Tom Yorath, senior partner and Lauren Ramsey, associate partner and actuary at Aon share some insights and ideas on completing GMP equalisation

As pension scheme projects go, GMP equalisation may feel more like a marathon than a sprint. But the findings in Aon’s 2023/24 Global Pension Risk Survey show that there are plenty of reasons to be positive about how far schemes have come.

The survey asked representatives from 204 UK defined benefit (DB) pension schemes of different sizes and from a mix of industry sectors, about their current risk priorities including hot topics such as GMP equalisation.

Schemes are Moving Forward

Our findings show that schemes of all sizes have made good progress towards GMP equalisation over the last two years, with around a 20 percentage point improvement in levels of activity. For example, 82 percent of schemes have now established a decision-making structure for GMP equalisation, compared to 62 percent in our 2021/22 research.

Schemes that started work early are now reaching the end of their GMP equalisation exercises. This year, 17 percent said they have completed implementation for ongoing members, and 43 percent report that implementation is in progress. Other schemes may still have more work ahead of them, but most are now at least addressing early-stage tasks such as data gap analysis (75 percent have addressed this for ongoing members).

But there is still work to do, especially in addressing historic transfers as required by the later ruling on the Lloyds Banking Group 2020 judgement. These are more likely to be affected by challenging data issues. It is more surprising to see slower progress on equalising future cash equivalent transfer values (CETVs), with just 39 percent of schemes saying they have completed it. This is a comparatively straightforward issue to address in isolation and ensures that future historic transfers-out are minimised.

Progress on GMP Equalisation

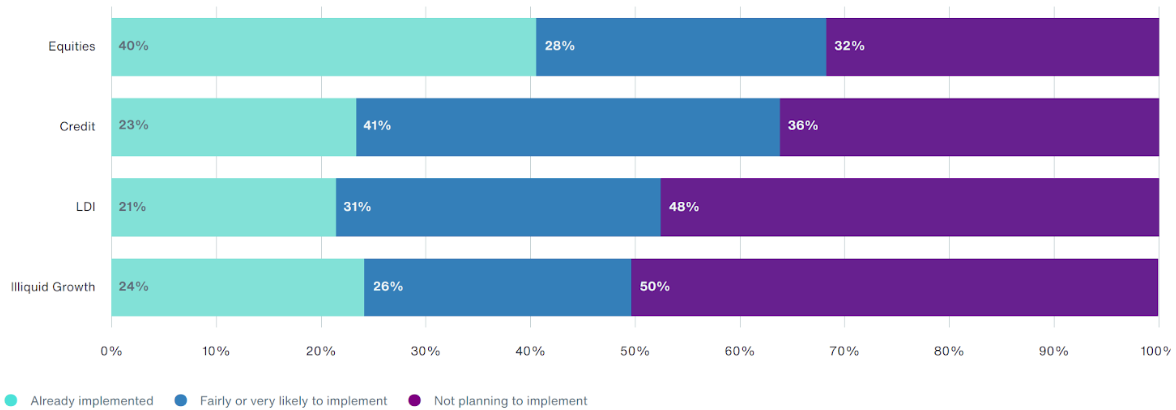

Source: 2023/24 UK Global Pension Risk Survey

Actions for Trustees

GMP equalisation is just one of many projects on trustees’ plates at present. Preparing for risk settlement and getting ready for pensions dashboards are among the other activities also fighting for time and putting intense pressure on administrator resources. To make sure GMP equalisation continues to move forward alongside other administration-heavy projects, there are three priorities for all defined benefit schemes.

- Have a clear data strategy. Data drives everything, from compliance exercises such as GMP equalisation, through to member option exercises and dashboard needs. It is essential that trustees have a clear plan that identifies how all data-driven projects can be completed efficiently. Creating a strategy that identifies when and how data-related work such as cleansing will be carried out, and in what order, is essential to make best use of limited administration resources.

- Combine GMP equalisation and member option exercises. We are seeing a trend for schemes to combine GMP equalisation with member option exercises such as pension increase exchange (PIE). Delivering two projects that have a significant amount of overlap is more efficient than trying to execute them separately and means both exercises can be completed more quickly. Running the exercises in parallel can also provide a more positive experience for members. Rather than GMP equalisation being a compliance exercise that leaves members feeling railroaded into changes that they have no control over, offering a PIE as well means members are given some choice about their future benefits. We have found that this drives higher member engagement, streamlines communications, and reduces the volume of member enquiries about the process.

- Sequence tasks to optimise timelines. Effective sequencing of the work involved in GMP equalisation can make sure that projects maintain momentum, make best use of trustees’ time and are completed as efficiently as possible. For example, trustees may know that a data cleanse will take 12 months. In the interim, trustees could use the time to address historic transfers, rather than waiting until the end of the project to address them.

In our 2019 Global Pension Risk Survey, the time and cost of implementing GMP equalisation were a major concern for 82 percent of respondents. It is very encouraging to see the progress schemes have made since in identifying and sequencing the tasks needed to complete this project, as well as proactively combining GMP equalisation with other priorities such as member option exercises.

While GMP equalisation continues to be a marathon, the elite frontrunners have already crossed the finishing line and, in the next two years, we will see the chasing pack start to cross the finish line. And, like completing a real marathon, that will be a major cause for celebration.

You can download a copy of the survey at www.aon.com/GPRS2023.