Renewable Energy

Aon is an insurance advisor and broker to some of the world’s largest Renewable Energy (RE) developers.

Our experience and fact-based approach give unique capability to add differentiated and unrivaled in-depth risk advisory and broking services.

The Aon approach creates collaboration where local, regional, and global colleagues support and work together to deliver results.

Our expertise extends beyond simply offering traditional insurance solutions as we analyze, assess, innovate, and transfer a variety of risk exposures faced by RE developers.

Aon’s Renewable Energy Experience

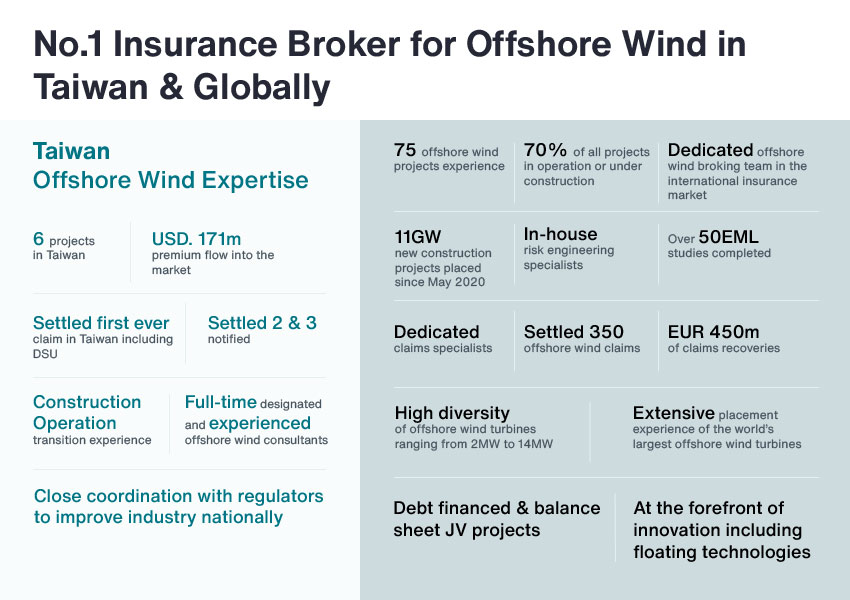

Aon’s Power Specialty business has a dedicated power resource of over 200 professionals servicing the power and utility sectors worldwide and more than 50 offshore wind colleagues globally with circa 70 percent market share, placing over USD$1 billion premium into the global markets annually.

Aon is the broker for more than 25 percent of the world's onshore renewables industry including covers for more than 55GW of onshore wind power and 17GW of solar developments.

We are a broker to some of the world’s largest renewable energy developers, and our market-leading position enables us to exert maximum competitive tension on the market and drive optimal results for clients.

Risk Landscape

| Offshore Project-Developer |

Insurance Advisor and Consultant |

Field survey and loss prevention of Land substation

Field survey of offshore wind turbine |

| Offshore project - Supply Chain |

Insurance Advisor and Consultant |

|

| Solar |

| Insurance Advisor and Consultant |

Assisting writing risk management project proposal |

| Lender Insurance Advisor |

|

| EPC/Supplier Contract Review (for insurance purpose) |

|

| Energy Storage |

Insurance Advisor and Consultant |

1. From the perspective of risk management, we provide the risk assessment from the initial design stage, walking clients through risk prevention, protection and disaster mitigation, in order to manage the project risks.

2. Assist in reviewing fire safety design and provide risk-related consulting.

3. Assist in writing risk management projects proposal |

| EPC/Supplier Contract Review (for insurance purpose) |

|

| Lender Insurance Advisor |

Site investigation and improvement suggestion report |

The insurance coverage of offshore windfarm includes:

- Extensive insurance coverage to ensure that the insurance plan meets the requirements of offshore windfarm developers and financing institutions.

- Due to the unique characteristics of offshore windfarm developing projects, the insurance policy should adopt tailor-made terms, rather than the traditional land-based construction and installation engineering insurance policy or property insurance policy.

- The wind farm insurance in Europe have been well-developed insurance policies - WindCAR and WindOP, which can seamlessly integrate the insurance protection of the important components, during the construction period and the operation period. The insurance coverage can cover the following six parts:

- Marine Project Cargo, Cargo

- Construction All Risks, CAR

- Delay in Start-Up, DSU

- Operation All Risks, OP

- Business Interruption, BI

- Third Party Liability, TPL

Suggestions are provided from the perspective of risk management, and risk considerations are included in the design stage to reduce the overall project risk from the perspective of prevention, protection and disaster mitigation. In the future, the risk will be transferred smoothly (insurance planning), and the risk loss in the operation stage will be reduced.

Client Benefit:

- Access to Aon’s local network of risk engineers, benchmark and advising on client risks prior and during construction, assisting with insurance-buying decisions.

- We use the financial strength and professionalism of the Aon Group to leverage pricing to reduce your overall total cost of risk.

- Portfolio benchmarking and risk analytics allows you to gain insight into the insurance market trends, underwriters’ appetite and innovative ideas.

- Bespoke policy wording.

- Negotiation and support on complex claims to bring about quick resolution and settlement.