The future of banking is changing. Technology continues to evolve at pace, boosting operational efficiency and revolutionizing service delivery across the financial sector. In this digital evolution, investment in fintech continues to gather momentum.

Global fintech investments reached $210 billion in 2021, up from $125 billion in 20201. Technological challengers are both disrupting and developing the future of banking, bringing both opportunity and new risks to the sector.

The Challenge: Intellectual Property and Litigation

The race to innovate continues. The rapid rise of digitally-capable fintechs across the sector is changing the demands on traditional financial institutions.

Technology has enabled banks to evolve their service delivery models. Accelerated by the prolonged social isolation during the peak of the COVID-19 pandemic, digital payments and online banking have developed rapidly to meet the demands of a remote world. In developing or acquiring new capabilities to match competition and meet innovation demands, filings for patents are on the rise. As the technological evolution gathers momentum, experts are forecasting the increasing investment in patents will drive an uptick in litigation similar to the activity across the technology sector2.

As banking and technology began to converge, traditional financial institutions trailed behind established and emerging technology companies with smaller patent portfolios. For example, one multinational technology corporation has five times more fintech-related patents than all the traditional banks did together in 20173, leaving a cohort of start-up fintechs and traditional banks potentially exposed to intellectual property (IP) litigation from their emerging fintech competitors.

The largest public damages award in the sector was seen in a patent infringement suit between a financial services group and a multinational bank. Although subsequently settled, the original assessment was $300 million against a multinational bank for using technology licensed to the financial services group4. This lawsuit cast a spotlight on this type of exposure; any financial institution could be liable to IP infringement for technology provided by third parties as well as innovation developed in-house by themselves. 106 financial services infringement suits averaged damages totalling $41.36m in 20215.

For new fintech players entering the sector and traditional financial institutions looking to maintain and grow their market share, facing an IP infringement suit from either a technology company or a bank is a material possibility. A claim could render a firm financially unsustainable, irrespective of balance sheet strength.

The sizeable revenues, and thus damages exposure, associated with financial institutions and fintech companies has also gained the attention of non-practising entities (NPEs), or often called, patent trolls. These are entities that exist with a sole purpose to acquire and assert patents with the hopes of a quick settlement from operating companies. Since financial institutions’ balance sheets remain focused on recovery from the disruption of COVID-19 and economic volatility, financial institutions have been a major target for trolls as they often lead to a quick settlement.

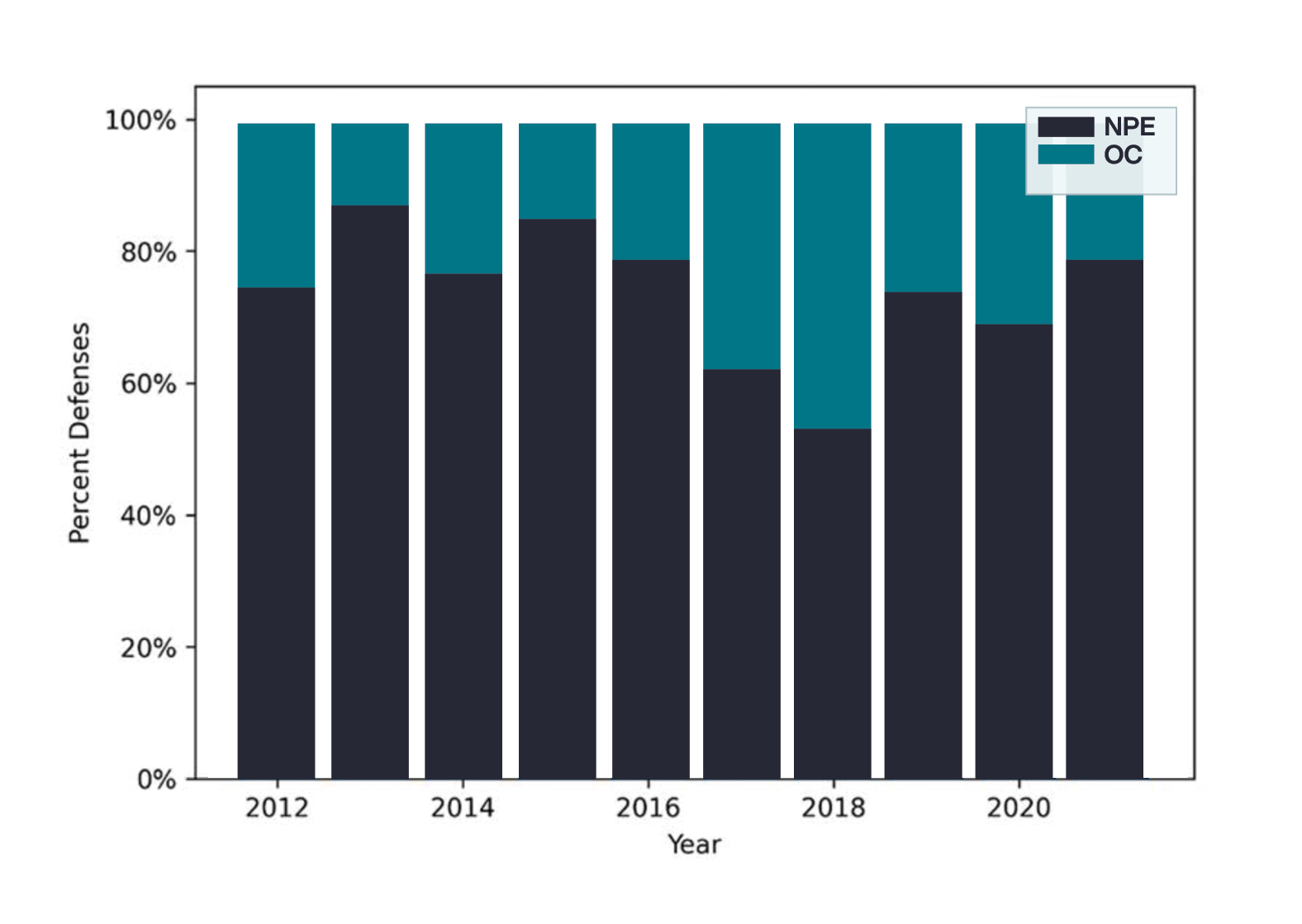

Percent of NPE Defenses (Financial Industry)

The chart6 on the left demonstrates that in 2018, only 53% of infringement cases for the financial sector were filed by NPEs, but this number rose to 79% in 2021.

Increasing IP infringement exposures are creating new risks for banks and fintechs to work collaboratively. The questions remain: how can fintechs grow and compete with traditional banks with this potential catastrophic exposure; and how can banks partner with fintechs knowing they may not have the balance sheet to sustain an infringement suit? A solution is critical for banks and fintechs to both accelerate innovation. In investing in fintech, or working collaboratively with a fintech firm, banks and other financial institutions could boost operational efficiency and service delivery while saving the costs of developing solutions in-house. Even for banks who have the capital and capabilities to innovate in-house, potential infringement claims remain a material risk to firms’ balance sheets.

The Solution: Intellectual Property Liability Insurance (IP Liability)

Using insurance capital can help alleviate this credit risk and allow fintechs to focus on innovation, cover contractual IP indemnities between financial institutions and banks, and reduce concerns around partnership. IP infringement is rarely covered in other, traditional insurance policies, including cyber, crime and errors & omissions (E&O) policies, potentially leaving firms exposed to IP infringement. This exposure can be addressed through IP Liability Insurance.

IP Liability Insurance can help provide protection from litigation asserted by a third party and the contractual indemnities provided to the insured’s customers. Using the insurance to cover the contractual indemnities between the fintechs and financial institutions can be a catalyst in enabling these parties to work together.

Financial institutions can also use the policy to help protect their supply chain. Often, financial institutions may receive IP contractual indemnities from fintechs who may not have the balance sheet strength to support them. By putting an IP insurance policy in place, firms can help alleviate this credit risk with highly rated insurance capital, therefore protecting their supply chain.

Risk practitioners managing this growing exposure should be asking if there are protections in their current insurance policies. There is often an assumption that all technology-related risks are covered by a cyber policy, but infringement risk may not be covered under either traditional financial lines or cyber policies and some policies have absolute exclusions for patent infringement and trade secret misappropriation. As banking operating and service-delivery models continue to evolve and digitize, it is advised that firms understand their new technology-related exposures and across their entire cyber, fraud and E&O programs. IP or infringement risk should now be part and parcel to this type of insurance portfolio risk review. An IP Liability policy can help mitigate infringement risk and be designed around a company’s evolving business to support acquisition and innovation.

A company’s intellectual property is core to the business, and therefore a company’s valuation. However, no matter how sophisticated a company’s patent portfolio may be, it will not dissuade third parties from asserting claims when they believe a company’s patent infringes upon their own. Fortunately, IP Liability Insurance can be a tool to help mitigate this risk and enable collaborative innovation through insuring contractual indemnities.

1 - ‘Total fintech investment tops US$210 billion, as interest in crypto and blockchain surges, says KPMG’s Pulse of Fintech’, KPMG, accessed 9th March 2021,

https://home.kpmg/xx/en/home/media/press-releases/2022/02/total-fintech-investment-tops-us-210-billion.html

2 - ‘INSIGHT: Patents as Weapons in Financial Services Industry—A New Era’, Bloomberg Law, 22nd March 2019,

https://news.bloomberglaw.com/ip-law/insight-patents-as-weapons-in-financial-services-industry-a-new-era

3 - ‘REPORT | FINTECH DISRUPTION’, Cipher, 7th February 2018,

https://cipherai.ovstaging.com/fintech-understanding-role-patents-2/

4 - ‘Wells Fargo and USAA to settle $300m litigation’, Rory O’Reilly, World Intellectual Property Review, 18th February 2021,

https://www.worldipreview.com/news/wells-fargo-and-usaa-to-settle-300m-litigation-21060

5 - DASP Platform @ Copyright 2022 Aon PLC

6 - NPE data derived from Aon’s proprietary review and Stanford Law School (2022). NPE Litigation Database [Data File].

https://npe.law.stanford.edu. Corporate industry data derived from Factset (2022). Corporate Metadata [Data File].

https://www.factset.com. Litigation data derived from Lex Machina. (2022). US Federal Patent Litigation [Data File].

http://lexmachina.com

About Aon plc (NYSE: AON) exists to shape decisions for the better— to protect and enrich the lives of people around the world. Our colleagues provide our clients in over 120 countries with advice and solutions that give them the clarity and confidence to make better decisions to protect and grow their business. ©2022 Aon plc. All rights reserved.

Aon UK Limited is authorised and regulated by the Financial Conduct Authority

The information contained herein and the statements expressed are of a general nature and are not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information and use sources we consider reliable, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.