Fortune Favors the Fittest

The Industry Divide

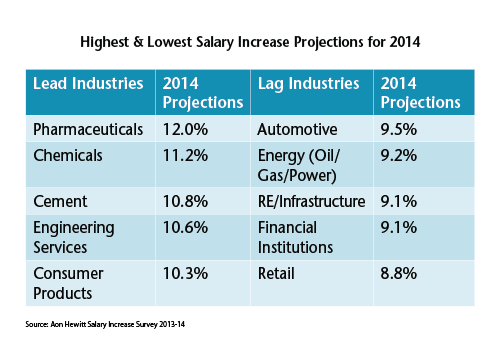

Sectors largely reliant on domestic economy such as

pharmaceuticals, chemicals, engineering services and

consumer goods, are projecting the highest salary increases,

typically above 10% for 2013-14. In these industries,

compensation costs represent a smaller percentage of the

total cost structure. However, the cautious streak is evident

as projections for 2014 have reduced by an average of 30

basis points from the actual increases provided in 2013 by

these industries.

Service industries like retail, financial services, and

hospitality bring up the rear in salary increase projections,

with these businesses impacted by the slowing down of

the economy and consumer spending. In these industries,

compensation costs are a significant portion of their total

cost structure, thus managing salary costs has become an

important element in their overall cost management strategy.

It is important to note that the dispersion between

the highest paying and the lowest paying industries has

narrowed in 2014 to about 2-3%, as compared to the 5-7% dispersion observed in 2013. This can largely be attributed

to the year being marked by high inflation, resulting in

companies protecting the minimum salary increase being

provided to employees to help set off this impact.

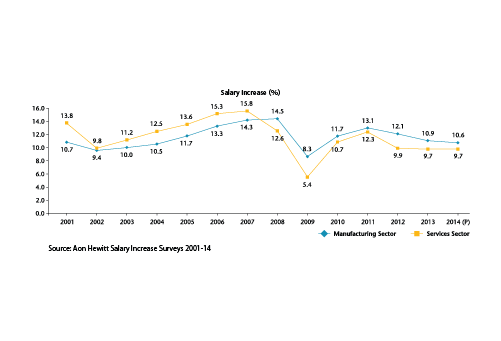

In fact, on further analyzing sectoral patterns in salary

increases across the last 14 years or so, it is evident that

increases in the manufacturing sector have remained fairly

stable. It is however, the increases in the services sector

that have reduced significantly in the period post the

global financial crisis. These are industries which have high

compensation costs as a percentage of revenue and hence

have been reducing

Top Talent to Thrive

With concerns over fluctuating economic conditions, India

Inc. turned to the Darwinian principal of natural selection;

‘only the strong shall survive’. With shrinking salary

increase budgets, the one definitive change observed in

the compensation philosophy of organizations in India

is the increased reinforcement of the performance and

rewards linkage. Top performers are projected to receive

an average 15.3% increase in 2014, almost 1.7 times

the average increment provided to employees meeting

expectations. Industries with the highest differentiation in

salary increases between a top and average performer are

telecom, retail and financial institutions (1.8:1), where

individual performance has a far bigger impact on business

performance. On the other hand, capital-intensive

industries such as energy, infrastructure and chemicals

reported the lowest differentiation (1.5:1 & 1.6:1) in salary

increases between a top and average performer.

Organizations are also ready to re-define what it takes

to be a top performer and ensure that the entry into this

|