Click here for printable version

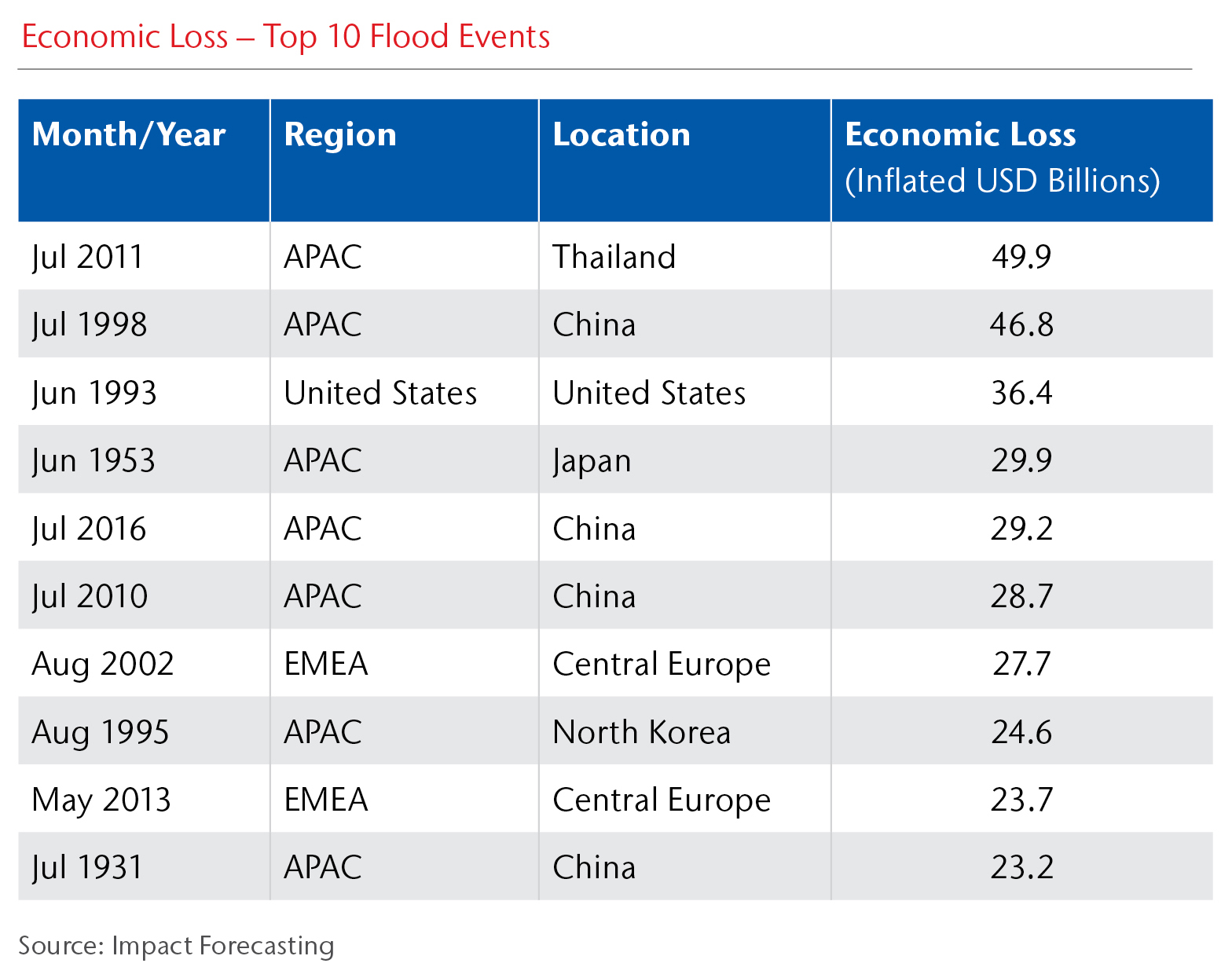

The risk of flood is prevalent all over the world, having caused almost USD550 billon of global economic damage over the past decade and leaving a huge impact on society. Although we can never fully protect ourselves from flood, the insurance industry plays a critical role in working with governments, businesses, and families to build resilient communities while underwriting profitability.

So how can a scientist’s perspective on flood help the insurance industry better prepare for this risk?

Dr. Petr Puncochar from Aon’s Impact Forecasting team tackles the topic by clarifying some common flood misconceptions between scientists and insurance professionals, explaining the pitfalls and benefits of modeling tools and, most critically, outlining the key opportunities to better understand this risk and build a more resilient future.

1. A flood is never just a flood: understand the basic hazard concepts

Despite many classifications of flood one fact remains common: it is a complex peril that takes four key forms – riverine, rainfall flooding, storm surge, and tsunami – which can occur simultaneously in extreme situations. Plus floods are often triggered by other perils such as earthquakes and hurricanes.

Despite many classifications of flood one fact remains common: it is a complex peril that takes four key forms – riverine, rainfall flooding, storm surge, and tsunami – which can occur simultaneously in extreme situations. Plus floods are often triggered by other perils such as earthquakes and hurricanes.

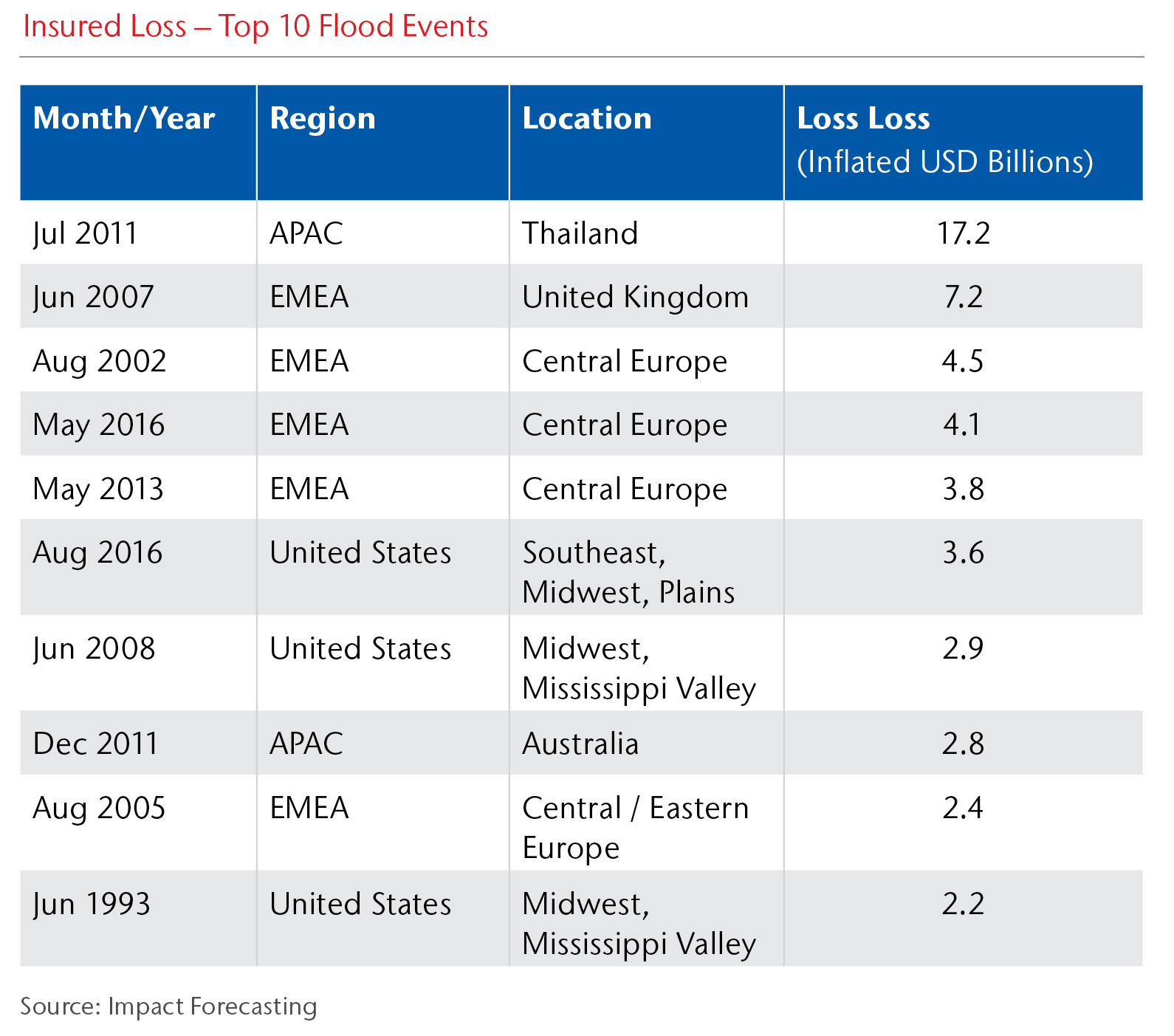

Riverine (fluvial) flooding is the most recognized type of flooding following an increased discharge and/or water level. Spatially, riverine flooding can occur both locally and across entire continental basins – such  as in Thailand in 2011, which remains the number one economic and insured flood loss in history. Flood models tend to solely focus on riverine flooding, but can be combined with other types, such as pluvial flooding or storm surge.

as in Thailand in 2011, which remains the number one economic and insured flood loss in history. Flood models tend to solely focus on riverine flooding, but can be combined with other types, such as pluvial flooding or storm surge.

Rainfall (pluvial, flash) flooding is caused by intensive rainfall, and is usually a short duration, which makes it difficult to predict and strongly limits its mitigation. Its accuracy today is significantly less than modeling the riverine hazard. Pluvial flooding in 2009 killed over 120 people in the normally arid area of Jeddah in Saudi Arabia.

Storm surge is the most common type of coastal flooding that is caused by a combination of low air pressure, water level uplift due to shear wind, high tide, and oscillating waves. Examples include the 1953 Netherlands event, which killed 1,836 people and caused widespread property damage, and the storm-surge caused by Hurricane Sandy, which impacted New York City in 2012.

Tsunami is a major threat to people living on coast with the overwhelming majority resulting from seabed displacement caused by earthquakes or submarine landslides. Recent tsunamis include the Boxing Day Tsunami of December 26, 2004 in the Indian Ocean, and the Tohoku tsunami from Japan in 2011.

So why is understanding this important? Insurers can use flood hazard knowledge to choose the correct tools to evaluate the risk and understand the nuances of the model outputs. Each flood type should be independently reviewed when setting or reviewing primary or reinsurance contract wordings.

Flood Frequency

A flood’s return period, or frequency, represents the likelihood of an event reaching or exceeding such a threshold within a certain period of time, with frequency being the return period’s inverse value.

vIn re/insurance, one must pay attention to differentiate between the return period of flood hazard (most commonly the flow) reached at one point of the river network, and the return period of flood loss that assigns the extremity of the financial cost of a flood event. Let’s use the example of flooding in Central Europe that impacts five countries. The combined return period of loss is assumed to be around 30 years; however, some observed flow values in Northern Austria exceeded 1,000 years as the return period of flood hazard is different at every segment of the river network.

So why is understanding this important? A lot of misunderstandings have occurred during discussions between re/insurance experts and hydrologists, and so there always needs to be a consensus.

2. Don’t be fooled by magnificent maps: pick the right tool to boost your flood risk understanding

Dozens of tools, datasets, and solutions exist that claim their absence will lead to substantial flood losses or bankruptcy! Finding a toolkit for effective flood risk management can be tricky and requires knowledge of key principles, what exactly certain data represent, and the limitations. Below is a shortlist to help clarify the different options when choosing the most effective tool for a re/insurer’s objectives:

Flood hazard maps are gridded datasets that show the spatial extent of flooding. These help to clarify which location/policy is floodable at a certain return period and by what flood hazard. Impact Forecasting provides sets of flood hazard maps with return periods of 1 in 20, 50, 100, 250, 500 and 1,000 years. For example, insurers can use its Thailand flood hazard maps to check the 1-in-100-year flood hazard for every location in Thailand and adjust premium accordingly.

Probabilistic catastrophe models are complex tools that quantify portfolio losses on synthetically generated realistic events. Traditionally used for reinsurance, the models have many additional uses, including detailed single risk assessments by insurers and simulating losses to understand the broader economic exposure for organizations such as governments, non-governmental organizations, and corporate companies.

Flood risk maps are a product of probabilistic catastrophe models and show the relative average annual loss (AAL) in each model grid cell. Relative AAL indicates the pure premium which needs to be charged to achieve a balanced flood portfolio. There needs to be sets of risk maps for different physical policy characteristics.

Underwriting platforms support primary underwriting by overlaying a single policy over a flood hazard or risk map and accessing the underlying hazard or risk value. Some platforms allow accumulation analyses to evaluate underwriting strategy on an entire portfolio. Underwriting platforms could exist as a stand-alone application or as a web-based system.

Loss calculation platforms provide the ability to run any catastrophe model through Monte-Carlo simulations and estimate financial loss based on an entire insured portfolio. Platforms must be robust enough to apply all possible insured conditions, provide detailed results, or analyze modeling uncertainties.

Case study: How accurate are these modeling outputs?

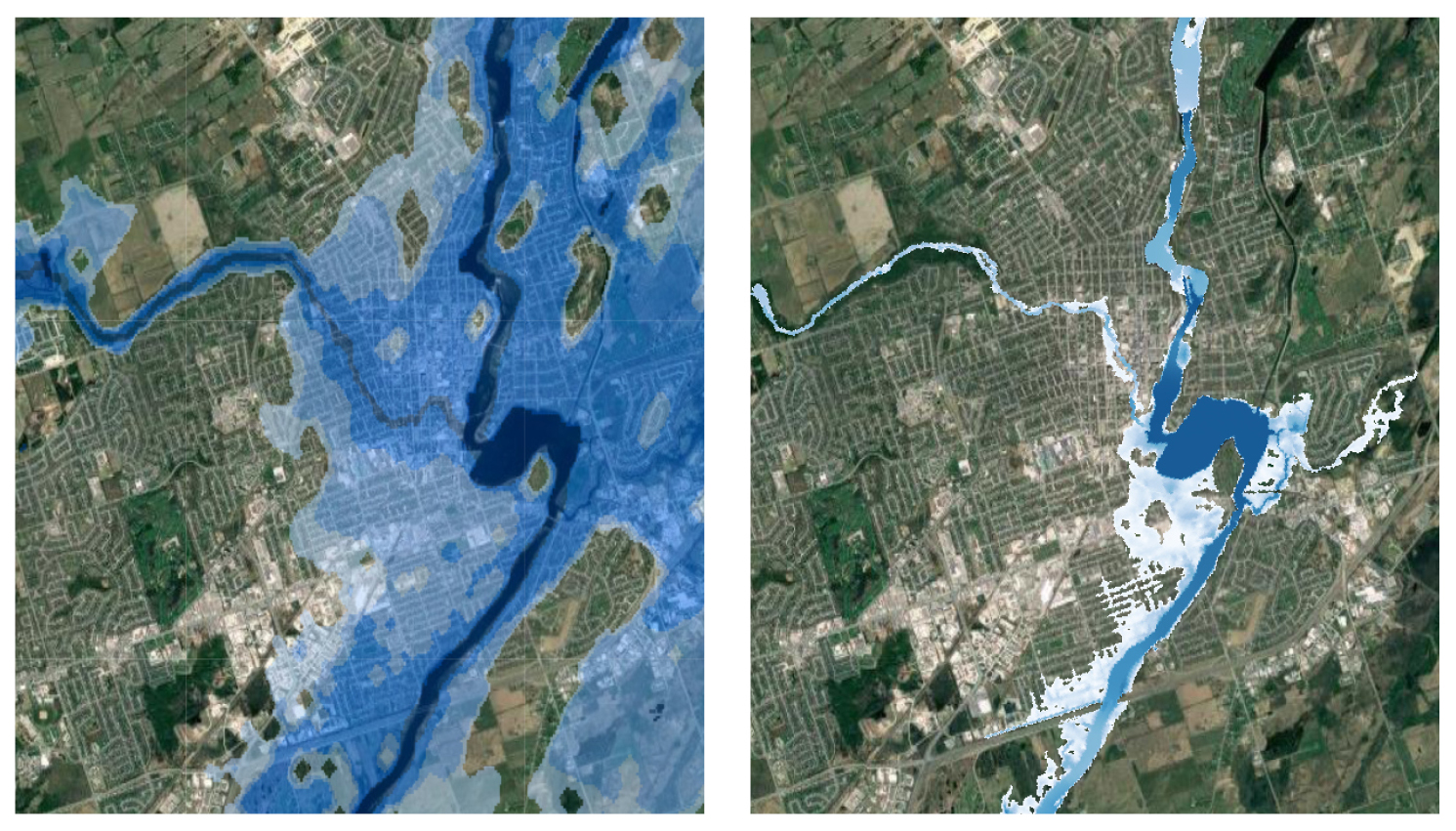

There can be substantial differences in flood hazard maps for the same location due to different methods and datasets. People tend to trust outputs of mathematical simulations, particularly if it is nicely visualized, but these can be misleading and need to be de-mystified. The accuracy highly depends on the underlying hydrological and spatial data, which methods were used to model the hazard, and what flood type the output represents.

True or false? These maps both claim to show a 1-in-500-year flood hazard map representing riverine flooding in Canada. However, the image on the left is calculated via a simplified methodology and based on crude spatial data so has grossly overestimated the flood risk. The image on the right provides a more credible representation, based on a higher terrain resolution and advanced hydro-dynamic simulations.

Through more detailed modeling such as this, inhabitants avoid being charged very high premiums or being refused any insurance protection at all.

3. Flood insurance buying is in your hands: use science to boost your customers’ protection

There is a surprising fact: everyone knows what flooding means, but the results of several questionnaires (including one example conducted for the National Flood Insurance Program) in the U.S., show only a minority of people know if their insurance covers this peril and if so, what specific type. This situation has resulted from a range of contract wordings that insurers have developed in various geographies over the years. These often limit protection to specific and rare types of flood losses, such as sewage back-up policies in Canada or extremely low limits in Austria that rarely cover the costs for a basic clean-up. This has led to a large difference in flood insurance penetration in various countries or even individual regions. For example, in Germany, Bremen has only 19 percent penetration, but Baden Wuerttemberg reaches 94 percent.

In many countries, such as the Netherlands and recently Canada, flood insurance has either not been available or has been absent for key occupancy lines, passing substantial risk to local government. This has changed in Canada after significant flooding in 2013 which created opportunities for insurance companies to offer comprehensive products.

For markets where flood insurance exists, including Switzerland and France, country-wide policies still use the flat tariffs regardless of where the insured risk is located. Meanwhile, in markets such as Austria, Australia, Canada, and the U.S., we have seen more advanced systems providing guidelines on avoiding the highest risks, and providing an indication of the flood premium to be charged. In general, the higher the flood insurance penetration, the more advanced systems are applied by insurers to understand and price the flood risk.

Based on recent serious flood events in Europe (2002, 2005, 2013), the U.S. (2005, 2012, 2017, 2018), Australia, Japan and Thailand (2011) and Canada (2013), families, communities, and companies are increasingly demanding a holistic weather risk insurance protection.

Now is the right time for the insurance industry to step-up and start offering this comprehensive flood cover – without taking significant additional risk – based on advanced analytical tools, to increase insurers’ underwriting confidence.

4. Join the model evolution from reinsurance to regulation: don’t miss out on these strategic tools

Since the 1990’s, the use of catastrophe models has evolved from reinsurance buying to shaping insurers’ strategies and enterprise risk management. Due to the ever-increasing value of modeled results – resulting from more granular data, advanced technology, and skilled modelers – these analytics are now reviewed and assessed by global rating agencies and regulators of financial markets.

For example, EIOPA’s Solvency II regulation requires companies to hold solvency capital to withstand a 1-in-200-year loss, stating: “The use of catastrophe models can help to decrease the solvency capital requirement and provide better flood risk understanding which can be potentially optimized.”

Similar strategies, often called and judged as Solvency II equivalents, now exist in multiple countries, such as Japan, the U.S., Bermuda, Australia, and many others. From a scientist’s perspective, it is encouraging to see the influence of catastrophe models is spreading as a strategic part of an insurer’s toolkit.

However, the key learning to keep in mind is where multiple flood (or other catastrophe) models exist, the user faces an important decision over which model to select for their needs, and which best reflects their firm’s own view of risk. Advanced expertise or model evaluation is crucial before making any decisions or ‘blending’ several model outputs into one exceedance probability curve. Again, the exact knowledge of model coverage is essential to make sure all aspects and missing flood sub-types are handled correctly, and the purchased protection is effective and reliable.

5. Climate change and the protection gap are buzz words for a reason: turn flood threats into opportunities for resilience and growth

Mitigating the impacts of climate change

The insurance industry, as a key risk transfer mechanism, can partially manage the negative effects of climate change by offering products to increase insurance penetration and build appetite, while using data and analytics to better understand the risk.

Rising temperatures and changing spatial and temporal patterns of rainfall can significantly alter hydrological cycles and flood regimes across the globe, although the impacts differ substantially from region to region. Studies have shown that the increase of flood frequency and intensity could be likely in regions such as Southeast Asia, India, and Eastern Africa. Increased risk of flash flooding associated with summer storm rainfall has been seen across developed countries in North America and Europe. Rising sea levels also pose a significant threat for low-lying regions through enhanced coastal flooding risk. Jakarta, with its soil subsidence, is fighting against time to complete a large construction project to protect the city from increasing storm surge risk.

Increased flood risk is not necessarily connected to changes in annual rainfall amounts, but rather to its distribution throughout the year. For example, developed markets such as the U.S. and Europe face a probable increase in the amount of precipitation falling during extreme rainfall events, but on the other hand, prolonged rainfall deficits are observed and projected. However, it is always worth noting that global increases in flood-related insured losses cannot be attributed solely to climate change. Socio-economic changes, such as population increase, economic growth, and in-floodplain development are among the main drivers of rising global catastrophe losses.

Flood insurance can locally become less available or affordable, particularly in the most exposed regions. The fact that the largest protection gap now exists in regions most prone to severe future impacts signifies an important challenge for various stakeholders, including local governments. Access to flood insurance will be determined not only by changing risk, but also by adaptation measures and the way in which societies ensure sustainable socio-economic development.

Bridging the Protection Gap: the role of flood models

Probabilistic catastrophe models and their underlying data hold key information about hydrological and flood regimes – therefore offering analytical tools that could trigger new insights and product opportunities. This is of vital importance in many developing countries with insufficient insurance penetration – and even in more mature markets such as the U.S. where we saw a lack of flood insurance after Hurricane Harvey.

Models will be a key starting point for governmental schemes and public-private partnerships to provide reliable and long-term insurance protection. In addition, with the increasing popularity of parametric insurance and insurance linked securities, catastrophe models are increasingly being used to not only design the parametric triggers for specific programmes, but also provide related pricing.

Some final take-aways…

- Always remember that flood, as an extreme natural phenomenon, will have modeling limitations, but understanding these will unlock more meaningful insights.

- There is a plethora of solutions for effective flood loss modeling and quantification but companies that invest in their understanding of each product’s strengths and limitations – plus how the tools fit into their existing workflows – will benefit from a strategic advantage.

- Even if there is no flood product for your territory, models today can be efficiently developed and tailored to your individual needs to ensure that you can take a more scientific approach to understanding and mitigating against this risk.

- There is an ongoing trend in the insurance industry to offer a broader, more holistic coverage for homeowners and businesses – but it does not have to bring additional risk if it is efficiently quantified via modern analytical solutions.

- Flood maps and models have many more uses than often described: keep an open-mind and discover a host of new opportunities where science can help achieve growth for insurers while building more flood-resilient communities.

About the Author

Petr Punčochář is responsible for Impact Forecasting’s international flood model development. Achievements include implementing new workflows and methodologies, delivering flood projects in new territories and building links between academic/technical expertise and re/insurance industry. Additionally, Petr provides general methodological and technical insights on hydrology, open channel hydraulics, geographical information systems and remote sensing systems. Petr has a PhD in hydrology and open-channel hydraulics from the Czech Technical University.