Overview

Our modern world is increasingly more volatile. Every day, business leaders are forced to navigate both known threats and unforeseen risks. The COVID-19 pandemic has not only dominated the risk landscape, it has fundamentally altered how business leaders prepare for emerging risks. Now, a new challenge has emerged: A global recession.

Aon’s Executive Risk Survey analyzes what makes confident and prepared leaders across the world stand apart in this new era of volatility. This is what we found.

Methodology

Aon commissioned its annual survey of C-suite leaders and senior executives in the U.S., the EU and the UK in September 2022. The 800 respondents represented companies with at least 500 employees.

Economic Outlook: Most Business Leaders Predict a Recession

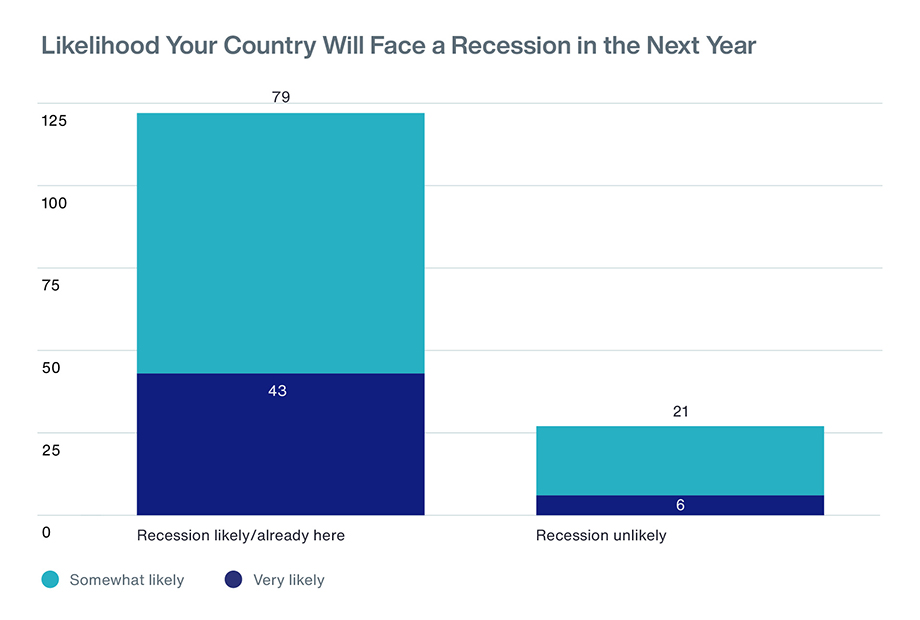

A majority of global business leaders (79 percent) expect a recession within the next year with 43 percent believing it is very likely.

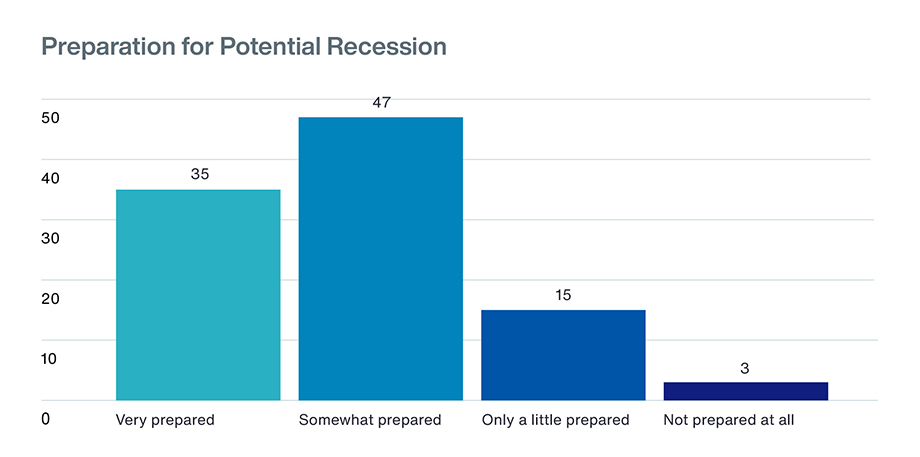

Only one-third (35 percent) of leaders feel very prepared for the economic downturn with 47 percent feeling somewhat prepared and 18 percent feeling only a little prepared or not prepared at all.

Top Risks: Companies Are Most Focused on Near-Term Inflation and Economic Risks

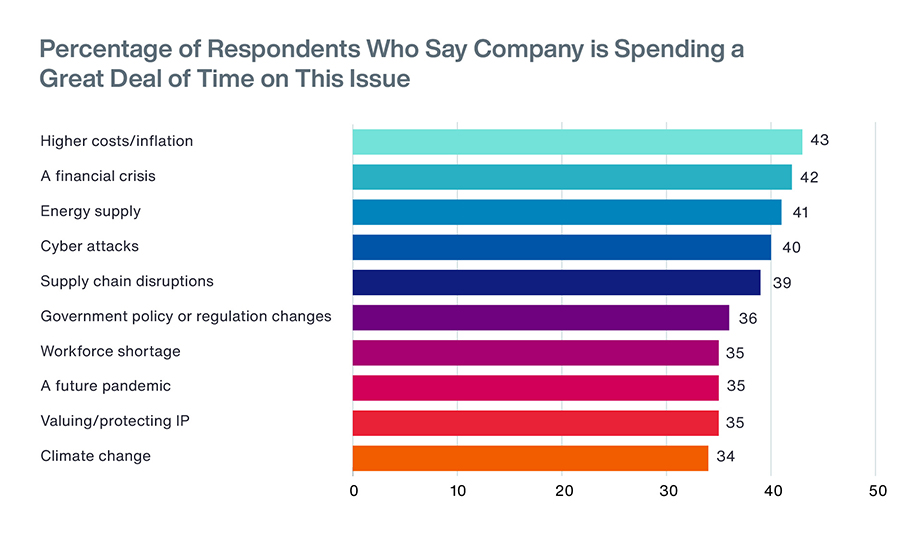

Higher costs/inflation and a financial crisis is the second greatest concern for business leaders in 2022. Last year, inflation ranked #10. Last year’s top two risks, cyber attacks and a future global pandemic, fell this year to #4 and #8, respectively. Energy supply and supply chain disruptions round out the risks within the top five rankings, at #3 and #5, respectively.

Valuing/protecting the company’s intellectual property rose seven spots to #9 (up from #16 in 2021) and for the first time since 2020, climate change cracked the top 10, up from #12 last year and #16 in 2020. In fact, 49 percent of very prepared leaders are spending a great deal of time on climate change, compared to just 26 percent of other leaders.

For the first time since 2020, climate change cracked the top 10, up from #12 last year and #16 in 2020. In fact, 49 percent of very prepared leaders are spending a great deal of time on climate change, compared to just 26 percent of other leaders.

Appetite for Risk: Confident Leaders Have an Increased Appetite to Address Interconnected Risks

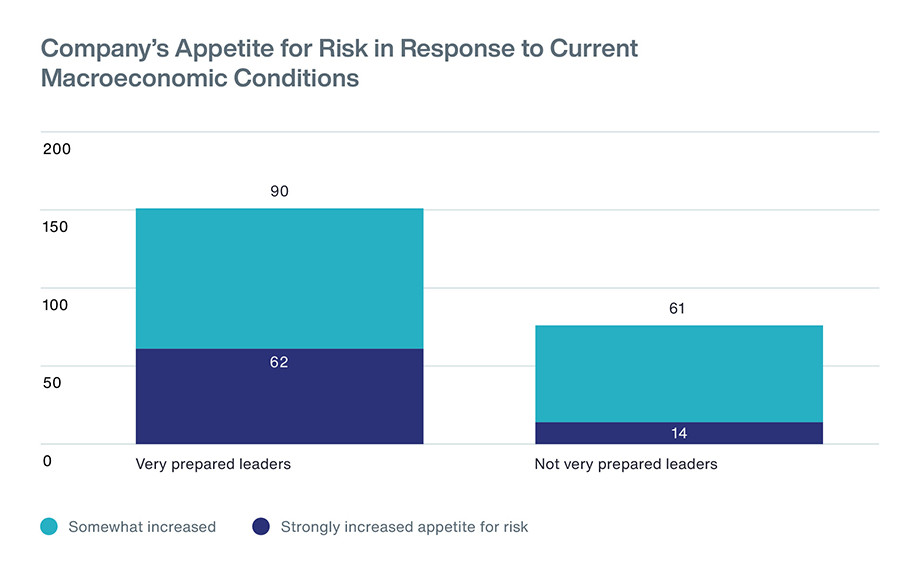

For companies that feel very prepared heading into a recession, addressing risk isn’t a choice – it’s a question of survival. Sixty-two percent of very prepared leaders agree that their company’s appetite to address risk has increased in response to the current economic climate.

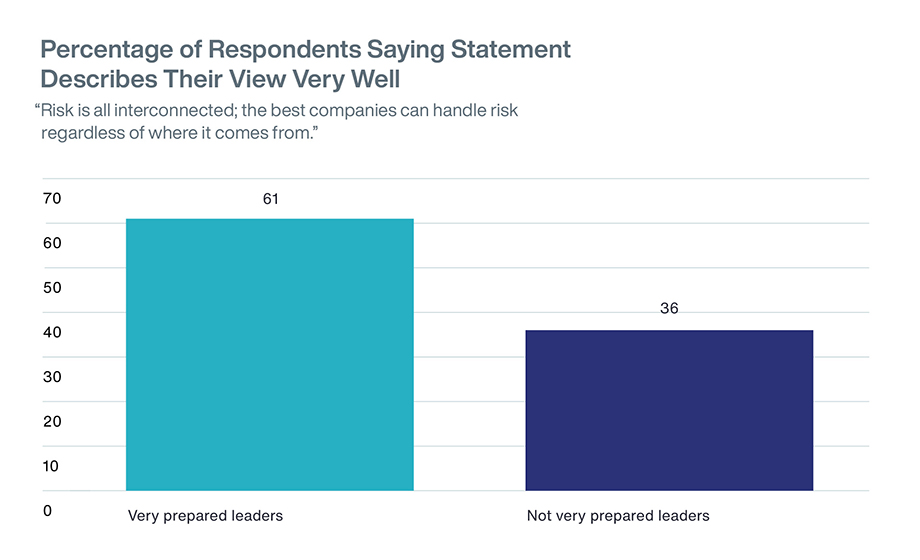

Sixty-one percent of those same very prepared leaders also agree that all risks are interconnected, and that the most successful companies can handle risk regardless of where it comes from. The COVID-19 pandemic taught leaders how to respond quickly to emerging risks, which gives them confidence as they head into a recession.

Responding to Changing Conditions and Risk: Responding to the Slowdown Without Sacrificing Long-Term Investments

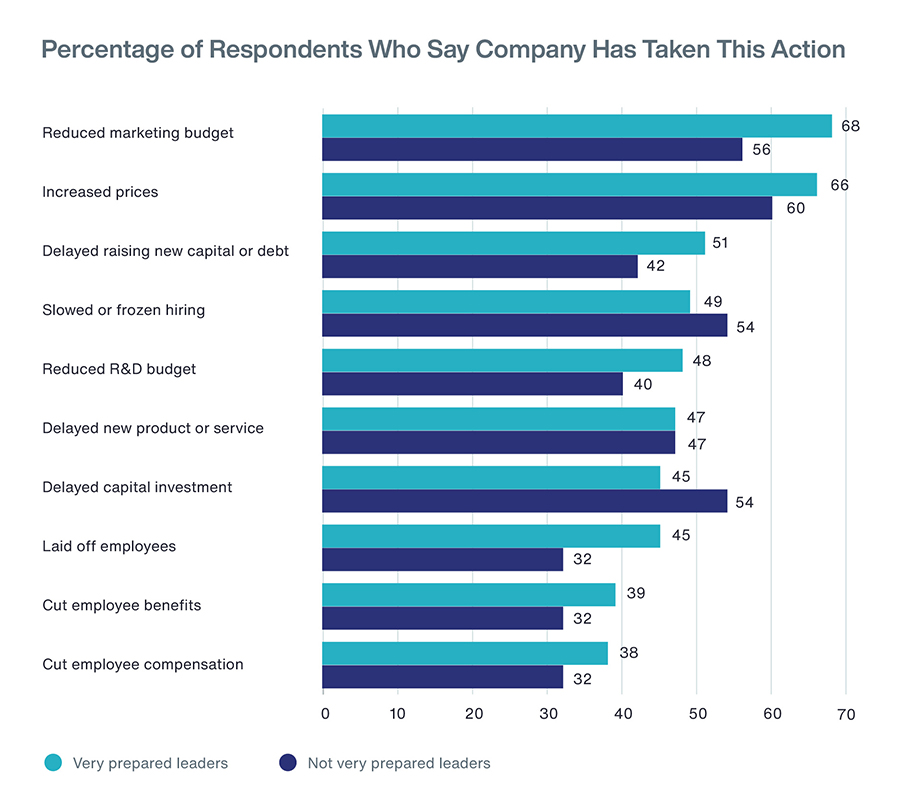

Prepared companies are taking action to prepare for a looming recession. Sixty-eight percent of very prepared leaders are reducing marketing budgets and 66 percent have increased prices.

Yet, these same confident leaders are resisting the impulse to slow hiring or delay capital investment compared to their less-prepared counterparts.

Making Better Decisions: The Value of External Sources in Decision-Making

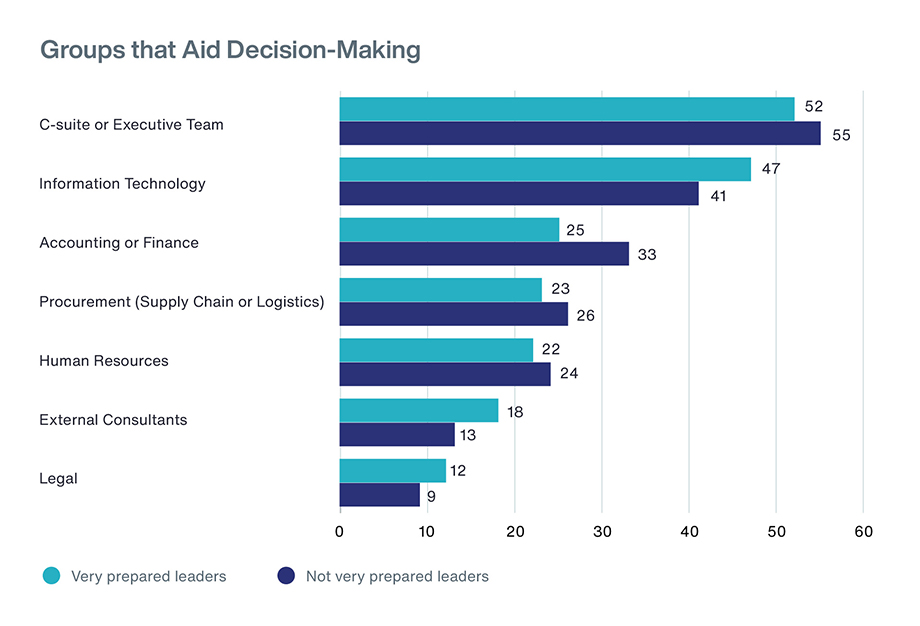

Very prepared leaders see more value in IT and external consultants than their less-prepared counterparts.

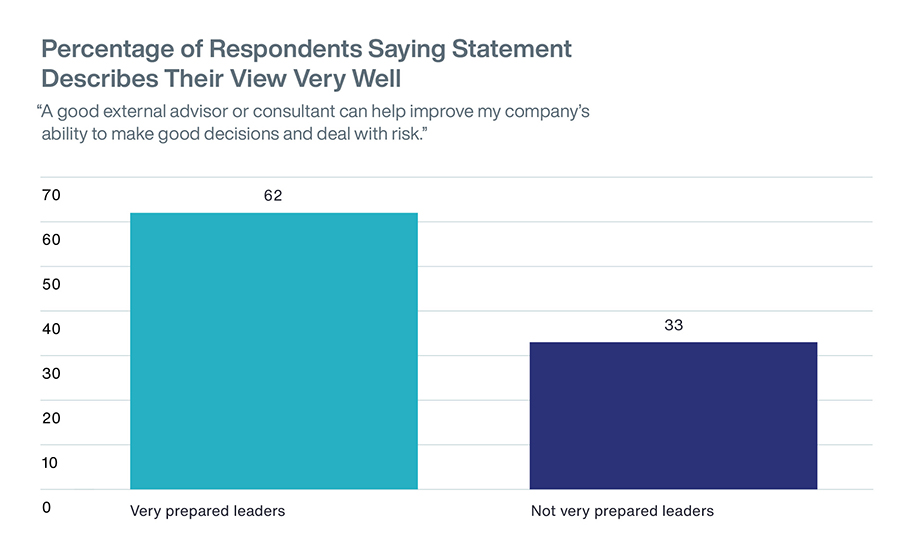

Sixty-two percent of very prepared leaders agree that a good external advisor or consultant can help improve their company’s ability to make better decisions and address risk. In contrast, only about half of not very prepared leaders feel the same way.

Conclusion: 4 Key Characteristics of Confident Leaders and Prepared Companies

1. Embracing risk is the only option.

For companies that feel very prepared heading into a recession, addressing risk isn’t a choice — it’s a question of survival.

2. Don’t hit the brakes on long-term investment — or ignore long-tail risks.

Despite a looming recession, confident companies are resisting the impulse to slow hiring or delay capital investment. While they are concerned about short-term risks such as inflation and rising energy costs, they are not losing sight of more long-tail risks like rising social inequality, cryptocurrency and disruptions to the market.

3. Analysis and advice from internal and external stakeholders is vital in making better decisions.

As leaders look to position their companies for a recession, the most prepared are focused on input from their internal teams, from the C-Suite to entry level, but are also open to outside help.

4. COVID-19 has shown that risks are interconnected.

As in past years, most business leaders don’t see COVID-19 as a one-time event, but rather something that exposed new risks and changed how they need to think. The best-prepared leaders strongly believe that COVID-19 taught them how to respond quickly to emerging risks, which gives them confidence as they head into a recession.

Insights from Aon

The Impact of Inflation

Business Resilience Starts with Workforce Resilience