News From Aon

Release of 2019 Japan Benefits Study Results

About Japan Benefits Study

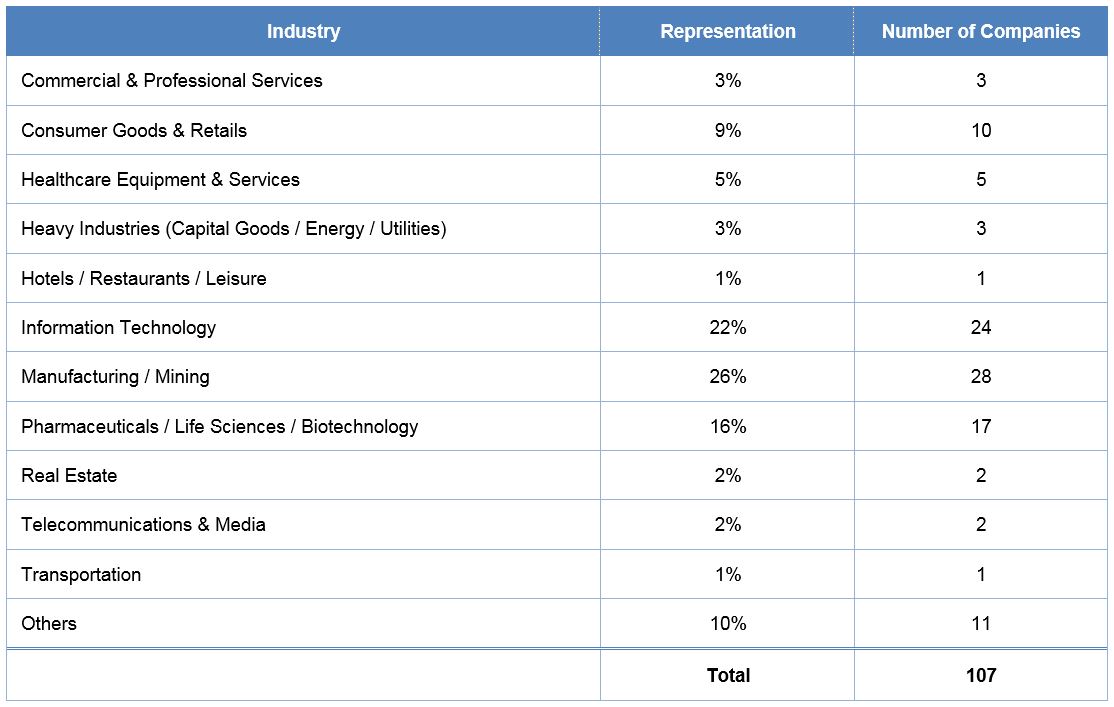

Japan Benefits Study is a survey conducted annually by Aon, covering 107 foreign multinationals in Japan this year, providing a comprehensive overview of benefits policies and employment practices. Our survey reports are divided into two parts, all available both in Japanese and English throughout the reports: the main report (about 100 pages) covering summaries of benefits policies and employment practices together with brief descriptions of statutory requirements and explanations of benefits programs, and Hot Topics report covering topics related to benefits and work rules currently being discussed in Japan. This year’s Hot Topics covers three themes: Work-Life Balance, Defined Contribution Plan, and Financial Well-being.

Participation by Industry

Highlights of Report

“Work-Style Reform Legislation” was announced in July 6, 2018 and the relevant laws have started being enforced from this year. It is imperative for the companies to not only offer attractive working environment to sustain workforce under the situation of decreasing working population in Japan but comply with the new legislation. This year's results show that companies are making efforts for employee’s health promotion and labor productivity by reviewing their working conditions and benefit programs.

- Increase in awareness of employers and employees to realize more flexible work styles

The trends of employers trying to offer more flexible and secure working environment are continuing, as can be seen from our survey results such as 15% increase (45% to 60%) of the prevalence of work at home and 7% increase (65% to 72%) of the prevalence of flextime system over the past 5 years. There are more companies allowing all employees to work at home now while it was common to allow only under certain circumstances with company approval in the past. Regarding flextime system, while 95% of the companies responded as setting core-hours (such as 10am-3am) in 2015 survey, the prevalence decreased to 78% in 2019 survey.

- As DC market expands, administration of corporate DC plan will become more important

The trends of DC plan are continuing, and the number of participants of both corporate-type and individual-type DC has been increasing steadily. Our survey results show 8% increase (56% to 64%) in the prevalence of corporate-type DC over the past 5 years. The legislation changes enacted in 2018 require employers administering DC plans to make efforts to review their DC plan vendors as well as to offer continuous investment education to their employees. Starting July 2019, DC plan vendors are required to disclose the list of their available investment funds for DC plans on their web site, which makes evaluation of DC plan vendors as well as the funds being offered possible. Administering DC plan properly will become important more than ever, especially in terms of reviewing their DC plan vendor and investment funds.

- Increase in Health insurance premium rate, and change in market trends of group-term insurances

Health insurance premium rates of multi-employer Health Insurance Associations (HIA) and in-house HIAs have been increasing steadily while there was no significant change in that of the Government HIA. Long-term care premium rates have been increasing overall. As for non-statutory group-term insurances, our survey results show an increase in prevalence of Group Long Term Disability (GLTD) as well as an increase in number of companies allowing employees to contribute to group-term insurances voluntarily.

【Contact Us】

Aon Hewitt Japan Ltd. | Retirement Solutions

[email protected]

Japanese version