Commercial consolidation solutions explained

There are two types of commercial consolidation solution:

- Off balance sheet commercial consolidators (such as Clara or The Pension SuperFund)

- On balance sheet capital backed investment structures (such as Legal & General’s Insured Self Sufficiency)

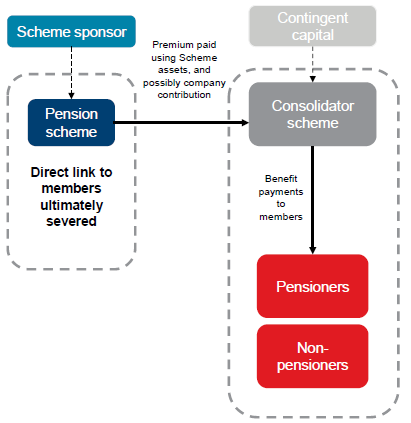

An off balance sheet commercial consolidator, or "Superfund", generally works as follows:

A premium is paid to the consolidator using Scheme assets, which may include an additional company contribution to support the transaction. The link between the Scheme and the members is broken with members receiving their pensions from the consolidator scheme once the premium has been paid.

The consolidator scheme operates as a pension scheme (with its own trustees, administrators and advisers) and the consolidator scheme sponsor is typically a shell company that holds capital. The Pensions Regulator must provide approval for commercial consolidators before they accept any schemes. The original Scheme sponsor must apply for Clearance if a transfer of the Scheme to a commercial consolidator is being seriously considered.

As the consolidator scheme operates as a pension scheme, member benefits are covered by the Pension Regulator’s guidance and the Pension Protection Fund.

On balance sheet capital backed investment structures

Capital backed investment structures are investments, where the scheme delegates investment to a third party in return for them putting up some capital backing to protect against adverse experience from investment returns and/or longevity expectations, for example. There is no transfer of the Scheme or the covenant away from the Scheme sponsor.

Capital backed investment structures often seek to provide a smooth path to buyout in the medium term, with the provider’s capital buffer being called on if actual experience is worse than assumed e.g. as a result of life expectancy increases, or lower than anticipated asset returns. In other words, the reliance on the current sponsor is reduced.

The provider typically receives regular administration and/or investment fees when performance is as anticipated or better.

Could commercial consolidators be right for your scheme?

Complete our short checklist to see if off balance sheet commercial consolidators might be a viable option for your scheme.

View Checklist

Where can I learn more?

View the video

Aon Solutions UK Limited - a company registered in England and Wales under registration number 4396810 with its registered office at The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN.