Did you know……..88% of companies’ profitability is directly impacted by the weather

Does the weather affect your business?

An increase in volatile weather globally is presenting heightened risk exposure across many industries.

From extreme low and high temperatures causing delays on a construction project, to excessive rainfall slashing summer sales for beer and soft drinks, firms can now take action to protect their bottom line against increasingly volatile weather. From The Beast from the East bringing much of the country to a standstill, to this Summer’s heat wave causing record sales of food and drink, it is clear to see the impact extreme weather can have on business, be it good weather or bad.

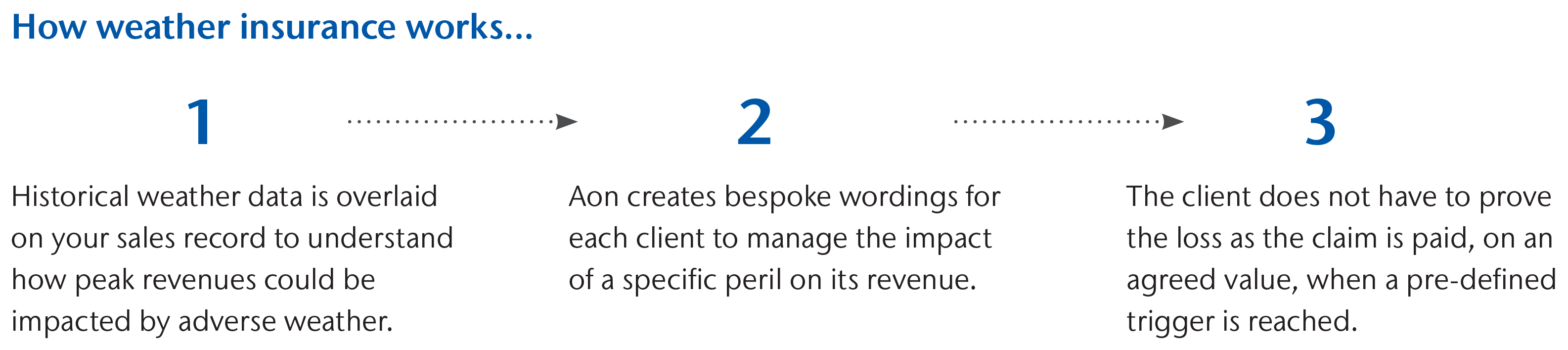

Aon’s weather solution helps clients access index-triggered solutions against losses from severe weather conditions that are tailored to your balance sheet.

Financial impact of the ‘beast from the east’ - Freezing weather sends a shiver through the economy

Analysts reported the impact of the “beast from the east” which swept in from Siberia was the most costly weather event since 2010, when freezing temperatures and snow brought the economy to a standstill.

The extreme weather had the biggest impact on the construction industry as sub-zero temperatures forced building workers off site. Reduced footfall at shops, leisure facilities, theatres, cinemas and restaurants lowered economic activity, while delays to material shipments interrupted supply chains.

Transport networks and retailers were also affected counting the cost of the freezing weather following multiple rail cancellations, a string of motor crashes and warnings that workers should stay at home.

Data and analytics at the heart of the solution

Weather data drives the efficacy of the parametric weather insurance cover. Aon uses a combination of traditional meteorological/weather station data in addition to more granular gridded data from satellites.

Drilled down to 250 x 250m grids, this means clients can obtain accurate insights on how weather will impact their business while reducing the basis risk by utilising interpolated data to offer specific granularity for risk locations.

Clients can benefit from access to independent weather data from Celsius Pro—specialists in structuring tailored index solutions to mitigate the effects of adverse weather.

The data is coupled with Aon’s analytical expertise to understand and validate available weather data and its impact on client’s business. We look to collaborate with the client to create viable risk protection and seek competitive market pricing to protect balance sheets from adverse weather that may occur in 2019.

Our expertise and network

The firm’s Aon Weather & Climate Risk Innovation network will help clients evaluate the potential impact of climate and/or weather risks on their operations, as well as develop comprehensive risk financing strategies to improve client resilience.

The Network brings together sector knowledge, experience and expertise from across Aon, supported by the firm’s advanced data, analytics, and partnerships with other innovative companies.

Given that most businesses are exposed to weather volatility at different points in their operations, there is clearly a demand for tailored and effective climate and weather risk solutions.

Our data and technology enables us to offer firms customised parametric solutions that provide protection for the climate volatility and weather events most likely to adversely impact their revenues and profitability.

Sources

- 88% of companies’ profitability is directly impacted by the weather; Weather Risk Management Association 2016

- Financial impact of the ‘beast from the east’ - Freezing weather sends a shiver through the economy;

- https://www.ftadviser.com/investments/2018/05/29/beast-from-the-east-lingers-on-for-uk-economy/

- https://www.theguardian.com/uk-news/2018/mar/03/freezing-weather-storm-emma-cost-uk-economy-1-billion-pounds-a-day

Aon UK Limited is authorised and regulated by the Financial Conduct Authority. FPNAT412