Pharmaceutical Industry: Finger on the Pulse

aggressive at junior management (field sales level), the

multinational and Indian companies converge across all

other management levels.

B) Pronounced Functional Premiums and

Pay Strategy

The industry has seen a more pronounced functional pay

strategy evolve. The functions can be clustered into four

types mentioned below n the basis of similar talent and

work patterns.

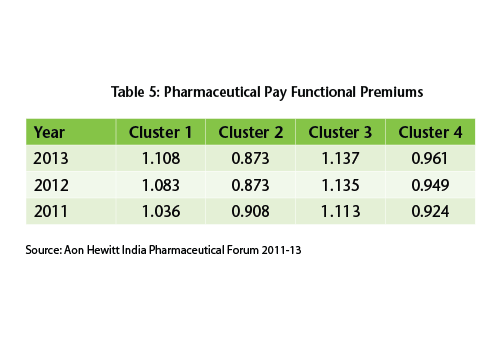

These functional clusters have seen a clear pay

differentiation strategy evolve. As tabled below -

the transition from 2011 to 2013 shows a sharper

differentiation across functional clusters. Cluster 3 and 1

emerge as the functions with premium - Cluster 3 which

has all the corporate functions is high on premium

as most pharma companies are increasingly looking

at other sectors like FMCG, banks, telecom, IT to get

talent for support positions; Cluster 1 which has all

the R&D and related functions has seen a major talent

war within the sector as R&D budgets for most Indian

companies have seen a year-on-year growth of 20-40%.

These functional clusters have seen a clear pay

differentiation strategy evolve. As tabled below -

the transition from 2011 to 2013 shows a sharper

differentiation across functional clusters. Cluster 3 and 1

emerge as the functions with premium - Cluster 3 which

has all the corporate functions is high on premium

as most pharma companies are increasingly looking

at other sectors like FMCG, banks, telecom, IT to get

talent for support positions; Cluster 1 which has all

the R&D and related functions has seen a major talent

war within the sector as R&D budgets for most Indian

companies have seen a year-on-year growth of 20-40%.

Cluster 2 - manufacturing and associated functions

are very region-specific and thereby the compensation is

usually driven by the region and its endemic talent pool.

This has historically been a function with the highest

discount with respect to compensation and continues

to be so. Cluster 4, the sales force makes up for the

majority of the workforce, especially at the junior levels,

and this cluster has been observed to be the one nearest

to the level median.

C) Client Considerations

C) Client Considerations

Aon Hewitt interviewed some of the notable C&B

professionals of pharmaceutical companies, to understand

their thoughts around rewards and the overall business.

We have summarized some of the extracts, based on

our discussion:

-

Some of the organizations have adopted a "wait and

watch approach", i.e. while they are optimistic about

the future prospects, they would exercise some bit of

caution given the larger economic sentiment. They

are aligning their existing strategies to cater to the

immense growth opportunities, while they are

keeping an eye on costs as well

-

"Do more with less" is the key message across the

board. Having said that, priorities continue to be

investment in the form of rewards initiatives

(compensation benchmarking, benefits, internal pay

ranges, etc.) such that rewards programs keep fueling

business transformation

-

More transparency and manager involvement: While

earlier all strategic discussions were limited to

boardrooms, there has been an increasing involvement

of managers in the decision-making process. This has

led to increased sense of ownership and accountability

in the minds of the employees with respect to

rewards programs

Buoyed by strong growth drivers, the Indian pharma

industry is all set for an exciting journey going forward.

Now with a stable government at the helm, its growth

story seems more sound and sustainable.

|