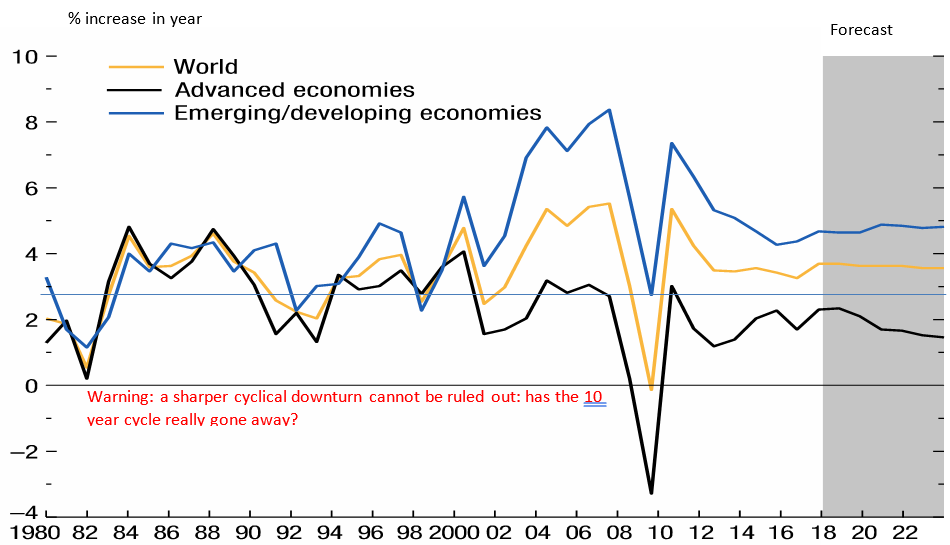

Global economic activity is slowing down. After peaking in 2017 post-crisis at an annual rate of about 3.8% (measured in purchasing power so adjusted to take account of inflation differences between countries), growth in 2019 looks like it will ease back to 3.5%. Such a pace will equal the post-recession low seen in 2012. Looking at global growth over the last 40 years (see chart 1), shows that a sharp deceleration in activity occurs every decade or so. On that basis, a sharper downturn than the one being forecast at some point in the next three years may be odds on, as the projected slowdown is not on a scale that matches that of the ten-year cycle.

Slowdown intensifies

Worryingly, the global slowdown has intensified since the second half of 2018. Output has slowed in the euro area. After averaging 0.7% per quarter in 2017, euro area growth was just 0.2% in Q4 2018, reflecting a sharp deceleration in Germany as its auto sector sales drop sharply. Growth in China eased back, from 1.7% a quarter in 2017 to 1.5% in Q4 2018. Recent data shows that US growth in the last few months has been decelerating. For Japan, economic output contracted by 0.6% in Q3 2018, while the pace of expansion eased in India and Russia during the year.

UK economic activity was recorded at 0.6% in Q3 2018, but preliminary figures show that its pace slowed to 0.3% in Q4. In its latest report, the Bank of England forecasts an expansion of just 0.2% in GDP in the first quarter of 2019 and 1.2% for the full year, down from a prediction of 1.9% as recently as November.

But the excellent news shown in the chart is that the world economy has not experienced an outright fall in growth at any time over the last 40 years. Even during the severe financial and economic crisis nine years ago, growth in China and India averaged over 6% a year, as their share of the world economy continued to rise. In short, as they are populous countries but poor, their potential for catching up with living standards in the advanced economies is immense and so they grow faster.

Nevertheless, the reasons for the slowdown currently underway in the world economy are clear, as is the reality that most regions and sectors are affected and hence the downside risks to activity and asset prices should be acknowledged.

Chart 1

Global trade slows

Growth in world trade has decelerated sharply. Partly driven by the trade dispute between the US and China and higher tariffs but also to a lesser extent the US dispute with Mexico and Canada, the pace of global trade has fallen to 2.8% a year in the quarter to November 2018 from a rate of 5% a year ago (see chart 2). Slower global growth also reflects a tighter policy stance in the US, with a reduction in the size of the Federal Reserve’s balance sheet and a rise in short and long-term interest rates compared with the year earlier. Monetary policy was also tightened in China, as it reduced liquidity and targeted loose credit conditions in its financial sector.

As signs of weaker global growth have emerged, financial market sentiment and asset prices have been adversely affected. It is also the case that, in some instances, asset prices had reached levels that seemed inconsistent with the performance of the underlying economy, so even without the economic slowdown that has emerged a correction might have been forthcoming. Most of this overvaluation seems to have been in equity prices in advanced economies but bond yields have also been at lows that only exceptionally loose monetary policy could justify.

Chart 2

Impact on equities

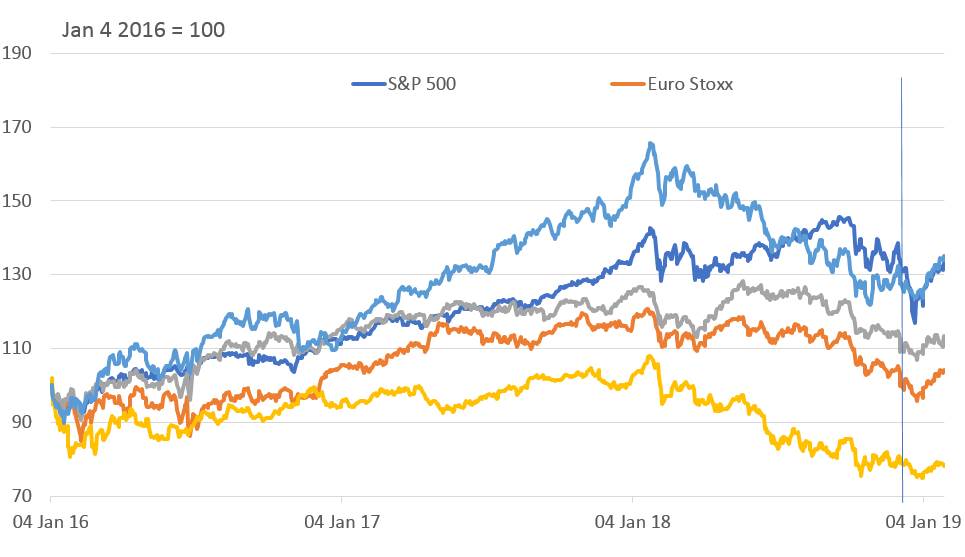

Equity prices fell back sharply in advanced countries at the end of 2018 (see chart 3). In early 2019, though, some rebound has occurred as policymakers have retreated from the harsher rhetoric about policy used late last year, especially in the US. By contrast, equity prices in emerging economies have held up rather better, and some countries have even shown increased asset rises compared with a year ago.

Expectations about increases in central bank policy rates have eased back in line with weaker economic growth, and long term interest rates have also dropped back.

Chart 3

Commodity price trends

Oil prices have also responded to weaker economic expansion by dropping back by around 25% since the middle of last year. There has been a sharp easing of industrial metals prices, reflecting the slowing trend of global demand. Both of these commodity price trends will feed into lower inflation pressure. Supply factors may keep the price of oil higher than otherwise as production problems in Russia and Libya partly offset the softening in global demand.

Corporate bonds spreads have widened, reflecting the risk to the balance sheets of over geared companies in the face of slower growth for their products. It may also be the case that some asset sectors – particularly those that had high yields – were overbought, so now may be oversold though are indeed riskier. In that case, some widening of spreads may have occurred in any event.

Brexit risk

Throughout the year ahead, issues of trade uncertainty, and in the case of the UK Brexit uncertainty, allied with policy outcomes are likely to keep the pressure on asset prices, weigh on economic sentiment and so on investment trends. For the UK, the Bank of England is assuming a smooth transition to a new relationship with the EU; should that not materialise then risk to the currency and to short term financial asset prices may be to the downside. However, if the outcome is positive for financial markets, the central bank may have to tighten more than is currently expected, which may offset some of the upside for asset prices.

From the US to the euro area, to the UK and the emerging markets, financial markets will have plenty to ponder on over the year ahead. On the one hand, trade issues, the end of the fiscal loosening and the end of quantitative easing in the US, a reversal of the loose policy stance by the EU (as it sells bonds or the effect of no longer buying) and credit tightening in China and India, will likely keep financial markets on edge. On the other hand, outcomes which are interpreted as orderly and or predictable could see rallies in asset prices.

Volatility brings threat and opportunity

Whatever the outcome, there is an economic slowdown taking place, its intensity is uncertain, and there are many policy risks in a range of countries. Hence, the conclusion appears to be that the world financial landscape faces many uncertainties that may lead to higher levels of volatility than seen in recent years, more in line with the reality of greater policy uncertainty and consistent with wider spreads. With higher risk and volatility, however, may come more opportunity to achieve outsize returns.

Professor Trevor Williams, University of Derby