Companies grow and change - and the pensions market moves fast - so it's easy to find yourself in a situation where your scheme's old strategy no longer meets your needs. Let's take a fresh look.

If you set up your DC pension scheme today, starting from a blank sheet of paper, would you choose the pension strategy you're currently following?

Companies grow, workforces change, and the pensions market moves all the time - and that's before we mention the recent legislative changes, which will have a impact on the way your members may eventually wish to take and use their money.

Take the time to check whether your strategy still meets your needs - and in the process to address any issues. We'll help you get it right.

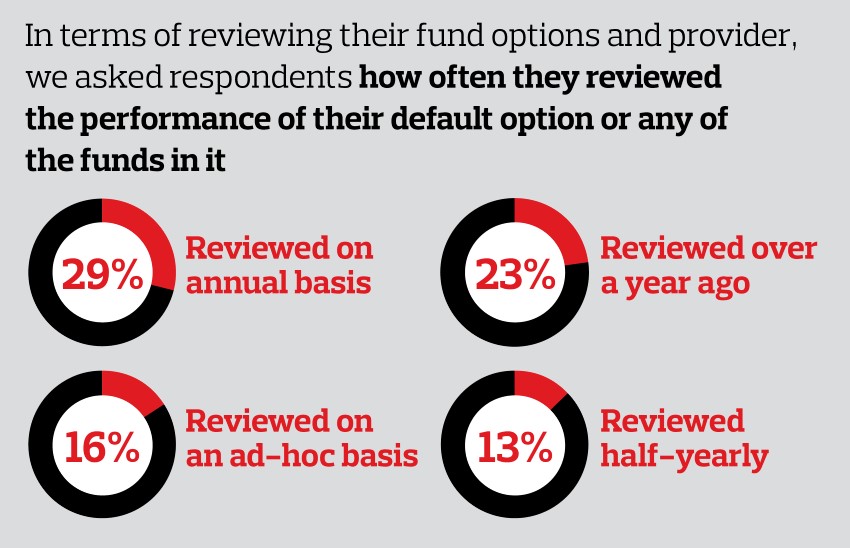

Source: Aon Benefits and Trends Survey 2019

Rationalising legacy schemes

The truth is, many DC pension schemes of any size can be the product of an organisation's history - trying to balance sometimes conflicting objectives and groups of members from various legacy funds. The administration requirements and risks are sometimes higher than they might be - with less than ideal results.

But we have a strong track record in helping pension schemes to rationalise older, legacy arrangements - giving all members the benefit of a strategy that works today.

Source: Aon Benefits and Trends Survey 2019

Responding to market changes

Lately, many of the reviews we've carried out have focused on helping schemes react to changing circumstances - whether helping members to make the most of new pensions freedoms, or taking account of the growing importance of Defined Contributions. Other changes have been internal - like a cohort of trustees retiring en masse.

While updating the strategy, we find it's essential to give governance support - helping to keep trustees and members informed, empowered and engaged.

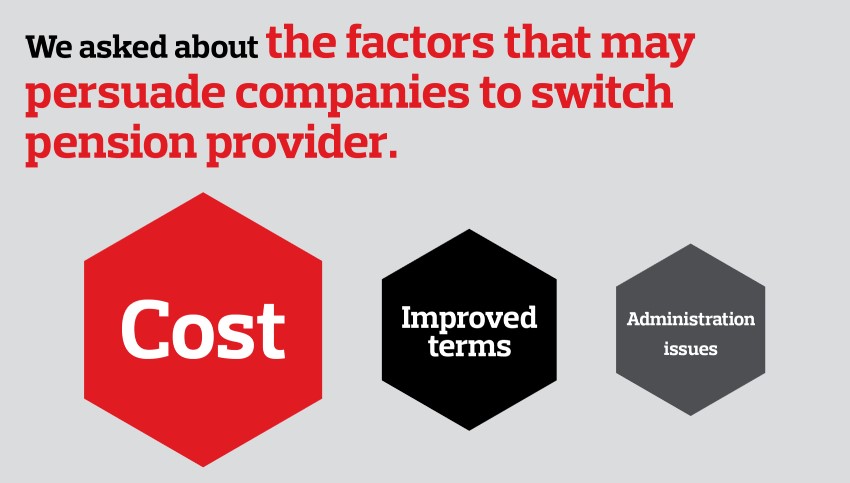

Reducing costs; improving returns

Particularly since Auto-Enrolment, it's not uncommon for pension schemes to take a disproportionate amount of time, resource and governance effort compared to the returns they give - both financially, and in terms of employee recognition.

We'll help you work on both sides of the equation - streamlining your strategy to reduce the burden, reviewing your investment choices, and helping employees to gain a clearer view.

Your pension members deserve a strategy that's every bit as good as if it was created, from scratch, today. Let's talk about a review. Email us on [email protected], or call 0344 573 0033.