IFRS 9 – New Way of Quantifying Credit Risk

IFRS Accounting Standards have been launched as an initiative to harmonize accounting standards across the European Union. They aim to increase transparency and comparability of company’s financial accounts. These standards have now been adopted by many countries across the globe, except the USA.

IFRS has to be applied by companies that have their securities traded in a regulated market. That means that it does not mandatorily apply to most small and medium sized companies. The increased transparency comes at a cost of increased volatility of a company’s results. Aon Trade Credit solutions help the client quantify, optimise and coordinate the outcome of change conduct.

IFRS 9 - Financial Instruments

Recognition and measurement, impairment, de-recognition and general hedge accounting

The new IFRS 9 and equivalent US GAAP rules (ASU 2016-13), effective January 2018, are aimed at increasing the accuracy and transparency of how credit risk is represented on a company’s Balance Sheet and P&L. For companies that are not Financial Institutions, this is mostly about the valuation of Accounts Receivable on the Balance Sheet and the resulting impairment results on the P&L. Both new standards include requirements around the use of both historic as well as forward looking credit information in order to calculate the provisions for credit losses (Expected Credit Losses).

- Under the new regulations, companies will have to start making bad debt provisions for possible future credit losses in the first reporting period – even if it is highly likely that the asset will be fully collectible.

- IFRS 9 requires an entity to base its measurement of expected credit losses on reasonable and supportable information that is available without undue cost or effort, including historical, current and forecast information.

- Expected Credit Losses (ECL) is a probability weighted estimate of a credit loss. The ECL should be forward looking and consider current and future projections, not solely historical data. The ECL has to be revised if any new information is made available.

The above means that the increased transparency comes at a cost of increased volatility of a company’s results, mostly due to the impairment of the Accounts Receivable on the Balance Sheet.

Challenges for corporates

Currently companies often make very limited provisions for receivables that are not yet overdue. That will have to change in the future, as companies will need to recognize expected credit losses (ECL) in their financial statements on all of their receivables. The estimation of the ECL should be ‘forward looking’ as opposed to relying on historic data as is most often the case today. ECL estimates should be updated every reporting period.

In focus

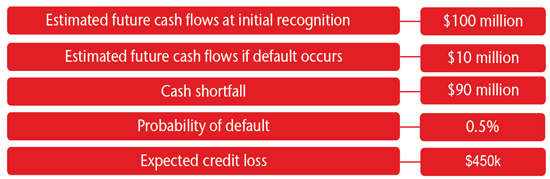

The ECLs are calculated by: i) identifying scenarios in which a receivable (or loan) defaults; ii) estimating the cash shortfall that would be incurred in each scenario if a default were to happen; iii) multiplying that loss by the probability of the default happening; and (iv) summing the results of all such possible default events.

For ease of illustration this example assumes only one default scenario. Under the accounting standards, companies would need to model multiple scenarios in order to define the right bad debt provision levels.

Example: Related Credit Solutions

ABC Corporation is planning for the implementation of the accounting standard changes and it is likely that the provisioning of doubtful receivable will increase as compared to current levels, especially due to the fact that probabilities of default will need to be applied across the trade receivables ledger. ABC Corporation is looking for opportunities around balance sheet optimization, reporting efficiencies and cost savings.

How may credit solutions help ABC Corporation?

- Quantifying the (new) amount of trade provisions required. Aon has experience in modelling expected credit losses based on client information available.

- Optimizing the credit risks. Our teams can perform actuarial analysis to help assess the financial statements impact of purchasing credit insurance. This would include considerations around optimal structure and potential costs.

- Coordinating with your auditors. Aon teams have experience in communicating on credit risk financial statement treatment with our clients’ external auditing firms.

Risk modelling illustration

Read our report on Trading Perspectives: