Geographic and Sector Insights

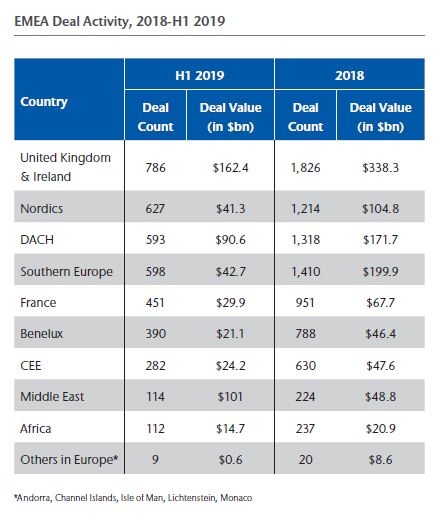

Three regions in continental Europe accounted for the bulk of EMEA activity in 2018. The UK

(including Ireland) was the largest deal market by volume and value, with 1,826 deals worth

$338.3B, followed by Southern Europe, where there were 1,410 transactions worth $199.9B,

while DACH posted 1,318 deals valued at $171.7B.

The Middle East and Africa recorded 224 deals worth $48.8B and 237 deals worth $20.9B,

respectively, in 2018.

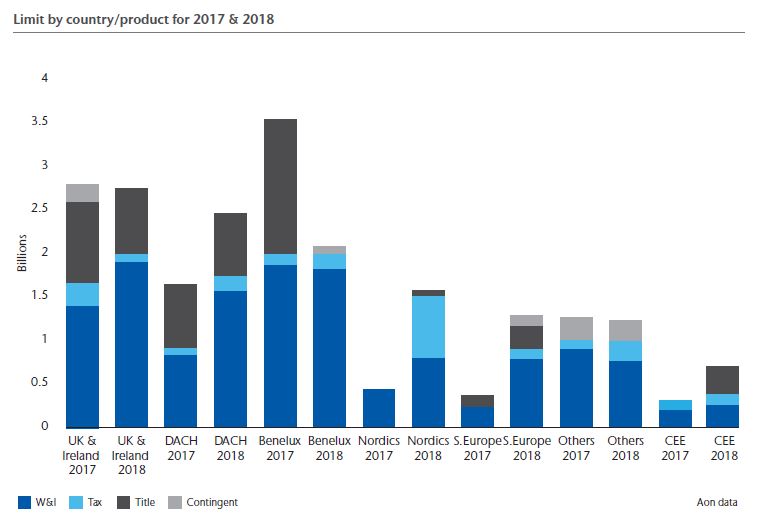

This spread of activity is broadly reflective of the policies placed by Aon’s broking teams across EMEA.

Aon EMEA provided cover for transactions involving target companies in 34 jurisdictions in 2018.The

UK & Ireland was the largest market for Aon last year, with limits running around $2.75B, followed by

the DACH region (circa $2.5B) and Benelux (circa $2B). The Nordics market increased three-fold to

more than $1.5B, and southern Europe more than doubled in size to more than $1B.

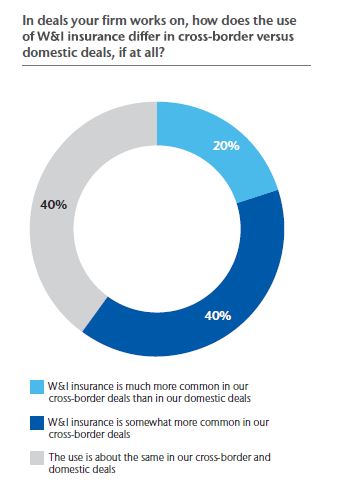

Dealmakers that have used W&I cover in EMEA have generally tended to make use of the product for both

domestic and cross-border deals. In our dealmaker survey, 40% said the use of W&I was usually the same

for cross-border and domestic deals, with 40% saying it was somewhat more common for international

transactions. Only 20% said W&I insurance was much more common in domestic acquisitions.

Transaction Solutions and Public M&A

An additional and developing aspect of the EMEA M&A insurance

marketplace is public M&A. Aside from public offering of

securities insurance (POSI), insurance products have historically

had little application outside of the private deal space. There are

typically very few, limited, or no warranties provided by the

target company or its shareholders in public deals, meaning that

W&I insurance is simply not relevant.

Aon, however, has recently challenged the market to come up

with more innovative solutions to meet client demand for greater

downside protection in the public markets, whether in an M&A

context or otherwise. This has meant engaging with insurers both

in and outside of the current M&A space and has resulted in a

number of groundbreaking placements.

Examples include structuring and placing a W&I policy for a

public-to-private transaction in Poland and placing a tax policy for

a public company to preserve the tax treatment arising from a

redomicile of its IP assets. We have also seen an increasing

number of public companies using W&I in private M&A, having

realized that they are able to drive comparable benefits to those

enjoyed by their private equity counterparts for many years.

These examples barely scratch the surface of what Aon perceives

to be the unmet needs for solutions in the public M&A transaction

arena. We expect the market to develop over the next few

years. Watch this space.

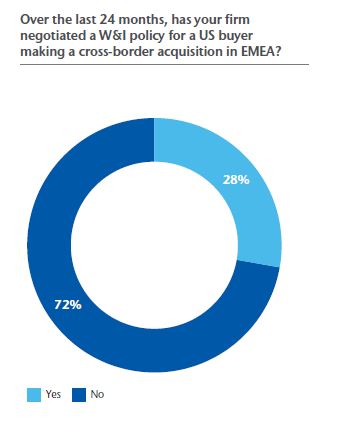

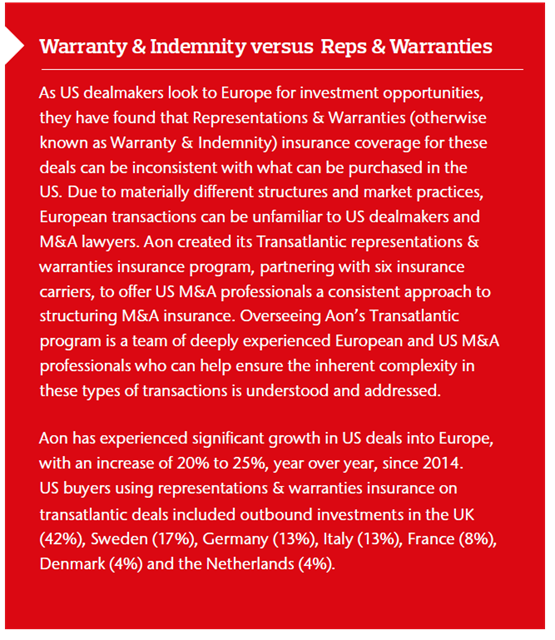

But even though W&I cover is now commonplace in cross-border deals involving EMEA targets, only

28% of those polled had negotiated a W&I policy for a US buyer making a cross-border deal in the region.

This could be down to the differences between US policies and those in EMEA (see “Warranty & Indemnity

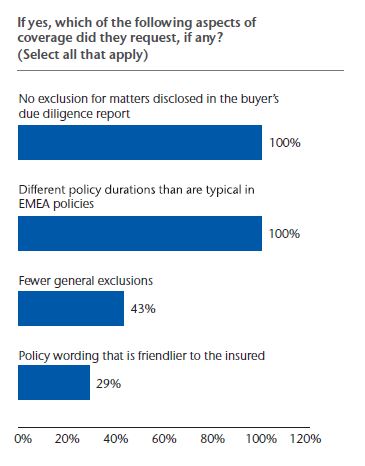

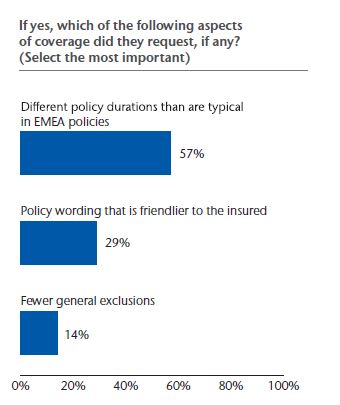

vs. Reps & Warranties” on page 8). All respondents who had negotiated W&I policies for US buyers

making a cross-border acquisition in EMEA reported policy durations different to what was typical in EMEA

policies, and said there were no exclusions for matters disclosed in the buyer’s due diligence report. Some

43% noted fewer general exclusions, with 29% noting policy wording that is friendlier to the insured.

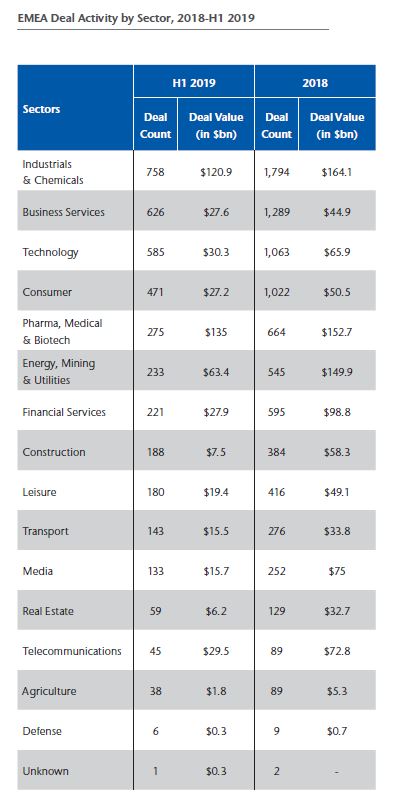

With regards to sectors, the industrials and chemicals industry delivered the largest deal volume in H1

2019, with 758 deals valued at $120.9B. Pharma, medical and biotech was the largest sector by deal

value over the period, with a value of $135B across 275 transactions. Business services and technology

were the next busiest sectors by volume, with 626 deals worth $27.6B and 585 transactions worth

$30.3B, respectively.

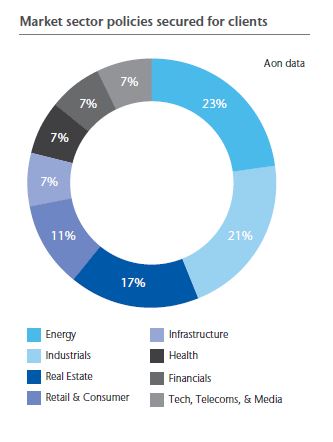

The insurance market remained relatively agnostic on industry, with market sector policies secured for

clients operating across a broad range of industries (see chart on page 9). The largest sectors were

energy (23%), industrials (21%) and real estate (17%).