Mitigate Market Uncertainties with Data-Led Portfolio Differentiation

The reinsurance market is facing a unique combination of market uncertainties. With a majority of property reinsurance programs renewing on January 1, we explore the challenges as some reinsurers reduce their appetite for catastrophe risk and reveal how to achieve portfolio differentiation in an evolving market.

Five Things You Need to Know

1 Macroeconomic volatility – with inflation being the number one topic – has coincided with an increased frequency of extreme weather events, causing reinsurers to reassess their appetite and creating a mismatch in supply and demand.

2 Reported equity has declined across the (re)insurance industry in 2022. Our estimate of global reinsurer capital is down 11 percent on June 30. Alternative capital is broadly flat at $96 billion, with the catastrophe bond market set for another year of growth.

3 The reinsurance industry has absorbed volatility and proved resilient to many historical shocks and challenges. Reinsurance remains a highly accretive source of capital for the insurance industry and one that is rightfully in high demand.

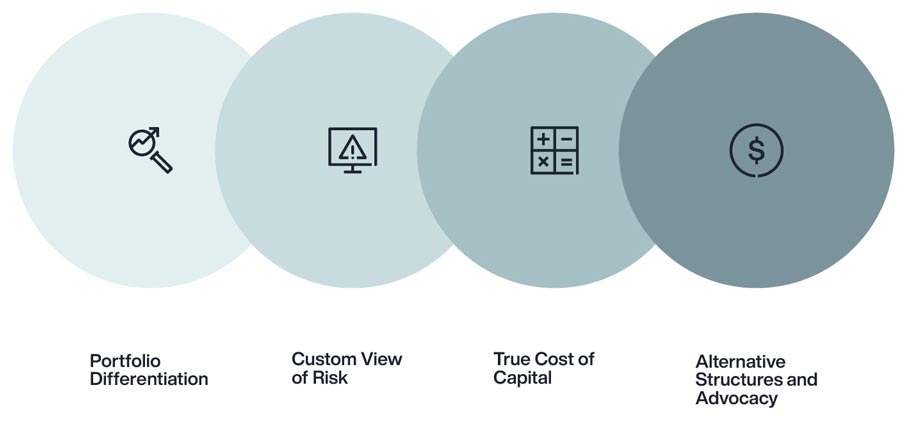

4 Insurers that take a pragmatic and flexible approach should yield materially better results this renewal, by anticipating market dynamics, exploring new sources of capital and differentiating with analytics to tell a granular story.

5 We see opportunities for diversification and growth beyond renewal, spanning the emerging market for intellectual property insurance that could one day surpass the mortgage reinsurance market, and the robust casualty and specialty reinsurance markets should remain attractive.