Podcast 34 mins

On Aon’s Better Being Series: The World Wellbeing Movement

While companies are increasingly investing in the security of their technology, systems and data, cyber risks continue to proliferate. Cyber-security vulnerabilities can threaten business continuity and cost organizations millions of dollars per incident: the global average cost of a data breach was $4.35 million in 2022. In addition to external dangers such as ransomware and phishing attacks, insider cyber threats are raising the threat level for businesses across sectors. Research shows that while leaders understand the importance of cyber security, many CEOs struggle to make decisions in this area.

What can leaders do to not only build their organizations’ cyber security but also strengthen their cyber resilience? Aon’s 2023 Cyber Resilience Report collected data from more than 2,000 clients to explore how businesses around the world are managing a rise in cyber risks, where organizations are making gains and which actions could help them prepare to face future cyber security challenges.

Aon’s Cyber Resilience Report found that businesses overall have increased their cyber-security budgets from 2020 levels, with improvements in data security, application security, remote work, access control and endpoint and systems security. The insurance market could be a driver in the move toward greater cyber health, because cautions from insurers have motivated businesses to implement more stringent cyber security controls. Though certain threats — such as vulnerability to inside attacks, reputation risk relating to a cyber incident and insufficient backup security for critical company data — persist, some industries appear to be making notable progress in improving their stance on cyber.

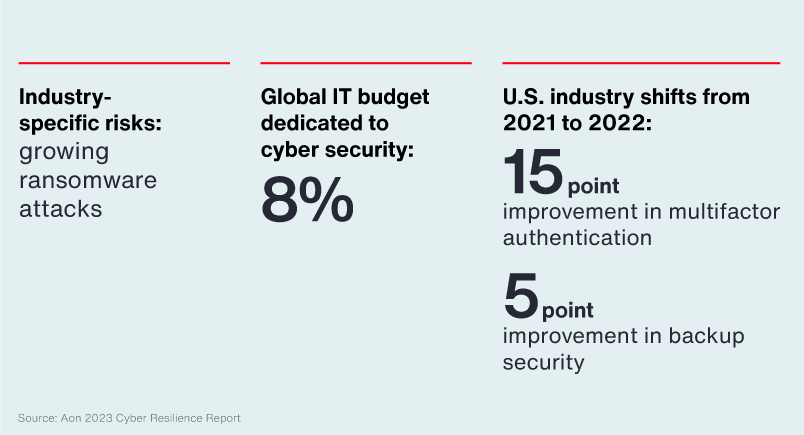

The finance and insurance sector show gains in cyber readiness in 2022, with small and midsize companies moving beyond a basic level of cyber maturity. Clients in this industry also indicated that they have increased their cyber security spend from 2021 levels, with 8 percent of their IT budgets devoted to this area last year. The use of multifactor authentication (MFA), a valuable security protection for financial data, also appears to have increased in 2022; in the U.S., deployment of MFA controls rose to 80 percent from 65 percent in 2021.

However, the finance and insurance sectors still face challenges in cyber resilience. With more customers turning to mobile banking and new forms of digital payment, the growing fintech sector is vulnerable to data breaches, malware and ransomware. And ransomware isn’t only a threat to fintech providers: the finance and insurance industry as a whole reported a 38 percent increase in ransomware claims from fourth quarter 2022 to first quarter 2023.

Preparing for ransomware attacks is just one of the actions the finance and insurance sector can take to build cyber resilience. Optimizing cyber insurance, mapping and managing third-party risks, and running a patch management program are also important steps in the journey to stronger cyber security. Finance and insurance businesses in Europe will also need to prioritize meeting the standards of the Digital Operation Resilience Act (DORA) in the next two years.

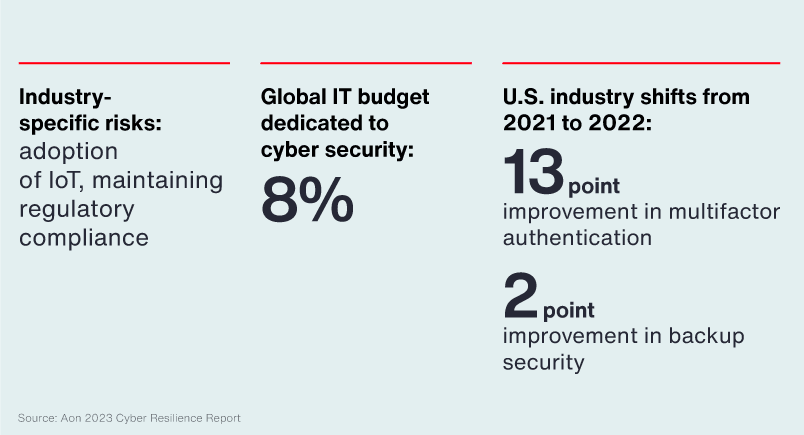

The healthcare industry faces unique cyber-security challenges, complicating the industry’s path to cyber maturity. The need to protect sensitive patient data, an industry-wide IT talent gap, potential liabilities related to regulatory compliance and a move to new technology rooted in the Internet of Things (IoT) are all critical considerations for healthcare companies. In this industry, cyber attacks are not only disruptive and costly — they can also lead to harmful or life-threatening outcomes for patients.

Like the finance and insurance sector, the healthcare industry devoted 8 percent of IT budgets to security in 2022. But the threat of ransomware looms large in healthcare as well: Aon’s Cyber Resilience Report found that while U.S. healthcare companies made notable improvements in protective strategies such as multifactor authentication, U.K. and EMEA healthcare companies lacked 41 percent of critical MFA controls.

To mitigate the risk of ransomware and other cyber threats, the healthcare industry can develop a better understanding of its cyber-security exposures. Building cyber resilience through collaboration with internal enterprise operations emergency centers can also strengthen cyber maturity across a healthcare organization. Improving the relationship between business continuity planning and incident response preparedness can contribute to greater alignment in cyber strategy as well. In Europe, the healthcare industry will also need to follow the new Network and Information Security (NIS2) Directive or face potential fines for noncompliance.

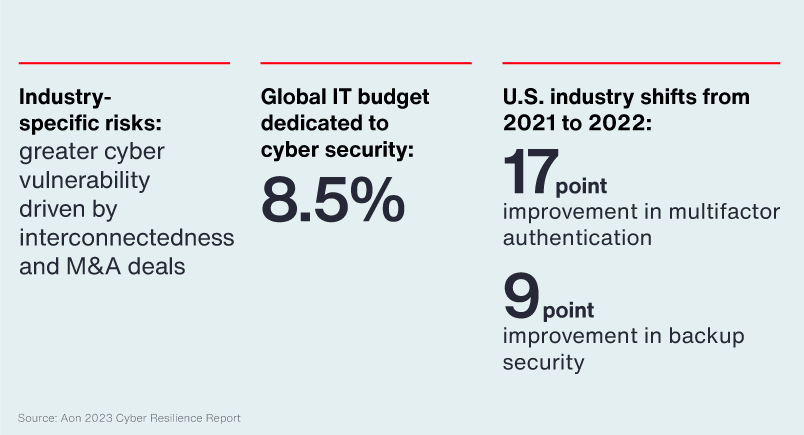

Manufacturing relies on networks of partners of varying sizes and capabilities, and the interconnectedness of the industry expands the footprint for cyber risk. A severe cyber incident has the potential to disrupt the supply chain, and the many smaller companies in the manufacturing ecosystem may have fewer resources to combat a cyber attack. Vulnerabilities in industrial IoT and the lingering effects of COVID-19-era pressures add to the challenges in building cyber resilience in manufacturing.

The industry is making strides in cyber maturity, however. Outpacing finance and insurance and healthcare, manufacturing companies allocated 8.5 percent of their IT budgets to cyber security in 2022. Though manufacturing still has room to grow in terms of cyber health, U.S. and U.K. manufacturers surpass other sectors in operational technology.

As in other industries, cyber resilience in manufacturing begins with understanding and managing risk. Focusing on response and recovery strategies and segmenting systems — including a separation of IT and operational technology to minimize in-network threats — could help to build a stronger cyber risk profile. Manufacturers in Europe must also turn their attention to regulatory compliance, upholding the standards outlined by the European Union Agency for Cybersecurity; U.S. manufacturers will need to comply with guidelines set by the National Institute of Standards and Technology.

To build cyber resilience, business leaders can consider a holistic approach. IT, finance, HR, risk and other departments are all susceptible to cyber attacks, and all departments can benefit from improvements in cyber strategy. The Aon Cyber Resilience Report identifies steps businesses in any industry can take as they progress toward greater cyber maturity:

Cyber Disclaimer

Insurance products and services are offered by Aon Risk Insurance Services West, Inc., Aon Risk Services Central, Inc., Aon Risk Services Northeast, Inc., Aon Risk Services Southwest, Inc., and Aon Risk Services, Inc. of Florida, and their licensed affiliates. The information contained herein and the statements expressed are of a general nature, not intended to address the circumstances of any particular individual or entity and provided for informational purposes only. The information does not replace the advice of legal counsel or a cyber insurance professional and should not be relied upon for any such purpose. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future.

General Disclaimer

This document is not intended to address any specific situation or to provide legal, regulatory, financial, or other advice. While care has been taken in the production of this document, Aon does not warrant, represent or guarantee the accuracy, adequacy, completeness or fitness for any purpose of the document or any part of it and can accept no liability for any loss incurred in any way by any person who may rely on it. Any recipient shall be responsible for the use to which it puts this document. This document has been compiled using information available to us up to its date of publication and is subject to any qualifications made in the document.

Terms of Use

The contents herein may not be reproduced, reused, reprinted or redistributed without the expressed written consent of Aon, unless otherwise authorized by Aon. To use information contained herein, please write to our team.

Our Better Being podcast series, hosted by Aon Chief Wellbeing Officer Rachel Fellowes, explores wellbeing strategies and resilience. This season we cover human sustainability, kindness in the workplace, how to measure wellbeing, managing grief and more.

Stay in the loop on today's most pressing cyber security matters.

Our Cyber Resilience collection gives you access to Aon’s latest insights on the evolving landscape of cyber threats and risk mitigation measures. Reach out to our experts to discuss how to make the right decisions to strengthen your organization’s cyber resilience.

Our Employee Wellbeing collection gives you access to the latest insights from Aon's human capital team. You can also reach out to the team at any time for assistance with your employee wellbeing needs.

Explore Aon's latest environmental social and governance (ESG) insights.

Our Global Insurance Market Insights highlight insurance market trends across pricing, capacity, underwriting, limits, deductibles and coverages.

How do the top risks on business leaders’ minds differ by region and how can these risks be mitigated? Explore the regional results to learn more.

Our Human Capital Analytics collection gives you access to the latest insights from Aon's human capital team. Contact us to learn how Aon’s analytics capabilities helps organizations make better workforce decisions.

Explore our hand-picked insights for human resources professionals.

Our Workforce Collection provides access to the latest insights from Aon’s Human Capital team on topics ranging from health and benefits, retirement and talent practices. You can reach out to our team at any time to learn how we can help address emerging workforce challenges.

Our Mergers and Acquisitions (M&A) collection gives you access to the latest insights from Aon's thought leaders to help dealmakers make better decisions. Explore our latest insights and reach out to the team at any time for assistance with transaction challenges and opportunities.

How do businesses navigate their way through new forms of volatility and make decisions that protect and grow their organizations?

Our Parametric Insurance Collection provides ways your organization can benefit from this simple, straightforward and fast-paying risk transfer solution. Reach out to learn how we can help you make better decisions to manage your catastrophe exposures and near-term volatility.

Our Property Risk Management collection gives you access to the latest insights from Aon's thought leaders to help organizations make better decisions. Explore our latest insights to learn how your organization can benefit from property risk management.

Our Technology Collection provides access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities of technology. Reach out to the team to learn how we can help you use technology to make better decisions for the future.

Trade, technology, weather and workforce stability are the central forces in today’s risk landscape.

Our Trade Collection gives you access to the latest insights from Aon's thought leaders on navigating the evolving risks and opportunities for international business. Reach out to our team to understand how to make better decisions around macro trends and why they matter to businesses.

With a changing climate, organizations in all sectors will need to protect their people and physical assets, reduce their carbon footprint, and invest in new solutions to thrive. Our Weather Collection provides you with critical insights to be prepared.

Our Workforce Resilience collection gives you access to the latest insights from Aon's Human Capital team. You can reach out to the team at any time for questions about how we can assess gaps and help build a more resilience workforce.

Article 7 mins

Macrotrends are transforming our world and creating emerging property-casualty exposures, which will have profound implications for the insurance industry.

Article 13 mins

Understanding market trends and future projections in an evolving cyber insurance market is paramount to strengthening risk mitigation and transfer strategies.

Article 10 mins

In an era of escalating climate-related challenges, the construction industry is turning to advanced climate modeling to fortify its risk management strategies.