The ever increasing advance of FinTech has led to the advance of new regulations. In particular the EBA’s new legislation: PSD2 (also known as the revised payment services directive), which came into force in January 2018. It has the aim of completely revolutionising the payments industry through simplification and increasing competition. This legislation applies to all member states within the EU, meaning big changes are occurring for Europe’s blossoming FinTech hubs such as London, Berlin and Dublin. It is creating opportunities for existing third party providers (TPPs) in payments and also allowing the creation of many more. Yet, despite PSD2’s significance and impending opportunity, too few founders are aware of the necessary technical standards needed to operate under this new regulation.

What is PSD2?

The new directive ensures that all Third Party Payment Providers (TPPs) will be subject to uniform regulatory supervision and guidelines, with a view to driving competition, transparency and innovation within the payments sector. It also means greater transparency for international payments, and seeks to eradicate hidden fees involved in customer transactions.

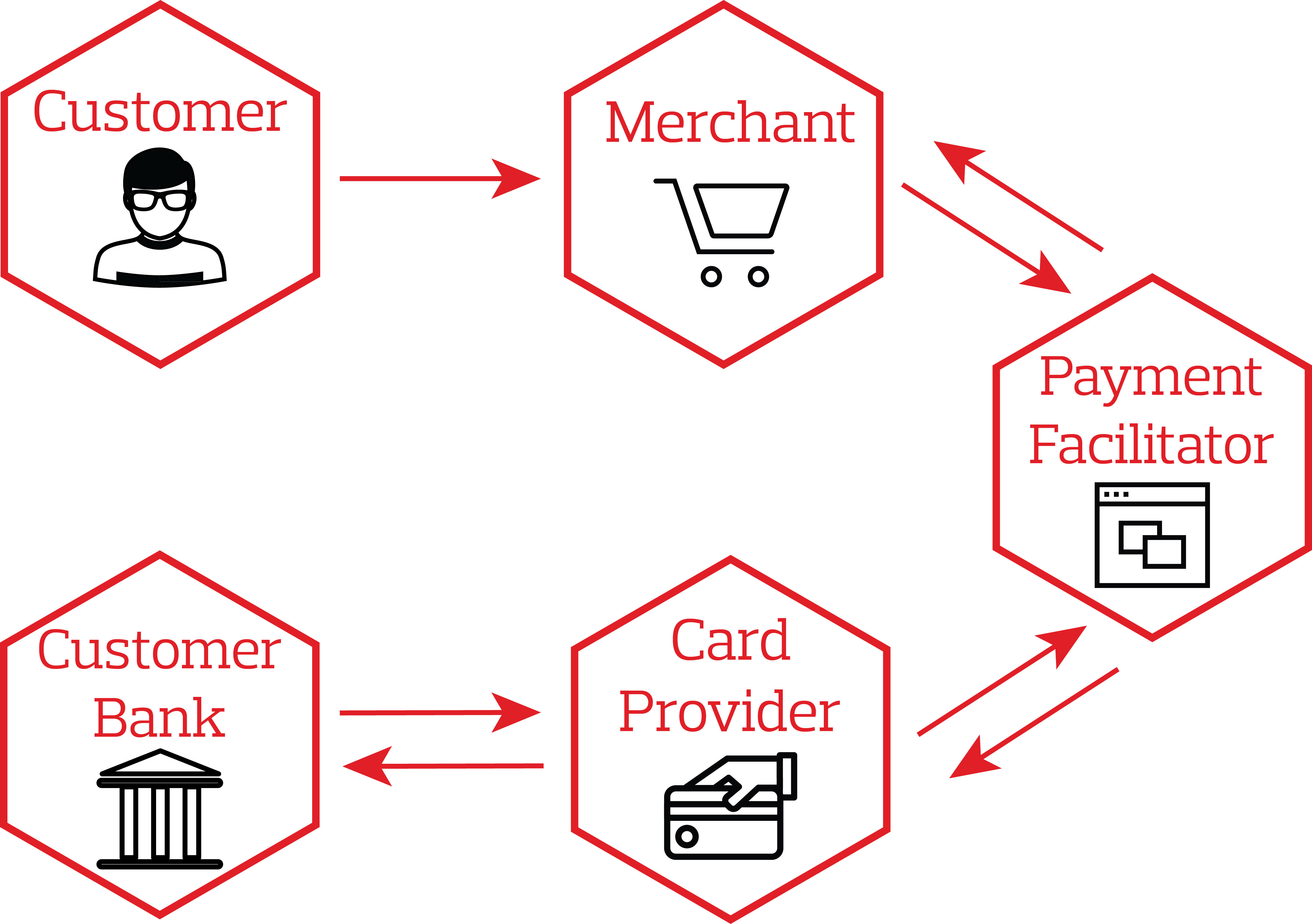

Online transactions often rely on third party facilitators to convey customer money to a merchant. For example, when purchasing something on Amazon.com, Worldpay would act as the broker who then go onto contacting your card scheme (VISA, MasterCard etc.), both acting as the middle layer between bank and merchant – with the customer’s permission, of course.

Online payments today:

Now with PSD2 implemented, it essentially cuts out these ‘middlemen’ in online payments through the creation of PISPs (Payment Initiation Service Providers), allowing the merchant (Amazon) and the bank to communicate with each other directly. This makes for a more straight-forward customer journey and reduced costs for merchants.

Online payments post PSD2:

But the changes don’t stop there, besides the creation and development of PISPs which, as mentioned, allow consumers to make payments from their bank accounts directly to an online merchant the new regulations create and develop AISPs (Account Information Service Providers). These provide customers with online consolidated information about their different payment accounts, which gives them a macro view of their finances allowing them to analyse their spending patterns, expenses and general financial needs.

Mandatory insurance cover

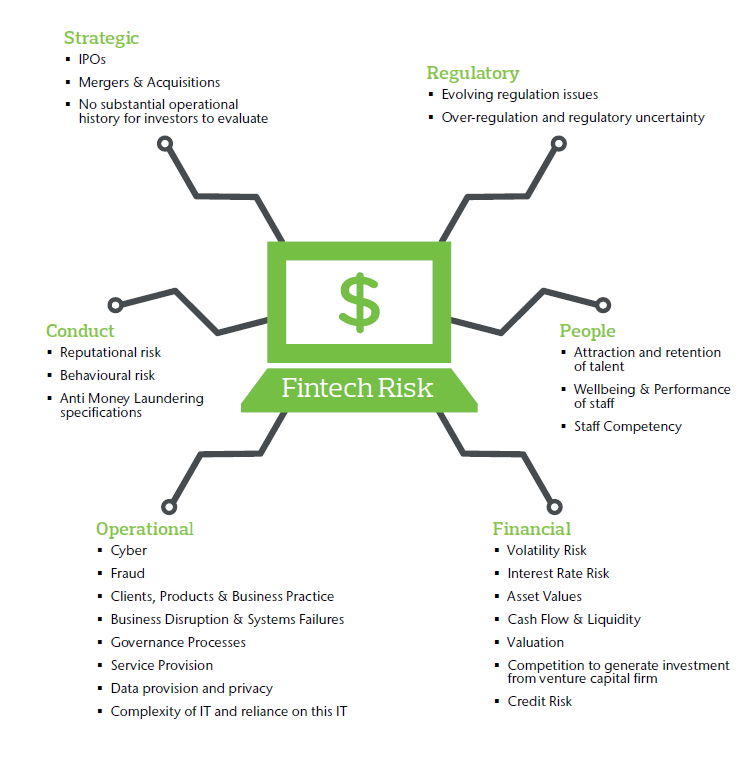

Under PSD2, TPPs have to comply with the Regulatory Technical Standards (RTS), with one of these stating that they will for the first time be legally obliged to buy insurance cover, which could be a big deal for startup founders who aren’t necessarily accustomed to purchasing cover.

This obligation raises a number of questions. For starters, what policy limits do FinTechs need to purchase? These of course vary significantly for each company, particularly since FinTechs can range from humble micro-businesses to unicorns such as TransferWise and Funding Circle with billion dollar valuations. Secondly, which TPP liabilities will actually be covered? These are largely covered under market standard products, but the right combination needs to be applied. PSD2 also means that FinTech companies are under a new level of regulatory scrutiny, and with that comes significant liability exposures.

It’s also an eye-opener for insurers, who have an opportunity to change how they approach clients if they want to attract FinTech founders – a new generation of digitally native business leaders, who mostly prefer to make purchases online.

Another challenge is providing suitable policies. FinTech throws a spanner in the works for insurers since ‘finance’ and ‘technology’ have tended to belong to different underwriters with different skill sets. The insurance market will need to respond quickly to these challenges if they want to attract FinTech clients, or perhaps partner with venture capitalists or accelerator firms to widen their distribution.

From disruptors to enablers

FinTechs are typically thought of as disruptors of the finance industry, however we have seen recently that they have increasingly taken on roles as facilitators or enablers for their corporate counterparts. For instance, almost half (47%) of UK financial services firms plan FinTech acquisitions over the 3-5 years, seeking to benefit from their technological advancements and data rather than having to overhaul their systems completely.

As PSD2 comes into force, we may see an interesting shift in the dynamic between FinTechs and corporates. The new directive will increase competition in the European market, which could accelerate the rate at which banks and other corporations snatch up FinTech startups in order to stay competitive. For FinTechs looking to work with or be acquired by large organisations, the need to be compliant under PSD2 and to have the right cover in place is all the more pertinent.

As Europe’s array of FinTech hotspots continue to develop rapidly, there is a growing opportunity for insurers to support them in fulfilling their PSD2 obligations. To do so, insurers and brokers will need to remain agile to meet the challenges and needs FinTechs present, and examine closely how those needs will evolve as the companies scale. At Aon, we are working closely with FinTechs to do just that.