LONDON, 4 January 2021 – Aon plc (NYSE: AON), a leading global professional services firm providing a broad range of risk, retirement and health solutions, has said that it expects the UK risk settlement market to continue to thrive in 2021. However, significant growth will depend on the number of ‘jumbo’ transactions taking place and on the speed at which the market for commercial consolidation develops.

Activity in the settlement market during 2020 was defined by the need to manage the effect of COVID-19 across volatile financial markets, uncertainty around longevity considerations and the changeable appetite of providers. Despite this, the market was remarkably resilient, with over £50 billion of pension scheme liabilities transferred to insurers and reinsurers, across both bulk annuities and longevity swaps. As well as this, there were significant developments in the market for commercial consolidation, with the launch of an interim regulatory framework from the Pensions Regulator in June which paves the way for schemes to consider consolidators as a serious endgame option.

Martin Bird, senior partner and head of Risk Settlement at Aon, said, “Some of the economic uncertainty, driven by Brexit and the ongoing COVID-19 pandemic, means that schemes will need to take a robust approach to get settlement transactions over the line in 2021. But we can be certain that there will inevitably be attractive pricing opportunities due to intermittent periods of market volatility and heightened provider appetite.

“We are currently working with a number of schemes which are already in the market looking for these opportunities. They are ‘transaction ready’ and consequently, able to move quickly.”

Bulk annuity market more attractive than ever in 2021 for small and mid-size transactions

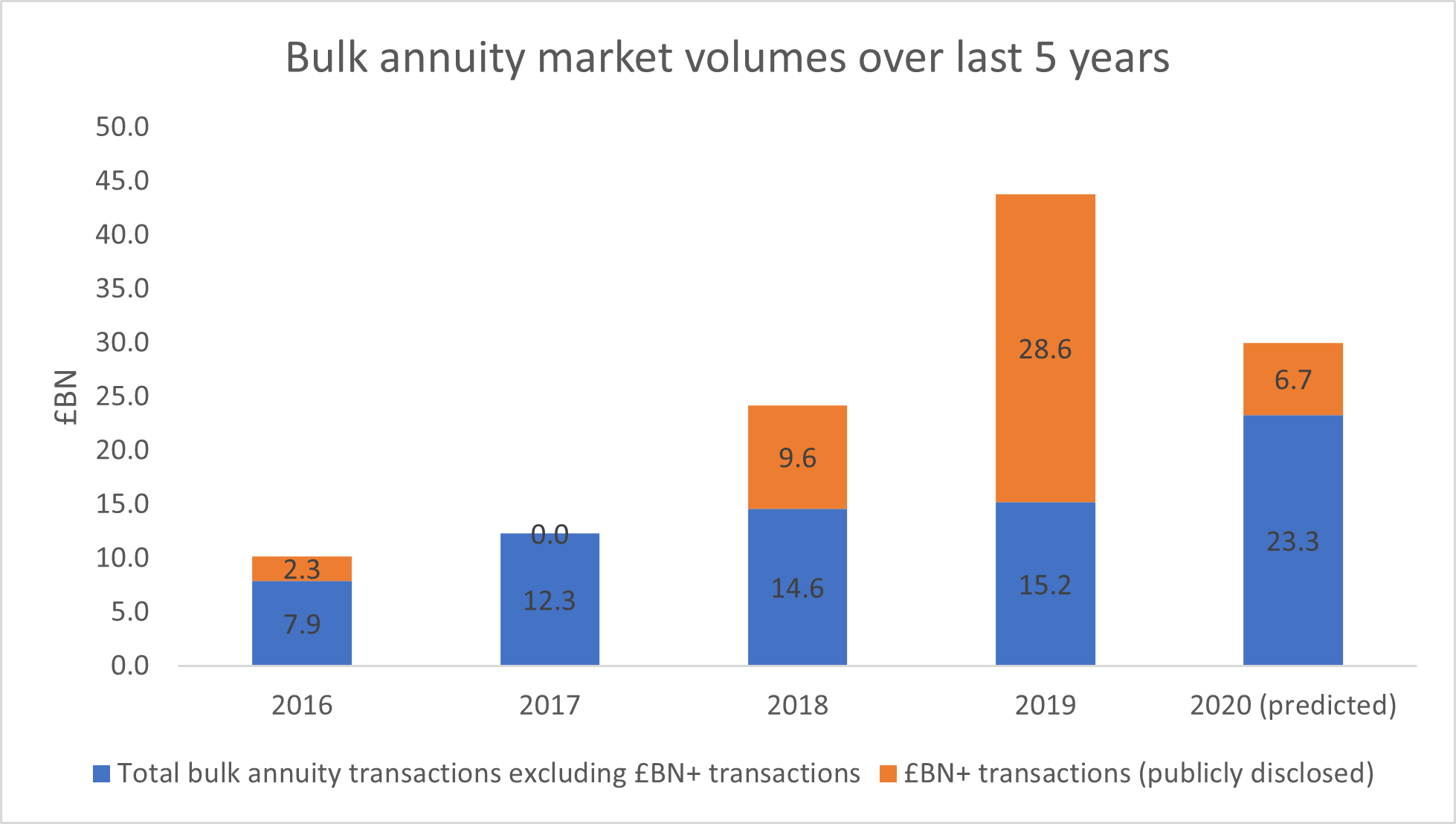

Mike Edwards, partner in Aon’s Risk Settlement team said: “Overall volumes in 2020 were lower than 2019, but we saw massive growth in the bulk annuity market for all but the largest transactions, with around a 50% increase in the volume of transactions below £1 billion in size. For smaller and mid-sized schemes this was driven by the emergence of better streamlined transaction processes, making them more appealing to insurers. We saw attractive pricing over the whole year as insurers looked to fill the void in volume targets left by a lack of ‘mega-deals’.

“Now in 2021, we anticipate strong appetite from insurers and reinsurers to grow the market further. We also expect there to be attractive opportunities for schemes of all sizes, with flexibility and nimbleness again being key themes. While many insurers continue to have the greatest appetite for billion pound-plus transactions, we expect that overall capacity in the market will be £30 billion to £40 billion, with a number of insurers looking to increase market share. However, overall volumes will, as always, be driven by the number of large transactions.”

Schemes will have to work harder in 2021 to stand out in a busy longevity swap market

Hannah Brinton, principal consultant in Aon’s Risk Settlement team, said: “In 2020 we saw a general change in attitude from pension schemes towards longevity risk, with more schemes prioritising its mitigation.

”Due to the combination of a wider than ever range of structuring options being available to schemes and increased capacity and appetite from the reinsurance market, the dynamics are currently very attractive for schemes wishing to pursue longevity swaps.”

“But reinsurers have finite pricing resources and they are increasingly having to select and prioritise transactions in much the same way as we’ve seen in the bulk annuity market. Now, more than ever, and to maximise reinsurer interest, schemes need to approach the reinsurance market with a clear strategy and objectives, as well as being thoroughly prepared from a data perspective.”

Commercial consolidation market - open for business in 2021

Karen Gainsford, principal consultant in Aon’s Risk Settlement team, said: “We saw significant interest in consolidation options from pension schemes in the second half of 2020 and we fully expect that the first commercial consolidator transaction will take place in 2021.

“The bigger question is how successful the consolidators will be at achieving scale and how quickly this may happen. A common theme in 2020 was of keen interest among pension schemes but a reluctance to be a first mover. Once the first deals occur and the concept is proven, it is entirely possible that we could see the floodgates open to superfund transactions in 2021.”

About Aon

Aon plc (NYSE:AON) is a leading global professional services firm providing a broad range of risk, retirement and health solutions. Our 50,000 colleagues in 120 countries empower results for clients by using proprietary data and analytics to deliver insights that reduce volatility and improve performance.

Follow Aon on Twitter

Stay up to date by visiting the Aon Newsroom and hear from Aon’s expert advisers in The One Brief.

Sign up for News Alerts here

Media Contacts

Colin Mayes

Aon

Phone: +44 (0)7801 748138

Email: [email protected]

James Hartwell

Kekst CNC

Phone: +44 (0)7870 487532

Email: [email protected]