Fortune Favors the Fittest

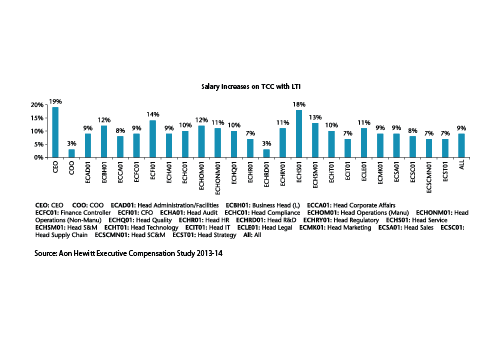

The CEO position analysed approximately 112

incumbents showing an average increase of 10% on fixed

pay, 13% on fixed + variable and 19% on fixed + variable

+ LTI. This indicates an increasing focus on loading

compensation on performance and variable payments

thereby providing executives an opportunity to earn higher

on meeting and exceeding set performance targets.

Another interesting observation is an increase in

the number of companies benchmarking executive

compensation on anchors including annual variable pay

and long-term pay by 15% and 27% respectively over the

previous year. This reflects the increasing importance of

these elements while comparing market pay levels and to

arrive at the realistic pay differentials to the market and to

the peer group.

The regulations around pay for performance as well

as investor and shareholder activism in India is gradually

picking up pace. Promoters and shareholders are increasingly

voicing their concern over disproportionate increase in

the levels of pay to executives in light of actual financial

performance. Over the last quarter, there is a sudden splurge

of companies moving towards business performance linkage

during their discussions on executive pay increase. The study

indicates that 53% of the participants in the survey are either

in talks to change their compensation structures or have

implemented a performance and retention-based plan to

counter disproportionate disbursement of compensation to

top executives.

Regulations around pay for

performance as well as investor

and shareholder activism in India

is gradually picking up pace.

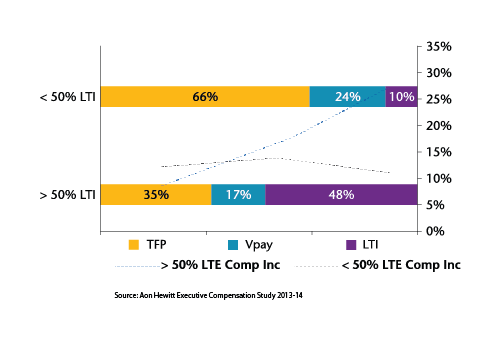

In the current year, we noted a far greater focus

on long-term pay than on annual incentives - while

certain industries such as banking have had regulatory

requirements drive this change, a wide variety of other

industries also seem to be adopting a greater focus to

incentives being delivered over 3-4 years than through

annual incentives. In fact, the study noted a direct

correlation between higher compensation increases and

higher mix of short and long-term variable components in

pay. This is presented in the chart below.

Companies where significant portion of compensation

is being delivered through variable components (short and

long-term incentives >50% of total compensation) showed

an average salary increase of 20% compared to companies

where pay mix is skewed towards fixed payments. This

compensation increase factor again gets loaded more onto

the long-term component than the annual component of

pay. We note that mature Indian companies are raising the

|