Other industries targeted – education and government entities

as well as COVID-19 research, election organizations,

healthcare and pharmaceutical, defense, energy, gaming, nuclear commercial facilities, water,

aviation, and critical manufacturing.

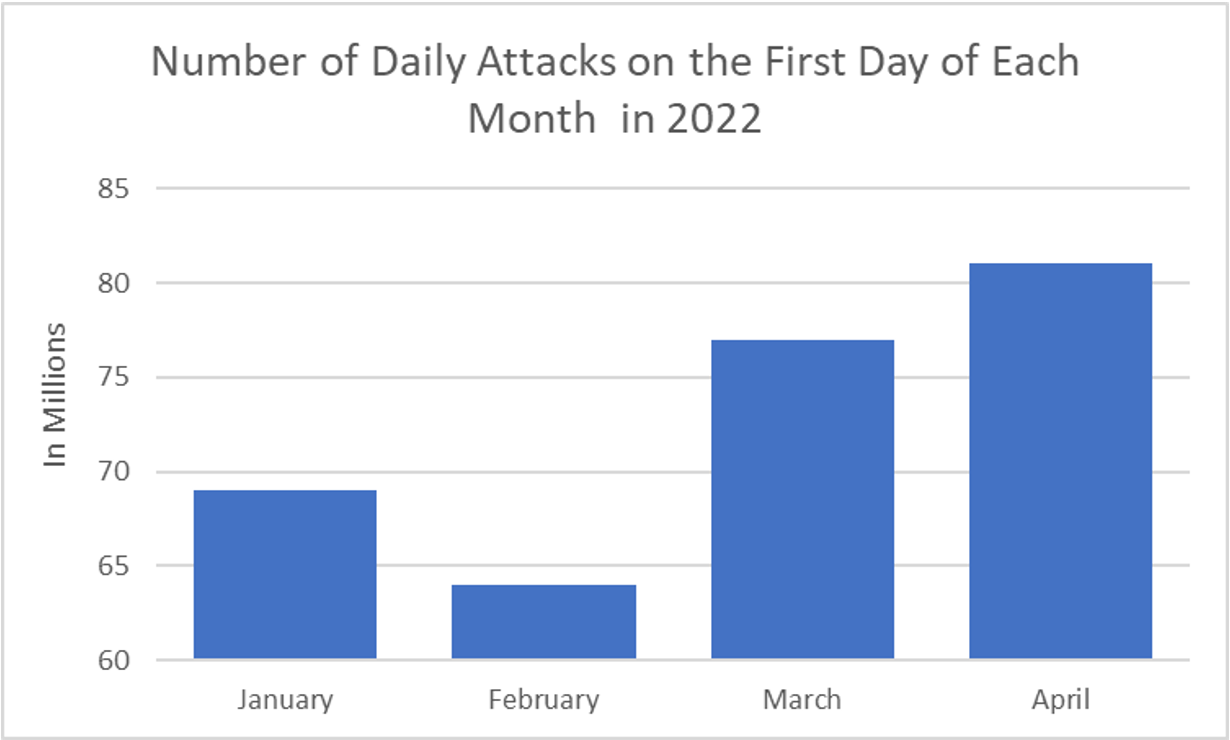

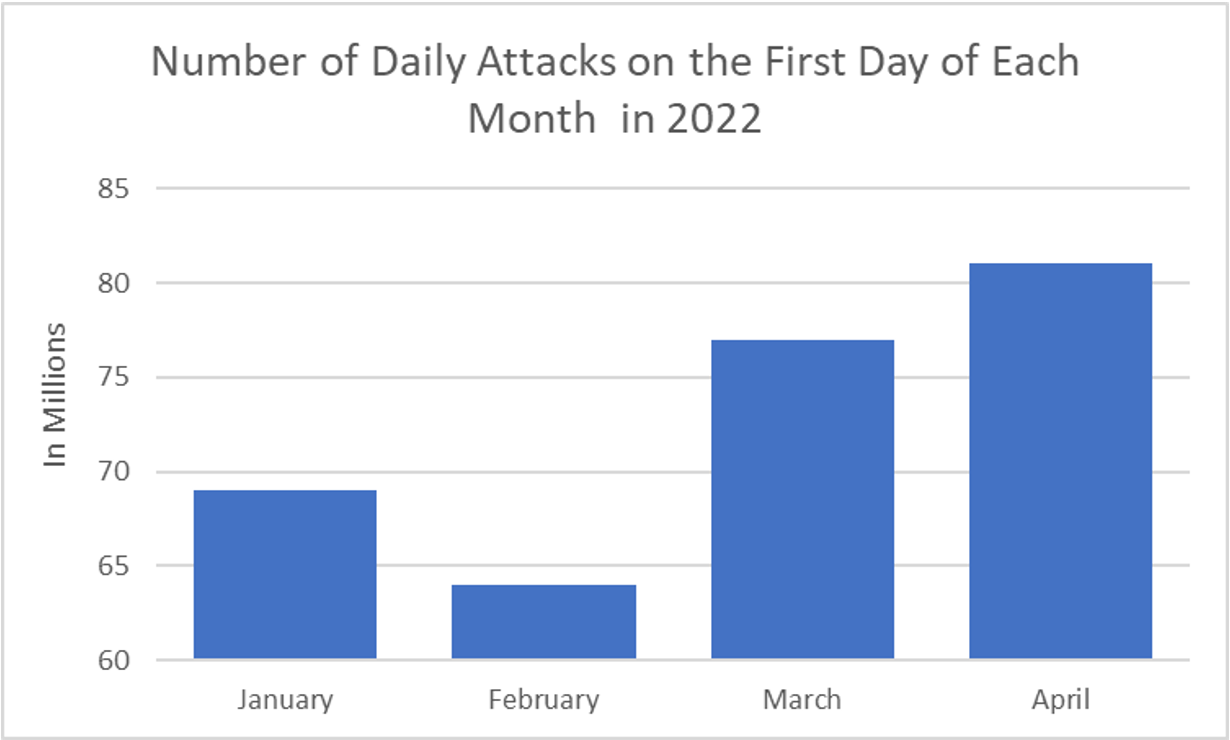

The average number of daily attacks globally, is about 65

million, with spikes in late January, February, and early April.

Source: Check Point Live Threat Map

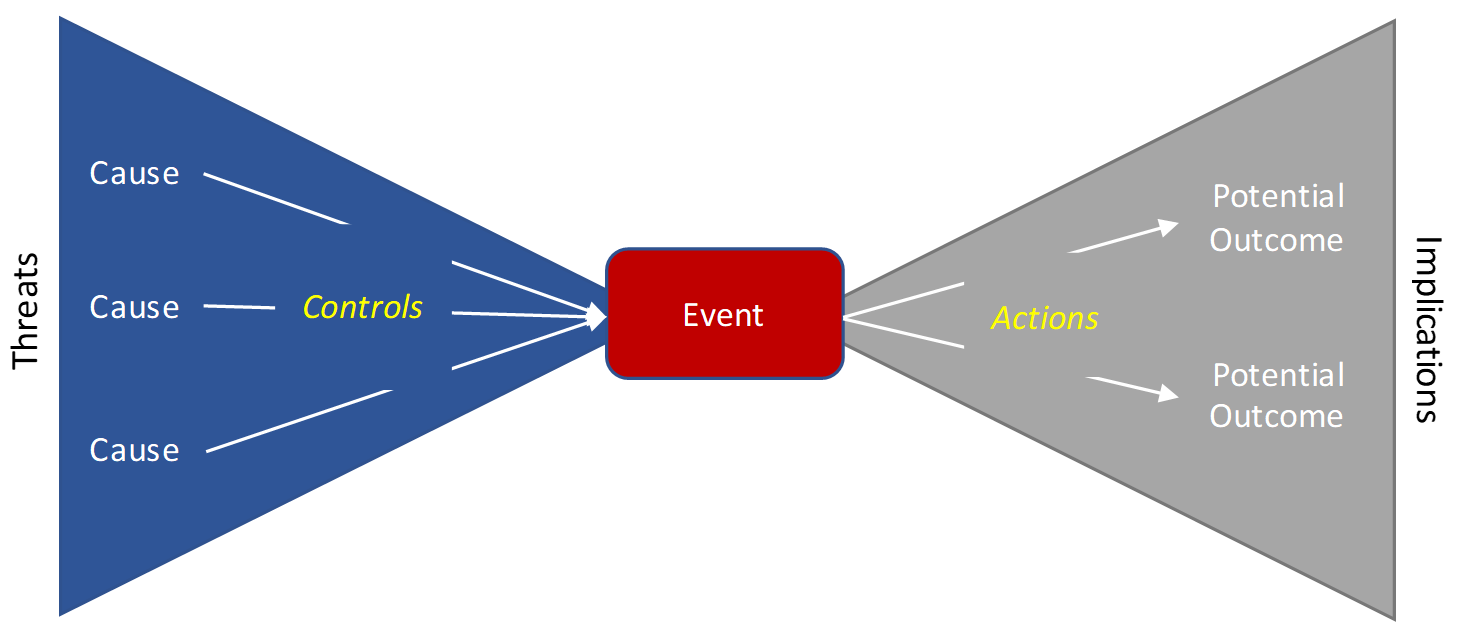

Several options are available for businesses to holistically understand their cyber risk

profile,” says Ladd Muzzy, Director, Enterprise Risk Management, Aon. “The approach

includes understanding the triggers to a cyber event, the technology and asset impacted, and the

outcomes (e.g., financial, reputation, compliance, etc.).”

By quantifying first- and third-party financial impacts and understanding the extent to which current

risks are insurable and retained on the balance sheet, organizations can better manage their cyber

risk profile, thereby improving the Total Cost of Risk (TCoR).

Businesses will also be able to develop effective risk financing and insurance solutions and provide

clarity to management on the optimal investment in cyber risk mitigation and transfer, thereby

protecting stakeholder value.

Steps to increase employee and vendor awareness around cyber threats and

exposures

- Use a strong password, either generated automatically by some operating systems or 12 to 15

characters in length, including special characters and symbols

- Use dual-factor-authentication either through email, text, or a combination of both

- Ensure that your anti-virus is current

- Use a VPN (Virtual Private Network)

- Only use trusted Wi-Fi sources

“The prevailing mindset is that it’s not just a case of if you are susceptible to a

cyber-attack, but rather when the attack will occur,” Muzzy advises. “Ensure that there

is an understanding of the causes to a cyber threat and its implications to ensure that your

organization, and those critical to its success, are protected.”

Human Capital

The Russo-Ukraine conflict is taking a toll on employees. On top of unexpected challenges such as the

two-year pandemic and economic uncertainty, the Ukraine crisis has added to the woes of employees.

Many are directly impacted by the humanitarian crisis, experiencing migrations and lack of basic

necessities in Ukraine. Others have become unemployed as companies including Starbucks and

McDonald’s have halted operations in Russia.

- 29% of the workforce is relocating to another country

- 43% of the workforce is relocating within Ukraine

- 40% remain in their home location

Source: Aon's March 2022 Ukraine Pulse Survey

Organizations are responding by providing:

- Salary advances to employees

- Paid temporary accommodation for employees and immediate families (housing allowance)

- Assistance to relocate, transportation, and visa/tax

- Security assistance

- Relocation assistance to employees who have family in Ukraine, even though the employee may not

physically reside there

- Hardship allowance

- Financial loan(s)