Exploration & Production

In a world of such uncertainty an insurance broker that can assist in the formulation of an appropriate risk management strategy is one that can support the upstream oil and gas sector as it looks to navigate current pricing volatility, irrespective of their position in the exploration and production lifecycle.

Bruce Jefferis

+18324766964

[email protected]

William Lynch

[email protected]

+44 (0)2070863965

Midstream

The volatility in crude oil and natural gas pricing has contributed to a new set of challenges and opportunities for traditional midstream companies. Due to continued pressure on upstream counterparts and the symbiotic link between their sectors, midstream companies are having to embrace what is being called the ‘new norm’ and adjust business expectations accordingly.

Aon has a proven track-record across all energy sectors. Our market share, combined with our global footprint enables us to accurately track market trends through data and analytics and develop a strong understanding of how these trends affect players in the midstream sector.

Midstream companies have a unique risk profile due to wide distribution of assets and proximity to third party property, both of which come with their own unique challenges in the insurance market. In order for you to optimise your risk transfer strategy it is essential to develop a complete understanding of your company’s risk profile.

Bruce Jefferis

[email protected]

William Lynch

[email protected]

+44 (0)2070863965

Find out more »

Downstream Energy – Refining

With losses related to COVID-19 heavily concentrated in the transport fuel sector, the market for refined products next year will be smaller than 2015, while global refining capacity will have increased by 4.2mn b/d over the same period.

The remaining unanswered questions regarding travel and a second wave of COVID-19 place additional strain on the financials of oil refiners, especially against the backdrop of a hardening downstream oil and gas insurance market.

At any time, but particularly when margins are tightening, refiners need to remain vigilant by controlling costs effectively and managing risks in the most efficient way possible – this is where Aon can support clients.

Bruce Jefferis

[email protected]

William Lynch

[email protected]

+44 (0)2070863965

Fuel, Gas and Lubricants

Aon is one of the leading specialists in the Fuel, Gas and Lubricants industry and has a wealth of knowledge when it comes to fuel distribution, terminals, depots and worldwide transits and storage, meaning we understand your business and insurance requirements. We operate nationally and internationally to offer an independent, professional and confidential service which includes:

- > An independent market review, using multiple markets

- > Ongoing management of your insurance portfolio

- > A fast and efficient risk management service with a dedicated broking and claims team

- > In-house claims handling and management service

- > Additional services for this industry including mergers and acquisitions, insolvency and restructuring, and employee benefits.

To find out more about Aon’s Fuel, Gas and Lubricant solutions, please click here

John Jenkins

Senior Account Executive

[email protected]

0161 687 2311 / 07341 036155

Nick Scott

Broking Manager

[email protected]

0161 687 2316

Contractors

It is no secret that the dramatic fall in oil price has had a significant impact on drilling rig utilisation rates. As operators cut back on capital expenditure they have narrowed their focus to the development of long term production assets and maintaining strategic supply through proven reserves. This has resulted in exploration campaigns being suspended or cancelled as they are no longer considered economically viable.

Bruce Jefferis

[email protected]

+18324766964

William Lynch

[email protected]

+442070863965

Offshore Construction

Over the last 10 years, the offshore construction industry has flourished, however the decline in oil price has dramatically slowed this growth trajectory. Many offshore construction projects have stalled, as the potential return on investment is no longer economically viable.

Aon’s product covers each stage of a project throughout its lifecycle as follows:

- Design and engineering

- Project management

- Procurement/fabrication

- Onshore storage

- Onshore transit

- Offshore transit

- Offshore installation

- Hook-up

- Commissioning

Waiting on weather

Offshore operations can easily be impacted by adverse weather conditions. Energy companies can now limit the impact of weather on the profitability of offshore operations through a dedicated parametric insurance solution.

Chris Graham

[email protected]

+442070864598

Vimal Patel

[email protected]

+442070863137

Decommissioning insurance solution

The decommissioning of offshore oil and gas installations and pipelines is not without risk and these exposures need to be carefully managed. Whether you are a contractor or operator, Aon understands the potential liabilities facing the sector and has created a bespoke decommissioning product with specialist insurers that can respond to client’s individual requirements

Chris Graham

[email protected]

+442070864598

Vimal Patel

[email protected]

+442070863137

Energy Risk Engineering

The benefits of a properly implemented loss prevention program extend beyond the physical protection of your core assets.

A major loss event will have a detrimental impact on the external perception of your organisation, which will inevitably translate into financial consequences.

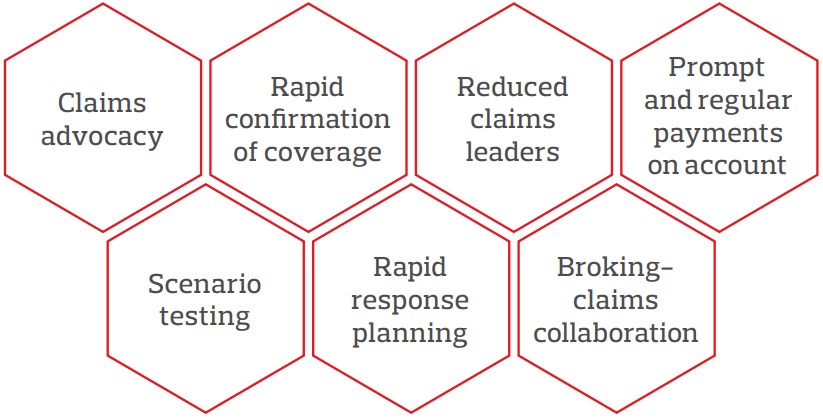

Energy Claims Advocacy

When it comes to claims handling our experience is that in a market where profits are squeezed, claims are inevitably scrutinised more.

We are seeing a growing trend towards the appointment of third party experts and greater technical debate. Unless this process is managed properly between all stakeholders, this can lead to the claim process taking longer to reach resolution.

Our goal remains to obtain confirmation of coverage at the earliest possible opportunity in order to provide certainty to our clients. This enables their business to return to normality as quickly as possible, supported by interim payments to restore lost revenue.

Our offering - The Aon Difference

Richard Hodkinson

[email protected]

+442070863087

Find out more »