Wait! What just happened?

The COVID-19 crisis has created unprecedented challenges to the insurance industry. However, the pandemic has not stopped the flow of other risks and subsequent claims activities from burst pipes to the impacts of natural catastrophes. So, with social distancing restrictions in place, insurance companies are faced with effectively servicing customers remotely.

But as is ever the case throughout history, disruption can foster change that benefits both the customer and the business. In the claims space, insurers are now attempting to solve the problem of how to manage claims remotely to maintain or even enhance the level of service for customers.

So, in this environment who is thriving and how can you be one of them?

The initial issues that hit organizations, as they went from an office setting to staff remotely working, were typically driven by legacy technology and on-premise/on-network systems. This was not a challenge for firms that had already shifted to cloud-based solutions. As remote working is likely to be an increasingly large component of workforces going forward, this will be another trigger – in addition to efficiencies and cost savings – for IT departments to orientate towards cloud-based platforms and Software as a Service products. The ability for claims professionals to remotely view and estimate damage losses using ‘next-level’ virtual claims solutions is key to both surviving and thriving in the post-COVID world.

The fear factor around human contact has been as swift as it has been strong. So, it only makes sense that the way we manage claims must change to meet the prevailing social trends of post-COVID life.

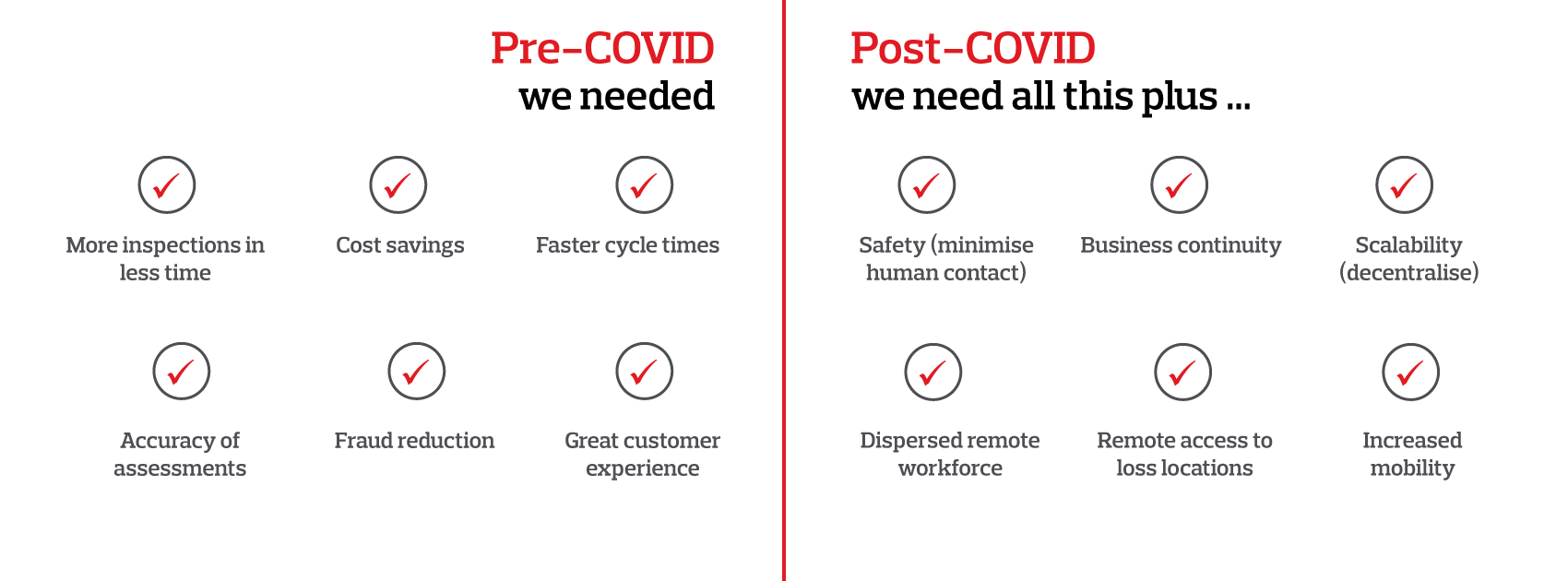

In the pre-COVID world, the embrace of remote claims inspections by insurers was luke-warm at best. While insurers saw the many benefits of moving to a remote assessing model, there was an inherent hesitancy to change the way ‘things have always been done’. The perceived need to visually inspect a loss, lack of process, technical training, key performance indicators and data to support these measures have been key barriers in the adoption of remote claims inspections.

Enter the pandemic: suddenly what was a ‘dip your toe in the water’ mentality has quickly transitioned to ‘dive in head first’. The need to keep policyholders’ claims moving while not flouting government regulations – and more importantly not spread infection – meant that insurers had little choice but to jump in and swim. Almost overnight, insurers have been forced to figure out how virtual inspections can be implemented in a manner that benefits their customers.

Virtual inspections

The new frontier of claims management

Virtual inspections are the logical manifestation – both during and after the pandemic – of the need for decentralization, with employees working remotely and productively by inspecting multiple losses virtually. Virtual inspections involve a remote desktop assessor connecting directly with a policyholder to inspect and assess their claim using live video streaming, meeting every insurer’s need to ensure the safety of customers and employees.

So, why in the post-COVID world, are virtual inspections so valuable?

Well, virtual inspections were already an extremely valuable tool – helping insurers to cut costs, reduce lifecycles, track fraud and more. COVID has simply exaggerated an existing market need for both decentralization and mobility.

The results: quicker and more efficient claims settlements

Claim Central’s virtual inspection technology has already helped both consumers and insurers during COVID by ramping up existing services and integrating live streaming technology into workflows across property claims.

Time to adapt: new ways of working

To facilitate these types of results and implement virtual adjusting capabilities, insurers need to focus beyond the technology. Operational processes, data models and KPIs – as part of a holistic approach – also need to be aligned for the technology to effectively meet the needs of the business.

Additionally, quality controls must be in place to ensure the accuracy of the estimates from the video technology, so that efficiency savings are not diluted by mistakes or 'leakage'. For example, there can be a difference of 10% to 30% in estimates from employees and independent adjusters, according to Aon Inpoint studies.

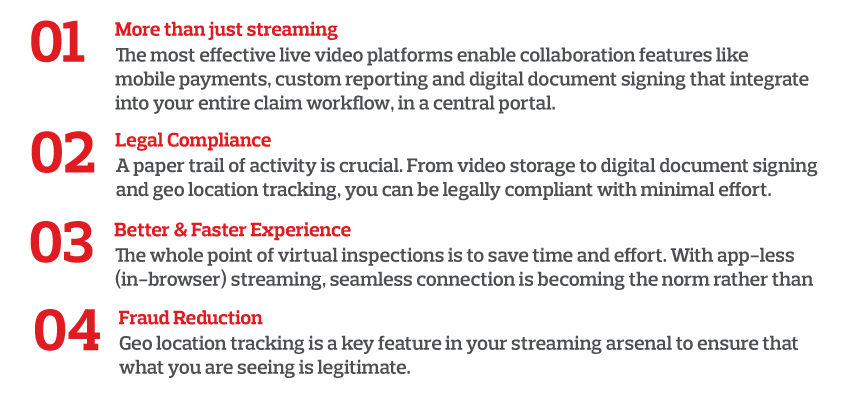

Your 4-point checklist for success

As a carrier looking to leverage this new technology, what should you look for in a virtual inspection solution?

About the Authors

Wes Williams is an account executive at Aon’s Reinsurance Solutions business where he provides risk, capital and operational advice to regional and coastal property insurers. He also represents various P&C insurers writing lines of business such as workers' compensation, general liability and automobile. Wes is a member of Aon’s MGA Solutions team and also focuses on various Aon InsurTech initiatives.

Mike Cummings is a principal consultant with Aon Inpoint Claims practice. He has over 25 years of experience in the insurance industry working in auto physical damage (APD), property, casualty, workers' compensation, litigation management, claims quality improvement, operations management, technology research and implementations. Most recently Mike has directed Aon Inpoint's research on InsurTech solutions for the P&C marketplace to enhance claims operations, customer service and communication. Mike leads the development of Aon Inpoint's software solution ClaimsMonitor.X (CMX). Mike graduated from Syracuse University, has an MBA from Babson College and holds the AIC insurance designation.

Brian Siemsen has been Global CEO of Claim Central Consolidated since 2002. Since then, Brian has built a business on his aspiration for the standard in claims management practices to be the intelligent use of insurance technologies and digital supply chain solutions, coupled with exceptionally talented people. Brian has successfully overseen the global expansion of Claim Central Consolidated into multiple geographies including Australia, the United States, South Africa and New Zealand – all the while driving the focus of the business towards technology solutions and data insights that provide continuous claims improvement for their clients. He has been instrumental in securing funding and undertaking key acquisitions to support the growth of the business.

A thought leader in the insurance and InsurTech industries, Brian has been a regular speaker and panel member of numerous events both in Australia and internationally. Among other awards, Brian was selected as Ernst & Young’s Young Entrepreneur of the Year in 2012 and was proud to oversee Claim Central Consolidated’s nomination at #8 in AFR’s Most Innovative Companies in Australia in 2016.

About Claim Central

Founded in 2002, Claim Central Consolidated is a global insurance industry leader across technology, adjusting and property repair.

With locations in the United States, Australia, South Africa, Italy and New Zealand, we have pioneered digitally connected claims management services across the globe and were recognized as the Australian Financial Review’s 8th Most Innovative Company in Australia in 2016.

Our solutions enable significant game-changing results for your business including:

- Improved quality of claims handling and day-to-day operations

- Reduced claim lifecycles

- Better customer claim experiences

- Reduced claim costs

About the partnership

Aon plc and global InsurTech firm Claim Central have established a strategic alliance focused on digitizing and streamlining claim management capabilities and enhancing the customer experience using transformative technology and services developed specifically for property and casualty (P&C) insurance organizations.