This article:

- Provides readers with key takeaways from the EU’s adoption of CSRD

- Alerts readers to how CSRD will impact EU and non-EU companies differently

- Highlights regulatory disclosure changes impacting different countries and regions

On November 28, the European Union (EU) Council adopted the Corporate Sustainability Reporting Directive (CSRD), which becomes effective 20 days after its publication in the Official Journal of the European Union. The CSRD requires companies to report on the impact of corporate activities on the environment and society and requires the audit (assurance) of reported information.

On November 15, the European Financial Reporting Advisory Group (EFRAG), a body designated by the EU to define the European reporting standard, voted for the European Sustainability Reporting Standard (ESRS) to implement the Corporate Sustainability Reporting Directive (CSRD).

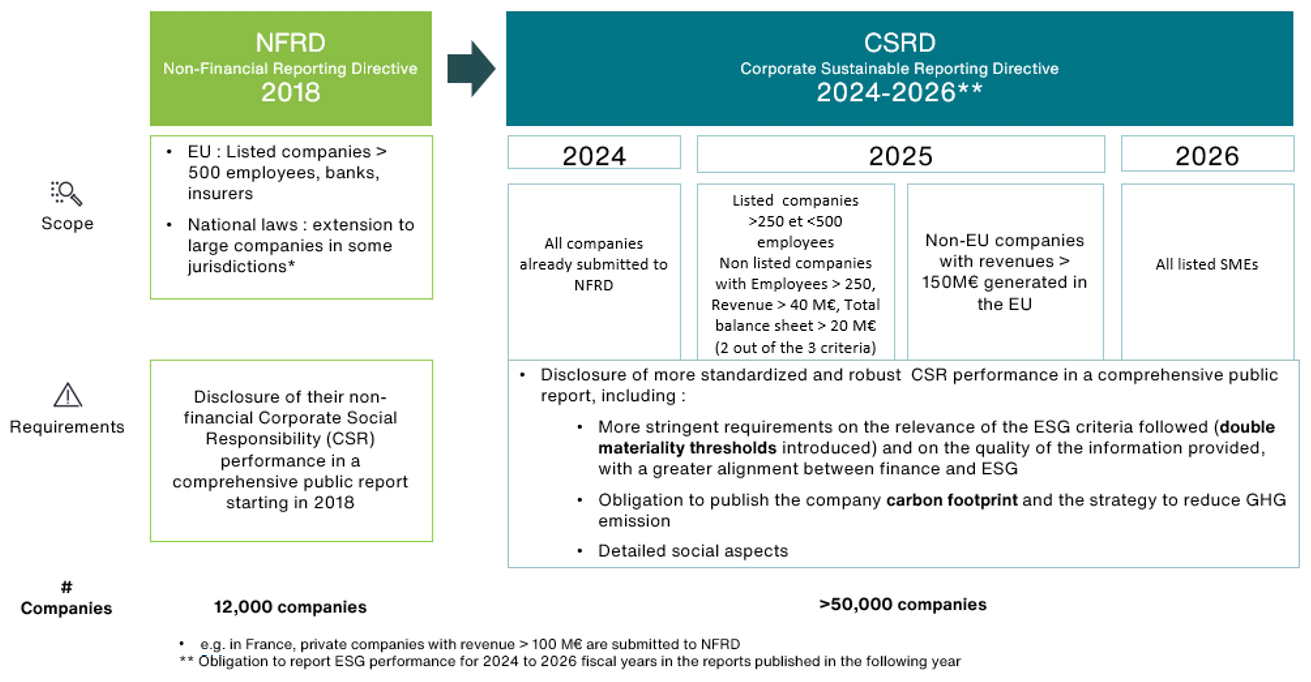

Proposed to the European Parliament in April 2021, the CSRD will replace the current Non-Financial Reporting Directive (NFRD), which has been in effect since 2018 and will extend its scope significantly. Today, only 12,000 companies are subject to the NFRD. This new rule will impact an additional 38,000 companies and changes will apply starting in 2024.

Who Will be Impacted?

CSRD will apply to:

- All EU companies meeting two of the three following criteria:

- Employee count is greater than 250

- Total revenue is greater than 40 M€

- Total asset value is greater than 20 M€

- Non-EU companies with revenues greater than 150 M€ in the EU

- EU-listed and private companies with more than 250 employees

- All EU-listed small medium enterprises (SMEs) (defined as all the listed companies that have not been part of first round of CSRD regulation in 2025 as not meeting the criteria described above)

As was the case for NFRD, EU countries choose to extend CSRD’s scope within their jurisdiction to a broader range of companies than required by the EU.