Fortune Favors the Fittest

bar for future performance along with linking it to higher

compensation for its executives if targets are achieved.

Increased Correlation with Business Fundamentals

Correlation between executive remuneration and

underlying business fundamentals is a highly debated

conversation not just in the developing countries but

also in the developed economies of the west. In India,

this has been under significant scrutiny over the last few

years and it appears that Remuneration Committees are

becoming more aware of this issue while determining

executive pay levels.

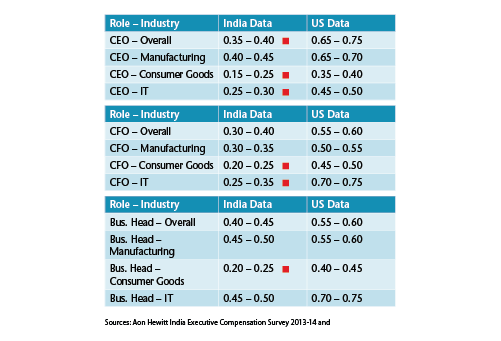

The correlation factor for the CEO compensation

with the size of the business (revenue and turnover)

has improved from 28% last year to 40% in the current

year's analysis covering over 190 Indian CEOs. However, it

may be noted that the mathematical correlation between

executive pay in India with business fundamentals is far

lower compared to global standards - the values are less

than half the global levels. The R square factors between

compensation and revenue for the US-based CEOs are

0.60 on Total Annual Compensation and 0.75 on Total

Compensation including long-term incentives. The

following table provides a broad analysis of these correlation

factors (compensation costs with revenue size) seen in India

and the US for certain critical positions across key sectors:

Mathematical correlation between

executive pay in India with

business fundamentals is far lower

compared to global standards.

Increase in correlation factors signifies an increased

linkage between the compensation levels and the

underlying business fundamentals and also shows greater

alignment with performance.

Measuring Executive Performance

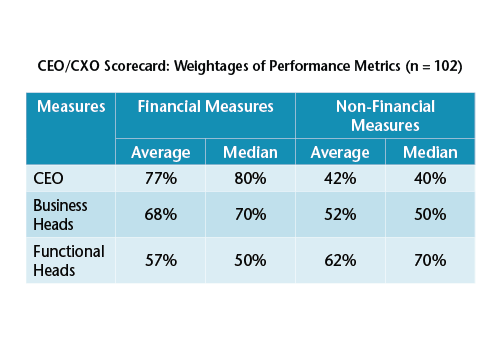

We have talked about an increased prevalence of performance

to pay relationship, but what would it take to measure the

executive performance? The Aon Hewitt study captures and

closely analyses the performance metrics for executives. The

following table shows the categorisation of performance

anchors into financial and non-financial measures. The higher

financial measure linkages are seen for the CEO as well as the

business heads, while non-financial measures tend to be more

important for functional positions.

CEO/CXO Scorecard: Weightages of Performance Metrics (n = 102)

The performance measures are in principle similar to

those seen for larger developed economies with financial

measures being focused around profitability, revenue,

and cash flow measures along with strategic initiatives.

Non-financial measures are typically around service,

quality, customer and employee-related matters.

The performance measures are in principle similar to

those seen for larger developed economies with financial

measures being focused around profitability, revenue,

and cash flow measures along with strategic initiatives.

Non-financial measures are typically around service,

quality, customer and employee-related matters.

Despite differences expected in the way performance

might be evaluated in different businesses of different

sizes, the study couldn't identify any specific trends based

on sector, ownership or size. The broader buckets for

measuring performance remained similar to the overall

trends noted by us above.

|