Record number of transactions of over £1 billion takes bulk annuity market to new heights

LONDON (21 October 2019) - Aon plc (NYSE:AON), a leading global professional services firm providing a broad range of risk, retirement and health solutions, has said that over £25 billion of pension scheme risk has been transferred to the insurance market already in 2019 through the eight largest bulk annuity transactions alone.

2019 is shaping up to be yet another record-breaking year for risk settlement, with Aon’s analysis concluding that over £25 billion of this has come from just the eight largest transactions. The volume of pension scheme liability transferred to insurers from these transactions alone exceeds the previous annual record for total bulk annuity market volumes - 2018’s £24.2 billion which covered over 160 transactions. Further large transactions are likely to be announced before the end of the year and yet more are anticipated in what is expected to be a very busy start to 2020.

Mike Edwards, partner at Aon, said:

“2019 has seen a number of records broken in the bulk annuity market including the largest ever transaction, with telent’s £4.7 billion buyout, and the largest scheme to use buy-ins to manage risk to date, the National Grid UK Pension Scheme. These transactions demonstrate the growing scope in the market for large pension schemes to implement bespoke de-risking solutions – a situation that is increasingly prompting others to follow suit.

“We have observed a significant shift in 2019 with the market for large transactions becoming increasingly dynamic, and – as we have always suggested – schemes needing to be prepared to respond ever more quickly if they are to capture the best commercial opportunities.”

Stephen Purves, partner at Aon, added:

"Aon has been at the forefront of the recent surge in market demand – we have advised on £20 billion of completed buy-ins and buyouts so far in 2019. But we are also cognisant of the implications for the rest of the market; large transactions create obvious challenges by absorbing insurer capacity, so presenting deals to the insurers in the right way - often using streamlined approaches - will help smaller schemes compete for insurer attention in a busy marketplace."

Notes to Editors

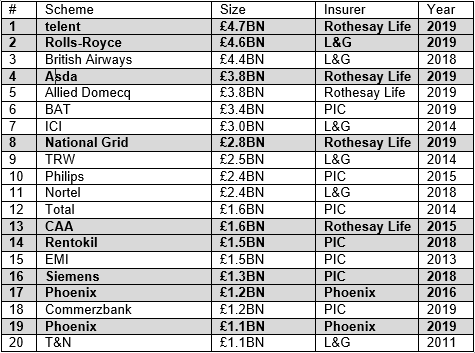

The table below shows the 20 largest UK bulk annuity transactions completed in the UK to date. Transactions where Aon was lead adviser are highlighted in bold:

Media Contact

Colin Mayes

Aon

07801 748138

[email protected]

Tommy Cooper

Kekst CNC

07983 921719

[email protected]

Notes to Editors

About Aon

Aon plc (NYSE:AON) is a leading global professional services firm providing a broad range of risk, retirement and health solutions. Our 50,000 colleagues in 120 countries empower results for clients by using proprietary data and analytics to deliver insights that reduce volatility and improve performance.

Aon announced in May 2018 it will retire the business unit brands of Aon Benfield and Aon Risk Solutions, which follows the retirement of the Aon Hewitt business unit brand in 2017. This move was designed to increase the rate of innovation across the firm and make it easier for colleagues to work together to bring the best of Aon to clients. Aon has five specific global solution lines: Commercial Risk Solutions, Reinsurance Solutions, Retirement Solutions, Health Solutions and Data & Analytic Services.

Follow Aon on Twitter: @AonRetirementUK

Sign up for News Alerts: http://aon.mediaroom.com/index.php?s=58