Public Sector Banks - More Bang for the Buck?

Aditya Nanavaty

Senior Analyst,

McLagan, An Aon Company

Roopank Chaudhary

Associate Partner,

McLagan, An Aon Company

Major banks should be not only socially-controlled, but publicly-owned," announced Indira Gandhi on the eve of the nationalization of banks in the Indian summer of 1969. Indian policy making has come a long way since, with three series of banking licenses and now talks of licenses on tap, thanks to RBI Governor, Raghuram Rajan. However, 46 years on, state-owned banks continue to account for 77% of deposits and 76% of advances of the banking sector. Touted to be the main reason why India's banking sector withered the storms of the global financial crisis of 2009 rather gallantly, the state-owned banks have held their own while foreign banks went in out of fashion, and Indian private sector banks made steady headway in both quantity as well as quality. With their

performance steadily improving and as they continue to give their private counterparts a consistent run for their

money (no pun intended), what emerges as a bit of a paradox is their ability to compete in the talent market. Given

factors ranging from strong unions, ownership and legacy, pay policies at public Sector Banks (PSBs) have been at a

peculiar variance as compared to those seen in the private sector. After all, institutions that make money by

dealing in money have always been known to drive employees through money! So how would the state-owned super banks

survive? Usually, it is the large pay gap that PSBs have with the private sector at the top management levels that

grabs the headlines. However, scratching beneath the surface reveals that an average public sector bank employee is

rewarded competitively, especially considering the wide gamut of benefits that are doled out. It is not really a

mcoincidence then that the PSB attrition number of less than 5% is significantly lower than banking attrition

number of 14.9%. At 23.5 years, average tenure at public sector banks is four times that at private sector banks

(5.85 years). This article is an attempt to explore elements of pay practices in public sector banks which give

them a unique advantage as employers and may remain unseen at first glance.

The Pay Paradox - Debunking the Myth:

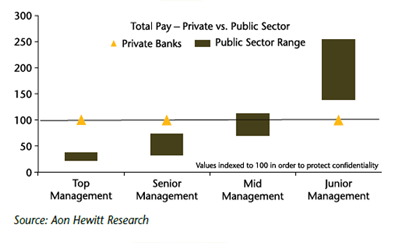

A. Quantum of Pay At 9.5 lakh per annum, an average PSB employee gets paid about 1.5 times higher

than an average private sector bank employee. At senior and top management levels, pay lags significantly with

respect to private sector banks. However, these levels account for less than 6% of the overall headcount of PSBs.

For majority of the headcount at junior and mid management level, median cost to company at staterun banks is

higher than that seen in private sector.

|