"The D&O market hasn't got any easier."

Those were the opening remarks from Aon’s Oliver Wheeler, D&O Practice Leader as he sketched out a picture of rising prices and shrinking Insurer capacity in the D&O market at Aon’s quarterly D&O pulse webinar.

Why do we need D&O Insurance?

Every Director and Manager, from Human Resource to Business Operations need to take an acute interest in their organisations D&O coverages, more especially in this volatile climate. D&O provides an additional layer of cover for a companies’ most important asset, it’s people, in addition to the traditional employee benefit covers.

Aon have a deep understanding and expertise of placing D&O covers for clients. We run effective communication strategies with Insurers and with our increasing market presence, we will work with clients towards maximising cover at optimal premium cost during these challenging times.

What is covered under D&O Insurance?

The core purpose of a D&O policy is to provide financial protection for managers against the consequences of actual or alleged “wrongful acts” when acting in the scope of their managerial duties. The intention is that the D&O policy will pay for defence costs and financial losses. In addition, extensions to many D&O policies may cover costs for managers generated by administrative and criminal proceedings or during investigations by regulators or criminal prosecutors.

Generally, coverage extensions are gaining increased importance among company directors. Providing opportunities for managers to receive wider, integrated cover offering a reliable, consistent and robust legal defence.

Climate of Claims

Now is a climate of claims against directors which is making uncomfortable reading. Either due to a regulatory breach, the fall out after a large cyber-attack or corporate resource challenges, the focus on personal accountability at board level is unyielding.

D&O liability insurance provides protection for senior management in the event that they are the subject of a claim or investigation arising from the performance of their duties at their company. For the directors, a policy provides personal asset protection should the employer’s indemnification fail for any reason. For the company, a policy provides balance sheet protection where the company has indemnified its directors.

Considerations for purchase of D&O cover

Directors and Senior Managers can face a wide range of claims relating to their role duties within the company. Within the environment today, claims may arise from:

- Government and Regulators

- Shareholders

- Company

- Liquidators

- Competitors

Structure of D&O Insurance:

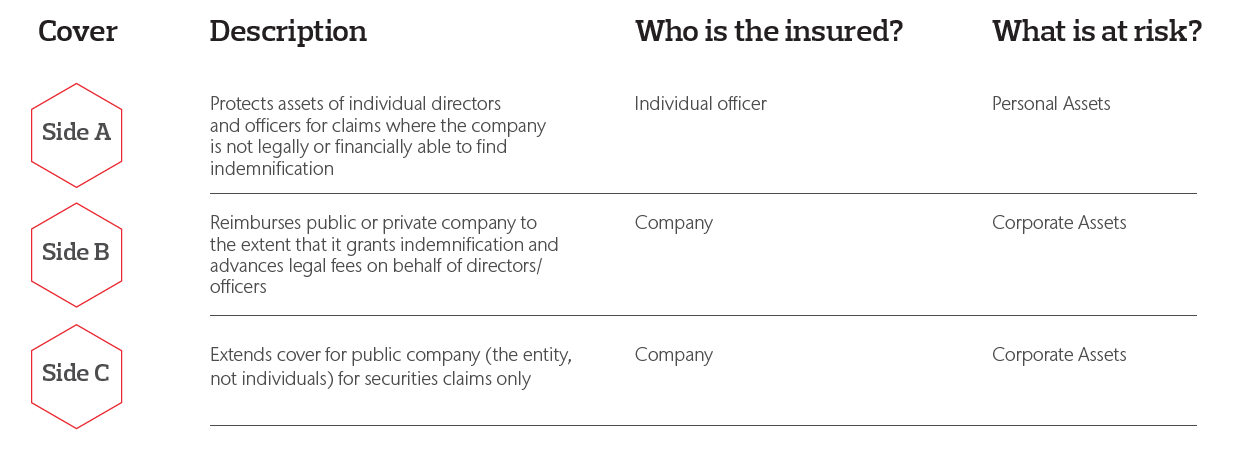

Cover Sides: A, B and C - D&O Insurance Structure

Generally, the structure of a D&O insurance policy is dependent on which of three insuring agreements are purchased. ABC are standard form policies for publicly listed companies; for private or non-profit companies, only AB policies would be used.

*Subject to terms and conditions of the insurance policy

Aon UK Limited is authorised and regulated by the Financial Conduct Authority. Aon UK Limited. Registered in England and Wales. Registered number: 00210725. Registered Office: The Aon Centre, Leadenhall Bulding, 122 Leadenhall Street, London EC3V 4AN. Tel: 020 7623 5500.

FPNAT526