Well One Money

The financial wellbeing of employees is an understandably high priority for many companies right now. We have several solutions to help support firms’ financial wellbeing goals, including our financial wellbeing app: Well One Money.

The Well One Money app helps employers look after their employees – by helping employees look after their finances.

We believe in the importance of financial wellbeing. The stress of financial problems can have a drastic impact on many aspects of a person’s life. Many companies want to provide dedicated support to improve the financial wellbeing of their workforce and have a positive impact on their employees’ lives and finances, as well as mitigating the impact of financial stress on work performance, these are some of the reasons nearly two-thirds of employers believe it’s their responsibility to help employees improve their financial health (according to our 2020 UK Benefits and Trends survey). The Well One Money app helps employers look after their employees – by helping employees look after their finances. And, for those who save into the Aon MasterTrust or Bigblue Touch Group Personal Pension as their workplace scheme, they now automatically have access to Well One Money to support their financial planning.

Holistic insight. Ultimate peace of mind

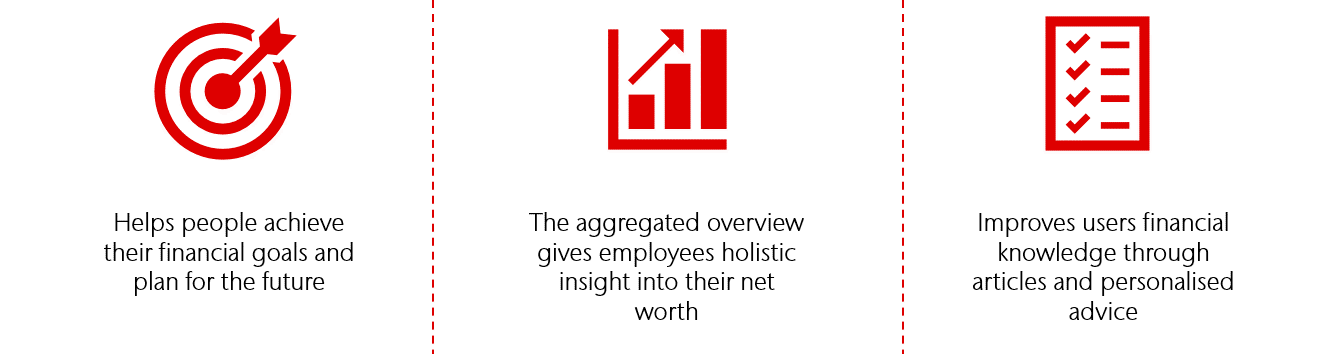

The Well One Money app is a financial management platform which gives an aggregated overview of the user’s current financial status alongside a financial forecast for any finance, savings or retirement goals they have. It also supports financial knowledge though easy to understand finance related articles and personalised advice.

Crucially, the app puts financial wellbeing at the heart of financial management:

Designed to help employers:

- Improve financial wellbeing of their workforce (and the associated risk of poor employee mental health)

- Increase engagement with employee benefits through personalised offers and portal integration

- Highlight pension value: you invest in your pension scheme – it’s time to shout about it

- Identify opportunities for additional support through anonymised data

Holistic support

Finances are complex, which is why we provide the following to ensure you get your return on investment:

- Engagement strategic sessions

- Launch communications email campaign and regular reminders

- Personalised nudges sent to users through the app to keep them on top of their finances

- Financial education support

Please note that the accounts information service of our Well One Money app is provided by specialist third party MoneyHub.

1https://www.bacp.co.uk/news/news-from-bacp/2019/25-march-people-with-mental-health-issues-35-times-more-likely-to-be-in-problem-debt/

Aon UK Limited is authorised and regulated by the Financial Conduct Authority. Registered in England and Wales. Registered number: 00210725. Registered Office: The Aon Centre, The Leadenhall Building, 122 Leadenhall Street, London EC3V 4AN.