The rise of operational losses from cyber attacks: Four steps to upgrading your BCM for Cyber Risk

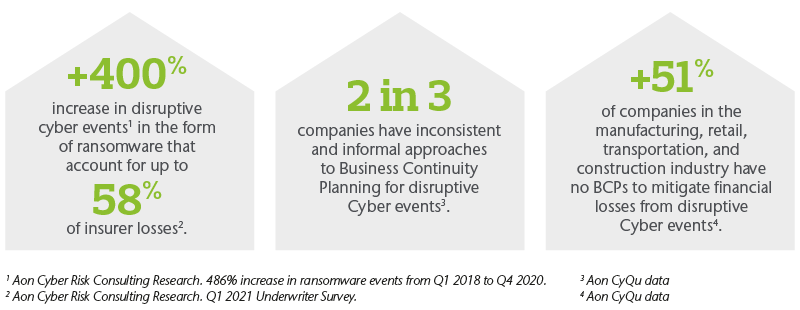

Two in three companies have yet to upgrade their ‘analogue’ Business Continuity Management (BCM) strategies to meet the challenges of the new digital environment and increasing threat from ransomware attack.

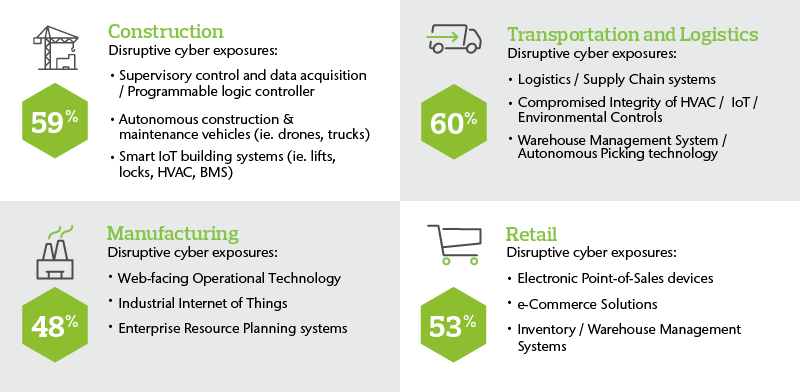

Accelerated digital transformation and the adoption of ‘Industrial Internet of Things’ (IIoT) has exposed more business processes, operational technology assets, and supply chains to a variety of disruptive cyber events. As this transformative journey continues, it is now vital that financial exposures to disruptive cyber events are addressed as a priority within business continuity planning.

Emerging cyber threat

However, as organisations continue to invest in connecting more of their business to the web, not all companies have upgraded their legacy BCM plans and processes to mitigate the increased cyber threat - and the operational and reputational losses that could result.

Our research has identified that two in three companies have poorly defined strategies for disruptive cyber events in their legacy plans—and more concerning—the majority of companies across the manufacturing, retail, transportation and construction industries have no plans to mitigate financial losses from disruptive cyber events.

Increase in ransomware claims

Threat Actors are upping their game and exploiting critical dependencies to digital technologies. Tracing the exponential trajectory of digital transformation investment, ransomware claims have increased by over 400% since 2018 and disruptive cyber events are contributing to 58% of insurer losses. These ransomware attacks are now resulting in losses that can exceed $100m.

Evolving landscapes

As the threat landscape continues to evolve resulting in disruptive impacts to many businesses, insurance carriers are scrutinising the appropriateness of BCP to manage cyber risk when underwriting cyber insurance policies.

We have seen over 60% of Insurers now listing Business Continuity Plans for Cyber Risk as one of the most critical topics in the determination of insurance policy pricing, capacity, and coverage. As claims continue to increase and the insurance market continues to harden, having formal BCPs for Cyber Risk will be a determining factor in how successful companies are in procuring competitive cyber insurance policies.

How ‘Cyber Ready’ is your BCM?

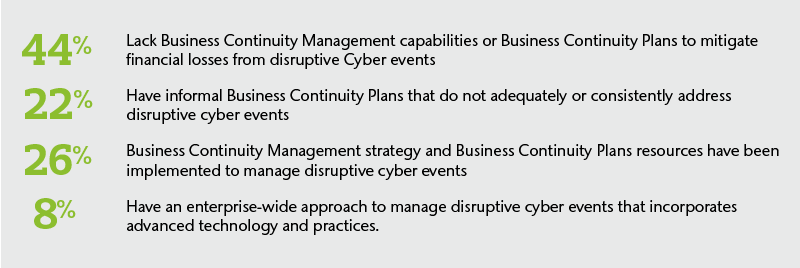

The Business Continuity Plans of two out of three companies are not ‘Cyber Ready’ for the challenges of the new digital economy or emerging disruptive cyber events.

The majority of manufacturing, retail, transportation and construction companies have the least ‘Cyber Ready’ approach to Business Continuity

Four steps to ‘upgrade’ your BCM strategy for Cyber Risk

As the technology and threat landscape continues to evolve, it is important that legacy BCM strategies are ‘upgraded’ to effectively mitigate financial loss and operational disruption to mission-critical business activities.

Aon has identified four critical activities that could ensure your Business Continuity Management Strategies and Plans (BCPs) are aligned with business activities, critical technology assets and third party services.

- Diagnose

Determine current readiness and maturity of the legacy Business Continuity Management strategy considers critical technology dependency and disruptive cyber threats.

- Planning

Build Business Continuity Plans to explicitly address disruptive cyber risk scenarios to critical technology dependencies (internal systems and third party services).

- Testing

Run tabletop exercises or full simulation exercises that contemplate disruptive cyber events to test the level of internal awareness and identify gaps in management strategies.

- Governance

Develop an appropriate governance structure for the cyber-focused BCM strategy and BCPs to ensure these arrangements remain continuously tested and aligned with changes to the business model, technology infrastructure, and risk profile.

Find out more about how Aon can support you to ‘upgrade’ your BCM strategy for Cyber Risk here.

To download a PDF version of this article, click here.

Statistics highlighted have been extracted from Aon’s proprietary analytics Cyber Quotient Evaluation (CyQu) platform 2020/2021.

This article constitutes information only and is not intended to provide advice. Professional advice should always be sought regarding insurance coverage or specific risk issues.