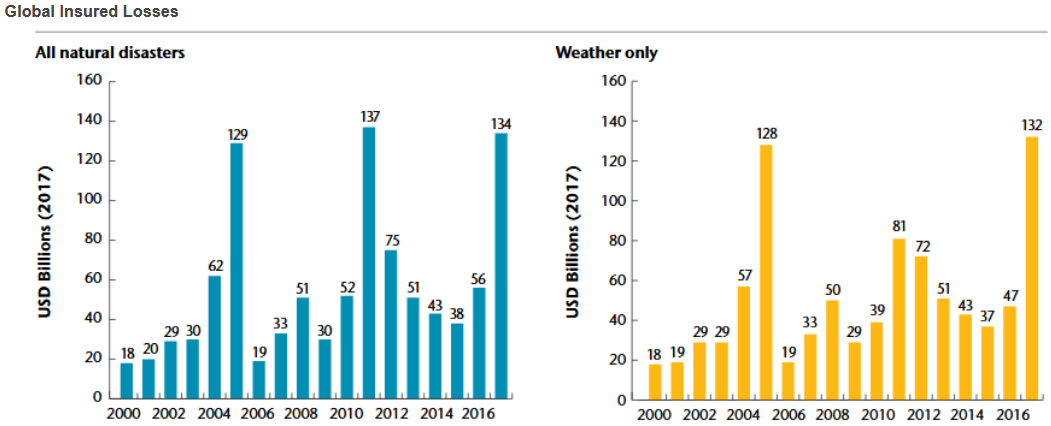

When insurers hear ‘weather’ they typically think ‘catastrophe.’ Aon calculates that weather-related natural catastrophes were 97% of economic losses and 99% of insured losses globally in 2017 – the costliest year for weather-related losses in history. While some events may be over in a day or two, their physical impacts linger for months or years, causing a chain-reaction to the commercial sector all around the globe, what the Financial Stability Board’s Taskforce on Climate Related Financial Disclosures (TCFD) calls ‘acute’ climate risks. What about longer-lasting weather patterns that affect a wide geographic area with extreme temperatures or abnormal periods of precipitation (either a surplus or a deficit)? These so-called ‘chronic’ climate risks are a growing challenge for businesses and societies, yet the majority of the resultant economic losses are not measured and few of them are insured. Aon’s own Weather, Climate, and Catastrophe Insight report highlights that the sixth biggest economic loss and eight largest insured loss of 2017 was a drought event. Managing these risks requires a better understanding of their impact to drive demand for insurance protection.

Ratings Agencies Assess Materiality

In a first-of-its-kind study, S&P Global Ratings analysed the impact of weather on corporate earnings. Looking at the S&P 500 index in the US, the study found that 15% of companies reported earnings impact from weather, but only 4% of companies quantified the impact . Of the companies that did quantify the impact, the materiality on earnings was, at 6%, significant.

S&P found these disclosures were being made by CEOs themselves, suggesting a disconnect between the management of climate risk and a broader risk management strategy. If climate risk disclosure becomes a regulatory or investor imperative, it is likely there will be increasing scrutiny on the materiality of weather volatility.

Some Industries Are More Exposed Than Others

Not surprisingly, some industries have greater exposure to chronic climate risk and weather volatility. In a recent report for the European Bank for Reconstruction and Development (EBRD) on physical climate risks, climate analytics firm 427 Climate Solutions looks at the sensitivity of various industries to four chronic climate risks: extreme heat, variability in precipitation (excluding flood), variability in temperature, and water stress. Eight industries show significant sensitivity to these weather conditions: consumer discretionary, consumer staples, energy, health care, industrials, informational technology, materials, and utilities. These industries align closely with those examined in the S&P study, with consumer discretionary, consumer staples, and industrials receiving the closest scrutiny from investors. Addressing chronic climate risks and weather volatility needs to be targeted and strategic.

From Derivatives to Insurance

Weather risks outside of large scale acute catastrophes have typically been thought of as a high-probability/low-impact events best managed by supply chain diversification, strategic risk retention, and the derivatives market. Weather derivatives date to 1996 but have not been used extensively outside the energy and agriculture sectors. Insurance-like in their structure, weather derivatives are index-based and require no proof of loss. There are an increasing number of parametric insurance products linked to weather, which mimic many of the feature of weather derivatives. The availability of products and capital is very much linked to regulatory conditions in different territories. Nonetheless, many of the players in the weather derivatives market are also players in the parametric weather insurance market. Aon currently sees access to $1.4bn in insurance capacity from traditional and alternative markets for such weather risk.

A Capital Efficiency Gap

Similar to the mismatch between exposure to natural hazards and availability of insurance, the ‘insurance protection gap’, we have another situation where there is ample capital, a recognised challenge, and a changing regulatory dialogue. Findings show that 88% of companies’ profitability is impacted by the weather. Climate change, for example, is increasing this weather-related volatility and there are existing solutions for protecting balance sheet impacts stemming from chronic weather and climate risk. The question arises then why aren’t businesses using capital more efficiently to address these risks?

When risks are not transparent or well understood, they tend to be ignored. Past experience often informs decision-making, but as the insurance industry knows all too well, past experience does not equate to future outcomes. As investors begin to delve into the topic of climate risk and the move to disclose these risks grows, this capital-efficiency gap will require a plug. As S&P highlights, few companies can quantify the impact, but analytics and risk management expertise can bridge that gap.

Climate and Weather Analytics: A Two Prong Approach

Expanding the demand for weather insurance requires an understanding of the macro-picture. Traditional insurance analytics look at a current state of risk and are focused on acute weather events. As awareness of climate risk grows, there are several emerging climate analytics firms that aim to quantify the impact of a range of long-term climate impacts, include chronic weather volatility.

If businesses start considering these longer-term impacts, they will see where the balance sheet gaps begin to emerge. For instance, if extreme heat was currently immaterial from an earnings perspective for an airline, but climate analytics could show that would increase over time with specific thresholds, an appropriate mitigation strategy, including risk transfer, could be developed for the airline. Risk consultants and brokers could work with the insurance market to identify trends in client demand over time so that ample capacity is available as the risk evolves.

When looking at how current weather volatility is priced, the industry has an arsenal of different data and analytics providers. For example, Aon has been collaborating with CelsiusPro to help streamline the process of measuring and pricing weather risk through data and analytics.

Growing Demand

Investors and regulators are providing the landscape for demand, with data and analytics facilitating the strategy and decision-making. Yet there is still the need for further education for the market. Buyers of insurance are often unfamiliar with derivatives and alternative risk transfer products. The entire industry needs to offer clear guidance on how these products work. Closing a capital efficiency gap is about using the right tool for the given efficiency frontier of company’s risk appetite.

Chronic climate risk is the creeping change in weather patterns that cumulatively add up and impact financial performance. It is frequently described as ‘death by one thousand cuts’. Unless these risks are quantified, and the products are well-understood by buyers and wider financial markets, demand will not be adequate. Ratings agencies are making it clear: these risks have material impacts. The opportunities for the industry to grow available capital for the weather insurance market are ripe; with the right supporting infrastructure and with the landscape quickly evolving, competition is likely to grow.

About the Author

Greg Lowe is Global Head of Resilience and Sustainability at Aon plc, the leading provider of risk, retirement, and health solutions. Greg also heads Aon’s Weather and Climate Risk Innovation platform that brings together industry leading capabilities in alternative risk transfer to non-traditional climate risks. Strategically responding to the capital efficiency gap and climate finance needs, Greg leads dialogues with clients, investors, and regulators on climate risk disclosure, urban resilience, financial institution exposure to physical risk, and lowering the cost of capital for the energy transition. Partnering with start-ups, he’s collaborated with organisations as varied as the United Nations, OECD, and Urban Land Institute. He is also responsible for Aon’s strategy on addressing its own environmental impacts. Prior to working at Aon, Greg was an Executive Director at Willis Towers Watson, having begun his career in investment banking at UBS. Greg holds and MSc in Environment and Development from the London School of Economics and a BA in Political Science from the University of Maryland Baltimore County.