Mutual Insurance

Mutual Insurers are facing considerable opportunities and challenges: competitive pressures and the generation of healthy growth, the need to operate efficiently, compliance with evolving regulatory and rating agency standards, and the impact of social media and internet marketing.

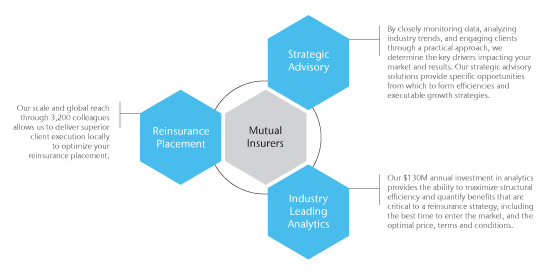

Companies that proactively address these issues will gain a competitive advantage and prosper for the long term. We have a proven track record of delivering customized, specific solutions to meet the business objectives and unique coverage needs of mutual insurers.

We have a substantial participation in the mutual marketplace going back many years and has learned from our clients that providing distinctive, tailored value both in terms of their reinsurance and across their operational objectives is key to achieving a successful partnership.

Growth strategies – protect and add to your business

- New products and services for your customers

- Granular, customized market intelligence and access to “big data”

- Opportunity sizing and competitor assessment

- Evaluation of distribution channels, regulatory considerations, and opportunity economics

Industry leading analytics – partner with the industry’s largest investor in data and analytics

- Predictive modeling

- Portfolio optimization

- Catastrophe management

Capital solutions – innovative answers to old questions