For people not very familiar with the acronym accentuated world of financial services, there sometimes stems a confusion when they are confronted with BFSI. Believe it or not, many people still elongate the grandiose sounding abbreviation to read as 'Banking and Financial Services Industry'. And that's not the correct one. BFSI routinely (and supported by Wikipedia) stands for Banking, Financial Services and Insurance. There have been enough and more reasons and logic for insurance to be kept slightly separate from the more traditional financial services as the unique nuances of this sector range from the obvious to the not-so-ordinary.

The Life Insurance (LI) space in India has followed a divergent trend from the rest of the BFSI sector, in the last decade or so. While the economic crisis devoured the larger financial sector like a giant tsunami, LI hung on like a stoic survivor only to eventually grapple with its own demons, and as a result, today is in the midst of a challenging environment. not surprisingly, the talent and rewards implications for this sector remain quite unique and inimitable, and it's interesting to see how they have shaped up as the industry has evolved.

The genesis of this article is to trace out the travels, travails, trials and tribulations of the LI industry in India as it carves its own niche in the dynamic BFSI space, and more importantly, how that has impacted the human capital that it engaged over the years.

The Millennium Child

The insurance industry in India has come a long way since the time when the sector was tightly controlled, with LIC clearly ruling the roost. With the introduction of the 1999 IRDA Act, the industry opened up and it led to the birth of the private LI industry in India. Between 2000 to 2002, was the golden era; LI in India was booming and the success stories of the newly formed private LI companies encouraged many other insurance firms to follow suit and commence business in India. Today, there are 23 private LI companies operating in India, as a result of that unprecedented growth.

Companies witnessed a dream run in the first decade of this century. Both on account of new Business Premium (nBP) and Gross Written Premium (GWP), numbers grew rapidly till 2010, notwithstanding the financial crisis that had engulfed the rest of the sector. This rampant growth obviously had a huge impact on the talent space. Till 2010, amongst all Financial Institutions (FI), LI in terms of pure headcount growth was one of the leaders. While most FIs (such as banks, investment banks, broking firms) were still recovering from the economic downturn, LI in India seemed to be rallying. The sector was hiring talent from banks, nBFCs and other allied industries such as FMCG and life sciences and giving them impressive year-on-year salary increases and bonuses.

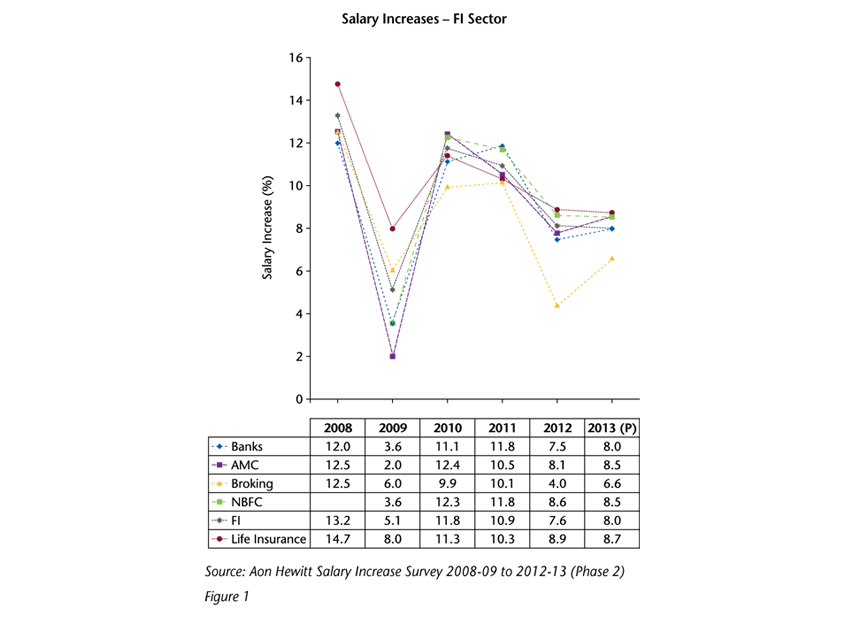

As can be seen in the below graph, while the FI sector had shrunk its salary increase numbers in line with the slump in business, LI had still managed decent increases in 2009 and beyond (the best amongst FIs).

Growth Pangs Set In

The party of a rollicking childhood eventually ended as the end of the first decade approached. And this was less to do with market realities or cyclical pressures than the

The human capital base that had grown in proportion to the growth in business premiums, is now coming to terms with the not so rosy scenario that confronts the LI sector today.

intrinsic way in which the sector had continued to operate in. With a focus on top line and rampant expansion, most LI companies continued to grow GWP and nBP by focusing on short-term investment products (not the core long-term savings products sold traditionally). Hiring, sales incentivization (which often led to mis-selling), branch expansion, and business models helped the industry grow rapidly both on account of nBP and GWP. However, given the skewed focus on short-term aggressive products and the inefficiencies that crept in the sales and operating model, the sector soon found itself struggling with high costs and less than modest levels of profitability, which to date has accentuated to a problem of gargantuan proportions. The regulatory body had no choice but to step on the pedal, and strictly review the business models as well as to manage consumer interests which had no doubt taken a beating given the lop sided growth of the industry.

However, against the backdrop of regulatory changes which started in 2010, the growth momentum slowed considerably. In 2011-12, many LI companies reported negative yOy growth of GWP. Private sector insurers posted a 4.52% decline (11.08% growth in the previous year) in their premium income. First year premium also registered a decline of 9.85% in comparison to growth of 15.02% during 2010-11. While there are many theories which support that the drop in GWP is due to a change in regulatory norms, changes in product mix and the strategy of the company, the subdued business sentiment also had a significant impact on the business, unlike earlier. And the human capital base that had grown in proportion to the growth in business premiums (and more so in line with the optimism and ambitions that had rallied the sector), is now coming to terms with the not so rosy scenario that confronts the LI sector today.

Cutting the Flab as Age Catches Up

Amongst FIs, after banks, LI companies are the largest employers in terms of headcount. Till 2010, most LI companies grew rapidly in terms of manpower. More was

The Aon Hewitt Salary Increase Survey reveals that insurance along with banking is one of the most volatile industries in terms of average salary increases over the last few years.

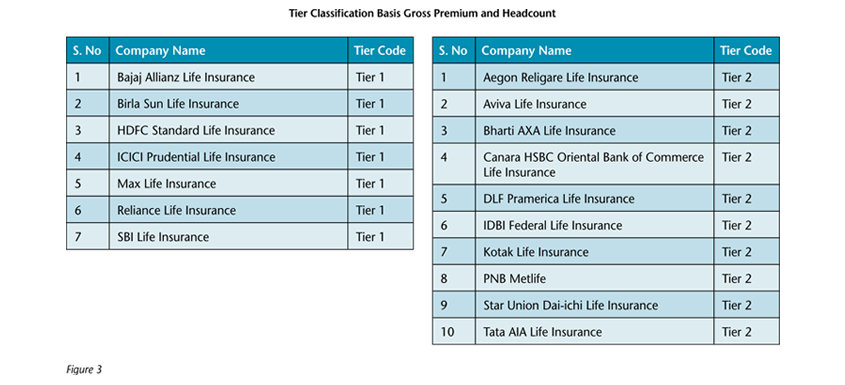

good and hiring was done to feed the optimism and fervor that had gripped the sector. The agency channel was driving this headcount growth to a large extent. All of this began to change post 2010, as organizational health and financial concerns prompted companies to take a hard look at their burgeoning size, and take corrective action. Over the last three years, many LI companies have significantly reduced their overall headcount. In the year 2012, organizations which systematically optimized headcount, reduced their overall numbers on an average by 15%. This trend is observed across both tier 1 and tier 2 companies (McLagan Aon Hewitt defines tier basis the gross premium and headcount. The cut-off for tier 1 company is gross premium of 5,000 crores or above and headcount greater than 7,000).

To ensure that the reduction in headcount does not impact business, many organizations have already invested or are currently investing in sharpening their technology platform. Technology-led business transformation initiatives are expected to drive efficiencies and business growth. Outsourcing is also emerging as a key trend. Companies are not only looking at outsourcing traditional shared resources and operations roles such as admin, F&A, IT ,HR, customer service and central operations but are also open to outsourcing sales roles (sale through the alternate channel).

Styling Suitable Structures

Interestingly, the dynamics of the LI industry has led to many changes in how organizations structure themselves. Till 2010, the Chief Distribution Officer (CDO) was a key role in most organizations; however, this role seems to be diminishing. Due to increased pressure on sales and margins, CEOs today are actively involved in sales. As a result of this, in many organizations the various heads of channels of distribution report directly to the CEO. Amongst the 17 organizations that participated in the McLagan Aon Hewitt LI Survey, only five have a CDO today.

Another significant change that we observe at the top level is that the Head of Finance or the Chief Financial Officer (CFO) in many cases is taking up senior level roles in sales, operations (claims and underwriting) and even actuary. Possible reasons could be that organizations today are often not looking at replacement hiring very quickly, and use this opportunity to give a wider span to top management. Another factor could be that since the LI companies are facing challenges in meeting the business numbers, an in-depth understanding of finance is an added advantage.

Austerity Measures to Manage Compensation Better

The Aon Hewitt Salary Increase Survey reveals that insurance along with banking is one of the most volatile industries in terms of average salary increases over the last few years. The survey mentions that over the last three years, the LI industry has witnessed a dip in the actual merit based salary increase in 2012-13. At 8.9%, which is by no means low, the numbers have gradually dropped over the last few years.

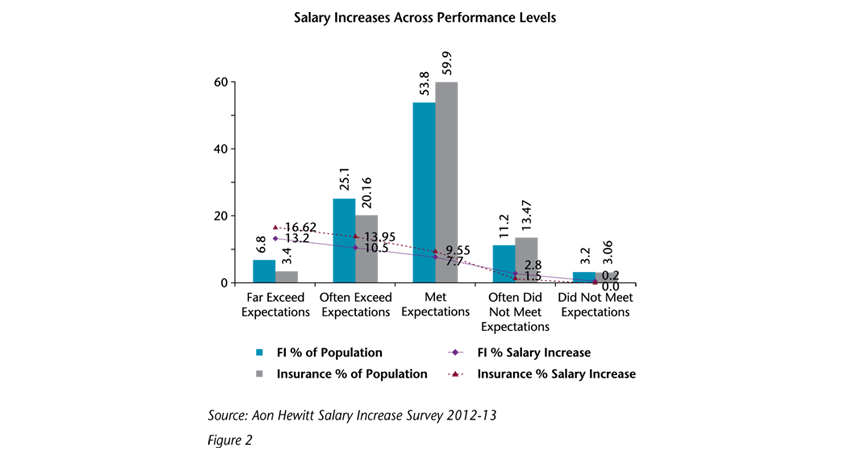

With organizations becoming focused on cost management, pay for performance as a concept is gaining a lot of acceptance in the LI world with CEOs and boards asking for a commensurate improvement in productivity as compensation levels go up. With limited budgets available, more and more organizations today are focusing on differentially rewarding their key talent and providing them with an accelerated growth path. When compared to overall financial institution, the performance distribution curve is steeper in case of insurance.

As can be seen in the graph below, not only are LI companies far more strict in their ratings mechanism, but they also are showing a higher multiplier for salary increases when it comes to their top talent.

HR teams are not only working closely with businesses to ensure that the limited budget is distributed in the most prudent fashion, they are also designing and implementing many non-compensation related initiatives (such as role

With organizations becoming focused on cost management, CEOs and boards are asking for a commensurate improvement in productivity as compensation levels go up.

enhancement, international stint, focused L&D opportunities) to engage top performers.

On the variable pay front, organizations are aiming towards making a strong linkage between performance thresholds and corresponding bonus payouts. The McLagan Aon Hewitt Insurance Survey revealed that in 2012 the variable pay in terms of pure quantum fell approximately 18% over the last year in line with declining performance.

Long-term incentives have also gained momentum. Organizations today are looking at shifting a part of the overall variable as deferred payouts particularly at the senior and top management levels, as they see this to be an effective retention mechanism.

Sales incentives are also under a lot of scrutiny. There is much talk in the industry about maximizing returns on sales force investment. Organizations today are looking at measuring productivity very seriously. Another emerging trend is the addition of retention or persistency while calculating incentive payouts. Organizations are not just tracking new business premiums but are equally concerned about recurring revenue/gross premium. While still at a pilot stage, in the future, we are expecting to see organizations deferring sales incentives over a period of time, not only to ensure that the gross premium target is achieved but also use it as a measure to track mis-selling.

How do the Newcomers Stack Up Against the Veterans?

While austerity and cost management are the top focus of insurance firms, if we look at tier 1(T1) and tier 2 (T2) firms in isolation, the story is slightly different. While the overall LI industry has declined on GWP by approximately 5%, the T1 firms have de-grown by approximately 7%, while on the other hand, T2 firms have grown by approximately 3%. While the low base of the GWP can be one of the reasons for this growth, we also observed that on the rewards front, T2 firms are getting more aggressive.

Last year, it was seen that many T2 firms undertook a significant manpower optimization exercise where they

let go of a significant part of their sales and some part of the operations team at the junior most levels. While they were reducing headcount at junior levels, they continued to hire at the mid and senior management levels, with the objective to build business.

With a significant part of the sales population being shaved off, the HR teams were able to work with a larger budget and reward aggressively at mid to senior levels. The McLagan Aon Hewitt LI Survey reveals that on total fixed pay, the T2 firms are ahead of T1 firms almost across all levels of management, with the exception of the CXO level. Particularly at the mid management, they are almost 10-13% higher than the T1 counterparts. However, after accounting for variable pay, T1 firms continue to enjoy a higher pay level.

Additionally, T1 firms have been conservative in giving pay increases across levels and their median growth has been almost flat across the organization. At the mid and senior levels, the median has actually shown a negative movement. However, for T2 firms the increases have been

Legacy payout ratios and traditional staffing models will need to be challenged as HR will need to carve out a roadmap for a leaner, more cost-effective set up.

positive across, particularly at the junior levels, where the median has moved by 8-9%.

nevertheless, the high increases across levels and the low headcount base has led to a higher cost per employee. While T2 firms are rewarding their employees to ensure that they attract the top talent and build for the future, the 'Return on Wages' has been less than satisfactory. The cost per employee in a T1 firm is far more competitive as compared to T2 with the latter being higher by 8% at junior levels and 10% at middle management level on the per capita cost. However, the difficult question that now confronts the T2 firms is whether this higher per employee cost is translating into the commensurate productivity and business performance. And if not, how long is this model sustainable and practical?

A Different Battle Will Begin

The war for talent has been a familiar battle that LI companies have been waging within themselves as with the rest of BFSI and some other industries. Attrition has always been a concern area for LI companies. While the current overall attrition rate of 63% (as per SIS Phase 2 – 2012-13) is far controlled as compared to what it was a few years back, this number is still fairly volatile especially given the high rates of attrition within the mammoth sales force, that forms the backbone of most LI companies. And there is more complexity that could make the war murkier and bloodier.

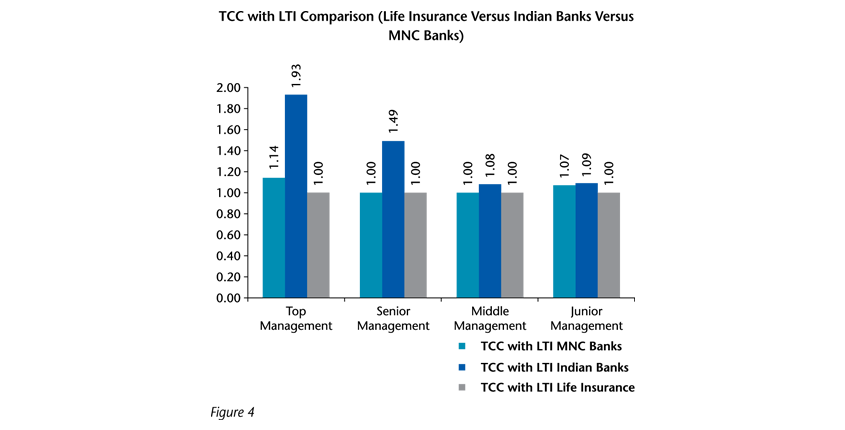

As nBFCs get ready for licenses to operate as banks, it is anticipated that the LI industry could be hit fairly strongly in terms of talent leakage. And they may be at risk as far as poaching goes because of three main reasons. Firstly, as the LI sector struggles to do well, the new nBFC banks may find it rather easy to attract talent from the sector given the new opportunities. Secondly, the compensation levels in insurance are lower than banking (in terms of absolute levels) so the talent becomes 'attainable' (refer figure 4). Thirdly, and most strategically, the new banks will need to focus hard on financial inclusion and setting up of a sizeable rural reach. Who better to manage this than LI distribution heads, who have done a remarkable job in pushing into tier 3 and 4 cities? Talent erosion is expected not just at the top levels but is anticipated to have a far reaching impact at junior levels as well, especially across these cities, which are typically servicing the agency network. So, from both a pull as well as a push perspective, the LI sector is likely to be the favored hunting ground.

As can be evidenced by the graph (refer to figure 4), pay levels in insurance are lower than MnC banks in terms of fixed pay and lower than Indian banks in terms of total compensation.

Where Do We Go from Here?

In spite of the business challenges that the industry has had to brave in the last few years, over the medium to long-term the growth prospects of the industry in India will remain attractive. As per a McKinsey report, the Indian LI industry's GWP is projected to grow at a rate between 13-14% from 2010-15, and India is expected to contribute 10% of total global premium growth in this period and be one of the few major markets globally to grow at double-digit rates in this period. However, to tap this growth, potential companies will need to think and act differently, come up with more sustainable and cost-effective strategies, and understand the consumer needs much better.

The role of HR will also commensurately need to become more strategic and forward looking. CEOs will look at HR managers to manage compensation costs, drive a stronger focus on 'Return on Wage' spends, organize structures to enable execution of strategy and create a compelling environment to differentiate heavily on performance. The focus will shift from attrition to key talent retention, and long-term incentives will be used to stimulate the right business behaviors along with being a retention tool. Business productivity is likely to be viewed alongside compensation positioning, and companies are likely to link the two parameters very tightly. Legacy payout ratios and traditional staffing models will need to be challenged as HR will need to carve out a roadmap for a leaner, more cost-effective set up.

As the landscape matures and the rules of the game become more constraint-driven, the companies that come out on top will be the ones who can manage their human capital more strategically, without dropping the ball on the operational implications.

Sources:

-IRDA Report – December 2012

- Aon Hewitt Salary Increase Survey

-McKinsey Report

- McLagan Aon Hewitt Life Insurance Survey 2012

|

|

|

|

|

Roopank Chaudhary

Director – McLagan Consulting,

An Aon Hewitt Company |

|

|

|

|

|

Sagorika Roy

Consultant – McLagan Consulting,

An Aon Hewitt Company |

For more information, please write to us at [email protected] |

|

|

|