Pension Scheme Funding

Three-yearly funding valuations are a key point of engagement for sponsoring employers with pension scheme trustees. Funding valuations not only determine cash contributions, but also influence scheme strategy for next three years and beyond, and are an opportunity to get employer objectives onto trustee agendas.

Our corporate consultants specialise in providing funding advice to sponsoring employers to ensure that scheme funding strategies meet corporate objectives, which often include:

- Managing cash contribution requirements over both short and long term

- Avoiding overfunding and reducing the risk of trapped surplus

- Managing funding and investment risks

- Having a clear “endgame” strategy to discharge pension scheme liabilities

- Avoiding long negotiations and minimising internal governance time

Our funding advice has saved our corporate clients over £10bn in deficit contributions in the past five years.

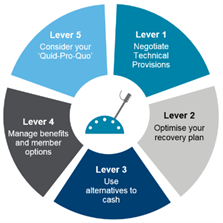

Aon's Five-Lever Framework

Our funding advice is built around our Five-Lever Framework, which enables sponsors to consider all available options, including:

- Advice on actuarial assumptions

- Structuring cash contributions

- Alternative financing and corporate finance

- Benefit changes and member options exercises

- Negotiating tactics

Drawing on our full range of expertise and tools

In delivering funding advice we are able to draw upon all of our capabilities including:

Data and analytics

- We are able to use benchmarking data collected from across our client base to enable our clients to understand where they sit relative to market practice and within relevant sectors.

- We are able to apply corporate finance approaches to quantify the impact of different solutions on your financial objectives, for example by comparing the net present values using your internal rate of return.

Technology

- Our Risk Analyzer tool enables our clients to investigate their schemes’ funding positions interactively. We can help you reach fast and effective decisions in meetings by working with live results, changing assumptions to see the immediate impact on your liabilities, and designing contribution plans.

Experience of trustees and The Pension Regulator

- Our experience across thousands of pension scheme valuations means we have a deep insight into the expectations of both pension scheme trustees and The Pensions Regulator, and how these expectations can be managed. This includes a deep understanding of how UK pensions are regulated, with Aon having provided several secondees to The Pensions Regulator.

Investment and employer

- Investment strategy and employer covenant are key inputs to funding strategy. Bringing in advice from our investment and employer covenant consultants means we can develop more effective funding and investment strategies, and demonstrate their effectiveness to pension scheme trustees.

Aon Solutions UK Limited - a company registered in England and Wales under registration number 4396810 with its registered office at The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN.