Dollars and Sense

The Benefits of Providing Your Staff with

Financial Education

Doug Webber

Principal,

Head - Financial Advisory Services,

Aon Hewitt

Many employees only ever receive role-specific training and

support in the workplace. They are taught how to be better

at their job, but this rarely branches out to cover other

lifestyle factors that might be affecting their performance

at work.

Employee's financial knowledge is one of these areas,

as staff who are worried about money aren't likely to be

optimally focused on their daily tasks. As organizations

begin to take a more holistic approach to employee

benefits, many are looking at providing financial

education as a component of broader wellness initiatives.

Companies that can implement lifestyle benefits such

as financial education are more likely to have engaged,

committed staff that are comfortable with the different

challenges they encounter at work. Aon Hewitt's Best

Employers are proof of how Australian and New Zealand

companies are better engaging their workers by investing

in them and their skills oth inside and outside of

the workplace.

Why Offer Staff Financial Education?

The link between financial education and organizational

performance may seem remote, but there are a number of

key advantages that come from providing this benefit to staff.

After all, finance is one of the biggest areas that can

cause stress in an employee's life and in many cases,

negatively influence their day-to-day work.

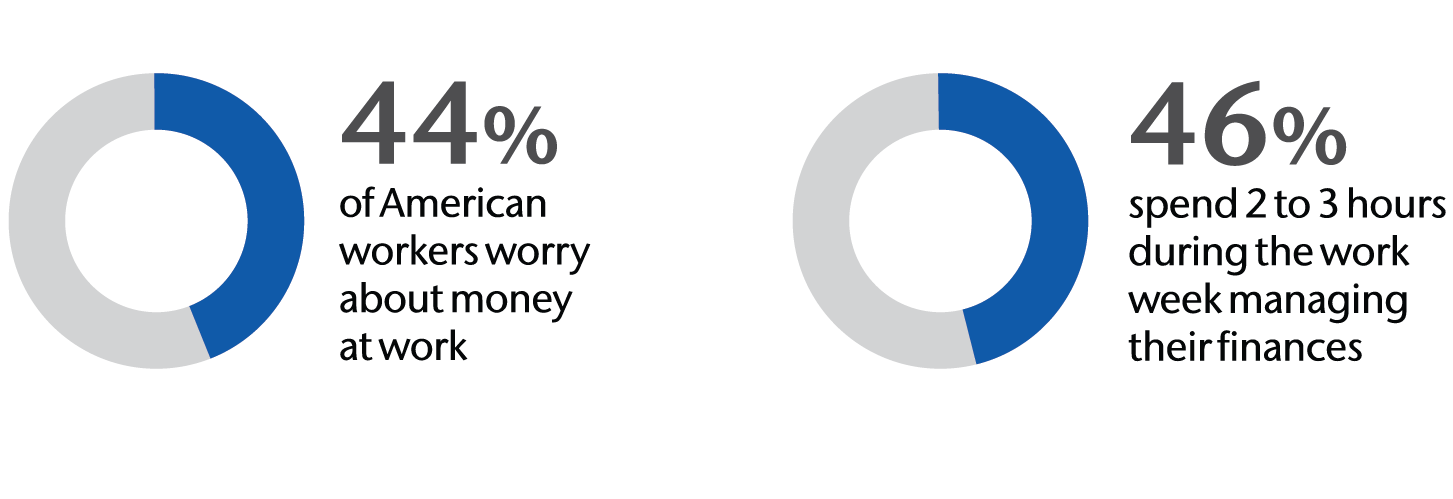

In fact, a 2013 Harris Poll conducted for Purchasing

Power, found that 44% of American workers are worrying

about money at work, while 46% are spending two

to three hours during the work week managing

their finances.

Staff who have the knowledge to manage their

finances outside of work effectively are likely to have

much lower rates of stress and will thus be more likely to

perform at their best when they do come into the office.

What are the Business Benefits of a

Financially-fit Workforce?

While helping employees to manage their finances is an

easy way to reduce stress and help employees achieve

better outcomes in their personal lives, there are certainly

other reasons why number-savvy staff can help build

a better business. Here are a couple of the biggest

advantages:

Building a better compensation package: With

employee wage growth less certain now than it has

been in the past, it's important for employers to think

about the full range of benefits and opportunities

they can offer to staff. Financial education can act as a

complement to the salary, helping staff to manage their

existing wage better and thus develop a better

perception of their overall pay package Stronger employee retention: Workers aren't just

looking for a job that pays the bills, so companies

need to create a benefits package that can keep

their staff engaged and interested in their work.

Up-skilling opportunities like financial education

demonstrate care and - particularly when coupled

with other well-being initiatives - can play a key

role in attracting and retaining quality talent

Building a comprehensive financial education program

within your business has clear benefits, both for

employees and the company, as a whole. As businesses

look to boost employee well-being both in the office and

in their spare time, financial education is a great way to

build this focus, so that both you and your employees can

reap the benefits.

|