exposures and deploying capacity based on careful risk selection,” says Brian Wanat, Aon’s Chief Broking Officer for Commercial Risk Solutions in the US.

Trends to Watch

- Geopolitical instability, supply chain challenges and macroeconomic volatility continue to create uncertainty. Inflation and the need for increased demand for limits is still top of mind. The increase in Secondary Perils losses have also put pressure on carriers as they are not modelled for and therefore have not been priced appropriately. Losses and lack of return on equity has led to a squeeze on supply of natural catastrophe capacity.

- Demand for capacity and flexibility continues to grow, and alternatives to traditional risk transfer solutions such as captives, alternative retention and limit strategies, “buffer” programs, parametric triggers, and large limit facilities such as the Aon Client Treaty play an increasingly important role in helping risk managers execute their risk management strategies.

- A two-tiered market has developed, with products and in-appetite risks targeted for insurer growth experiencing flat or decreased pricing and abundant capacity. On the other hand, challenging, poor-performing or out-of-appetite risks are experiencing material rate increases and tight capacity, although conditions are more moderate than in previous cycles.

Industry Spotlight

Supply Chain: What is the importance of supply chain resilience amidst complexities and challenges of global supply chains?

Environmental, Social, and Governance: Having emerged as key underwriting consideration, how can you differentiate your risk?

Inflation: What alternative solutions can you look towards to manage risk as a result of inflation?

Cyber: How can you bring sustainability and scalability to your cyber claims/risk management strategies as the nature of cyber risk evolves?

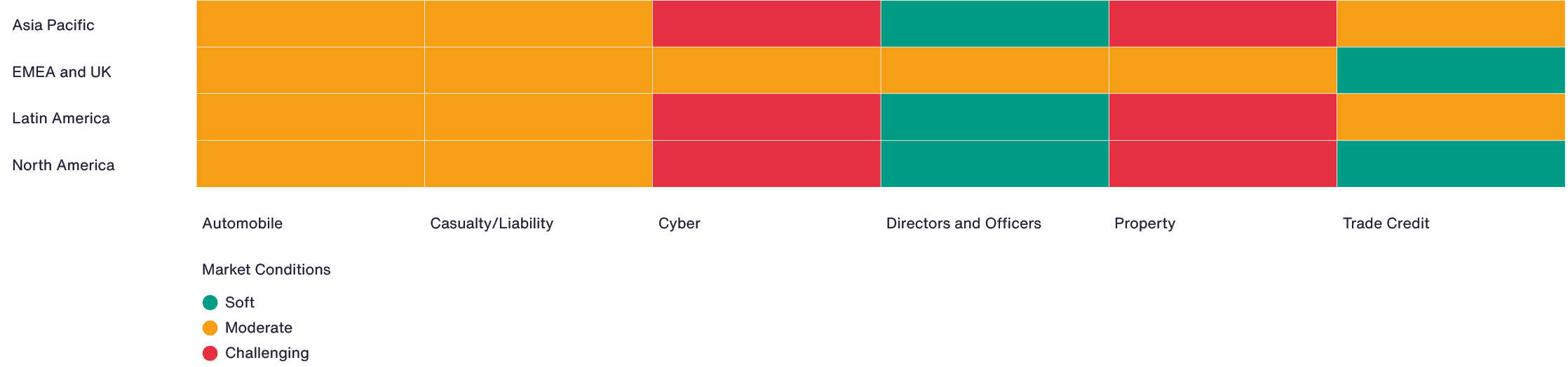

Source: Aon’s latest Global Market Insights

Competition and appetite are healthy, but insurers are closely monitoring their exposures and deploying capacity based on careful risk selection.

Actions to Take

As you prepare for the mid-year renewals, you can apply the following tips:

1. Explore alternatives to help you achieve flexibility and price relief

Traditional risk transfer continues to play a vital role in achieving risk management objectives. However, in challenging markets and risk situations where capacity is limited, alternatives may provide greater flexibility and some pricing relief.

Analyze your losses and risk profile and explore which alternatives to traditional risk transfer solutions (e.g., captives, alternative retention and limit strategies, “buffer” programs, parametric triggers, and large limit facilities such as the Aon Client Treaty) may be a good fit for your risk management strategy.

Where traditional insurance is the best option, partner with capital providers who may be willing to evaluate your risk on an enterprise level, making you less susceptible to appetite contraction on your lower-performing risk types.

2. Quantify your risk to help avoid potential gaps

Asset valuation remains a top insurer priority. Remain vigilant in managing your asset valuations and coverage (sub)limits to avoid gaps. Address inflation as well as other factors such as supply chains and contractor relationships that may impact recovery and indemnity periods. Revaluate exposure to property damage and business interruption in particular.

“Insureds should remain diligent in managing values and documenting valuation methodologies to avoid gaps in coverage and limits and to secure favorable underwritinengagement,” says Luca Tassarotti, Aon’s Head of Commercial Risk Solutions for EMEA.

Clearly demonstrating how you have measured the impact of risk factors on exposures allows you to access more favorable terms and capacity. Insurer confidence in your approach will not only reduce time-consuming follow-up queries but also results in superior pricing outcomes.

3. Proactively engage with insurers to build their confidence

Even with continuous engagement with insurers throughout the year, it remains important to start renewal planning early by conducting incumbent meetings to preview appetite and pricing and analyzing data to evaluate market alternatives and explore viability.

Be forthright in providing comprehensive underwriting information – especially related to risk control and mitigation practices and actions you have taken from past recommendations – but create discussion agendas that are focused on your differentiated strengths and key concerns. Highlight lessons you have learned from past claims, and actions you are taking to build resilience.

“Also, engaging with insurers across the portfolio rather than narrowly, for one product, deepens the relationship and may encourage insurers to look beyond only in-appetite products and risks,” says Paul Young, Aon’s head of Commercial Risk Solutions for Asia.

4. Differentiate your portfolio to optimize capital efficiency

Turn challenge into opportunity by effectively using this environment to build new relationships with insurers. For instance, ESG stories and climate strategies can be a way of communicating not just what the business is doing but also has an impact on its ability to differentiate in the marketplace.

Being prepared with high quality analytics that shows what the business is doing about inflation to attack its primary exposure shifts will also be more effective at renewals than clients that rely upon reinsurers to differentiate their portfolios.

“Buyers should look to differentiate themselves not only with accurate values and data but understand carrier partnerships and how they can best manage them in 2023,” says Angela James, Aon’s Chief Broking Officer of Commercial Risk Solutions for UK.

Ultimately, providing the right information to insurers shows that you are comfortable with your risk, allowing you to manage your risk profile in today’s two-tier market.

“Whilst there are constraints in certain lines of business, the market overall is looking to grow and take the opportunity whilst it perceives the rating to be adequate,” says James. “By keeping the abovementioned lessons and tips in mind, risk managers can put themselves in a great position with insurers and maximize the desire for growth in those lines of business less challenged by the reinsurance renewals.”

To learn more about what happened at renewal for the property, casualty and specialty reinsurance markets, and a view of what it means for the future, download the full Reinsurance Market Dynamics report.

15%

or $100 billion, decline in global reinsurer capital over the year resulted in a total capital of US$575 billion at YE 2022.

Source: Aon’s latest Reinsurance Market Dynamics Report

General Disclaimer

The information contained herein and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Aon's Better Being Podcast

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Cyber Labs

Stay in the loop on today's most pressing cyber security matters.

Cyber Resilience

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Employee Wellbeing

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Environmental, Social and Governance Insights

Explore Aon's latest environmental social and governance (ESG) insights.

Q4 2023 Global Insurance Market Insights

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

Regional Results

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Human Capital Analytics

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Insights for HR

Explore our hand-picked insights for human resources professionals.

Workforce

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Mergers and Acquisitions

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

Navigating Volatility

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Parametric Insurance

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Property Risk Management

Our Property Risk Management collection gives you access to the latest insights from Aon's thought leaders to help organizations make better decisions. Explore our latest insights to learn how your organization can benefit from property risk management.

Technology

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Top 10 Global Risks

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Trade

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

Weather

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Workforce Resilience

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

More Like This

-

Article 24 mins

Capturing Carbon on the Critical Pathway to Net Zero

As the world races to reduce climate risks and limit CO<sub>2</sub> emissions, the demand for scalable and cost-effective decarbonization technologies is increasing. Carbon capture projects form an important part of the low carbon energy transition, bringing both challenges and opportunities.

-

Article 13 mins

Protecting North American Contractors from Extreme Heat Risks with Parametric

Growing extreme heat conditions have escalated risks, delays and costs for the construction industry in North America. Parametric insurance can help protect against such risks, offering contractors and building owners agility, efficiency and flexibility.

-

Article 21 mins

How Insurance Can Help Hedge Potential Exposures Under the New Unified Patent Court System

The launch of the Unified Patent Court allows for a new patent filing process across Europe using a centralized system. While this brings significant financial and operational benefits, navigating these changes will demand a robust litigation risk management strategy.