Commercial Surety

Today’s competitive landscape, coupled with a volatile economic outlook, demands surety program certainty and sustainability. An efficient bond program can enhance corporate liquidity and maximise working capital.

What is Commercial Surety Bonding?

Surety bonds are financial instruments used between three parties: the principal, the beneficiary and the surety entity issuing the bond. Surety bonds offer the advantages of helping clients meet capital requirements, optimise their cost of capital, and provide an off-balance sheet solution to letters of credit.

Surety considerations:

Facility Size

- Based on the financial strength of the applicant and/or the parent group.

- Surety may offer the applicant an unsecured surety facility.

Bond Issue

- Subject to satisfactory review of the bonding obligation and draft bond wording.

- Premium is paid, then the bond is issued by the surety to the beneficiary.

Indemnity Agreement

- Applicant (and/or parent) will enter into an indemnity agreement with the surety provider.

- Indemnity agreement:

- is in simplified terms similar to a ‘parent company guarantee’.

- is a legal undertaking from the applicant that it will reimburse the surety in the event that there is a call on the bond.

- is similar to the counter indemnity agreement between the bank and applicant for bank guarantee facilities.

Benefits of Surety

- Ability to release working capital and credit facilities from the bank

- On demand guarantees and conditional wordings will allow room for negotiation with the beneficiary

- Competitive pricing, especially when compared to bank guarantees

- Reduced need for security, relying instead on a group counter indemnity

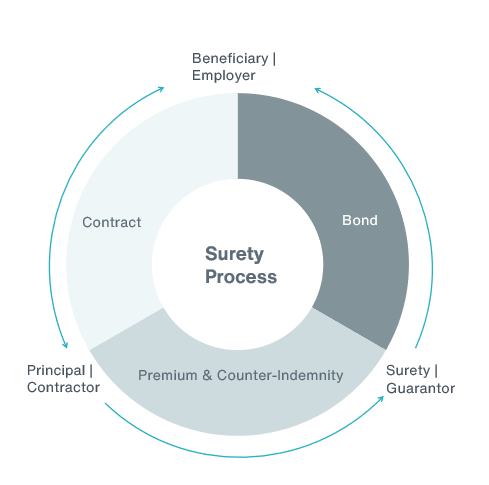

Surety Process

Surety facilities help support organisations by providing additional liquidity that improves working capital and increases flexibility. A surety bond is a financial instrument through which an insurance company – the ‘surety provider’ – guarantees the successful performance of a contract by a business – the ‘principal’ – to a third party – known as the ‘beneficiary’ or ‘obligee’. If the principal fails to deliver on their contractual requirements, the surety provider will compensate the beneficiary.

Our focus is to help you maximise working capital efficiency and facilitate the growth of your business.

Capacity

Aon can approach the surety market globally for all surety needs. The size of the surety lines depend on due diligence undertaken.

Aon can approach the surety market globally for all surety needs. The size of the surety lines depend on due diligence undertaken.

Pricing

By utilising Aon's extensive expertise, we are able to offer competitive prices in all regions.

By utilising Aon's extensive expertise, we are able to offer competitive prices in all regions.

Indemnity

We help negotiate the best terms within the indemnity agreement. Indemnities are generally negotiated on an unsecured basis.

We help negotiate the best terms within the indemnity agreement. Indemnities are generally negotiated on an unsecured basis.

Flexibility

Surety lines can be used to issue guarantees directly, or they can be used by working in conjunction with banks to share capacity, or as a fronted solution.

Surety lines can be used to issue guarantees directly, or they can be used by working in conjunction with banks to share capacity, or as a fronted solution.

How Aon Can Help

We help clients make better decisions by carefully evaluating their strengths and opportunities, sharing the surety options available to them and creating custom solutions to help them achieve their goals. We conduct nearly 175,000 surety transactions annually and manage over $200 billion in surety liability, placing us as one of the largest surety brokers. Our team comprises some of the strongest surety consultants in the world, with deep experience managing programs with complex indemnity structures, high-volume transaction counts and significant risk analysis.

We combine this knowledge and experience with custom client benchmarking, exclusive data and analytics and leading technology to offer comprehensive surety services.